Ninety percent of contractors, specialty contractors and modular builders using prefabrication or modular construction who were surveyed by Dodge Data & Analytics said they improved productivity, achieved better quality and increased schedule certainty when using prefabrication and modular construction methods, compared to traditional construction methods. That’s according to DDA’s new SmartMarket report, “Prefabrication and Modular Construction 2020.”

The new report updates a 2011 report that looked only at prefabrication. The 2020 version shows that attitudes and interest in both techniques have increased considerably in the last nine years. DDA surveyed 176 general contractors and construction managers, 219 specialty and trade contractors and 15 modular builders and manufacturers, all of whom were already using some form of modular construction or prefabrication.

Respondents had to have worked on a multifamily or non-residential building project in 2018 and a prefabrication or permanent modular construction project within the last three years. No more than 50% of their projects could be single- or two-family homes.

“This was not an adoption survey; first question was, if you used it,” says Donna Laquidara-Carr, industry insights research director at Dodge Data & Analytics in New York. “This was looking at people who were already doing this. We took them down two tracks. People on the modular side who were only modular [builders] were roughly a third of the respondents and those put in the prefab group were about two-thirds.”

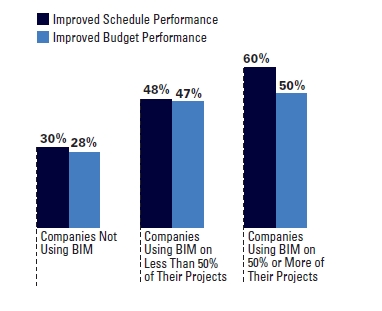

One of the central questions of the study is how the use of building information modeling (BIM) affects projects.

The survey found that a strong correlation between companies’ BIM use and the degree to which they have experienced improved schedule and budget performance from using prefabrication and/or modular construction. The findings are similar for both users of prefabrication and modular construction.

Growth was seen among contractors doing modular construction in the use of a full volumetric approach, in which entire parts of buildings (such as bathrooms or hotel and hospital rooms) are delivered preconstructed on site and assembled there.

Sixty-one percent of respondents said they expect to employ that method on at least 10% of their projects in the next three years, up from just 44% from those doing modular construction who report using that approach currently.

Improved schedules, decreased construction costs and better quality are what the respondents said are the top drivers of the new delivery methods. The survey also asked about obstacles to adoption. Responses included owners who did not understand modular construction and prefabrication and had differing perspectives on them from architects, engineers and contractors.

To read the full report and understand more about modular construction and prefabrication, visit Dodge Data & Analytics.

Post a comment to this article

Report Abusive Comment