For the first time since Q1 of 2022, construction industry executives report a stable and slightly growing market on ENR’s Construction Industry Confidence Index (CICI) survey. The index vaulted up 10 points from Q4 2023, to a rating of 52. Nearly 65% of respondents see the current construction market as stable, with only 18.8% seeing a declining market. That latter number was 34.6% last quarter. Execs are also showing more faith in the economy as a whole. The economic index is also up 10 points, to a 48 rating this quarter.

The index measures executive sentiment about where the current market will be in the next three to six months and over a 12- to 18-month period, on a 0-100 scale. A rating above 50 shows a growing market. The measure is based on responses by U.S. executives of leading general contractors, subcontractors and design firms on ENR’s top lists to surveys sent between February 19 and March 25.

Related link: ENR 2024 1Q Cost Report PDF

Subscription Required

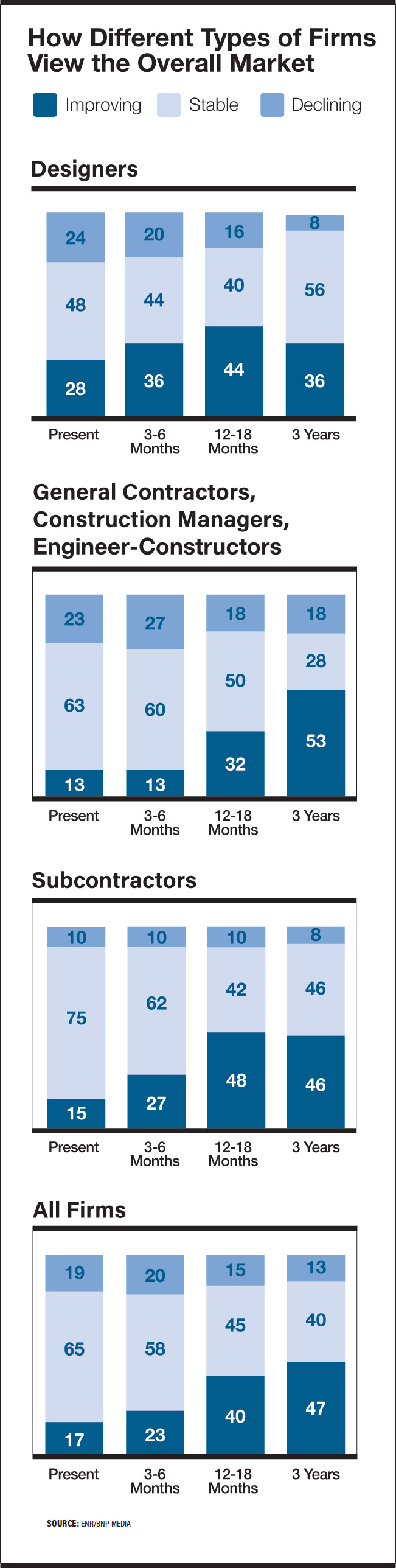

GCs and CMs are more pessimistic than either designers or subcontractors. Calculated separately, their confidence index comes in at 47. More GC/CM firms see a declining market 3-6 months from now (27%) than currently (23%). Design firms report the largest divergence of opinion, with nearly the same percentage seeing a currently improving market (28%) as declining (24%).

Confidence is highest among firms who do business in the Midwest, with a confidence rating of 55. Firms who work in the Northeast/New England/Mid-Atlantic region had the lowest rating, coming in 49. That is still a 29% improvement over last quarter’s 38 rating.

The CICI’s results are mirrored by those of the Confindex survey from Princeton, N.J.-based Construction Financial Management Association (CFMA). Each quarter, CFMA polls CFOs from general and civil contractors and subcontractors on markets and business conditions. The resulting Confindex is based on four separate financial and market components, each rated on a scale of 1 to 200. A rating of 100 indicates a stable market; higher ratings indicate market growth.

All indices the Confindex tracks rose between Q4 2023 and Q1 2024. The overall Confindex is up 13.5% this quarter to a 109 rating. The largest increase was in the “business conditions” index, which jumped 25.3% to a 109 rating. The “financial conditions” and “current conditions” indices saw more modest gains, up 5.8% to 109 and 7.3% to 103 respectively.

Confindex respondents report a surging short-term optimism. “The order of magnitude seems really significant,” says Neil Shah, CFMA CEO and president. The “year ahead outlook” index increased 20.8% to a 116 rating—its highest reading since Q4 2021. CICI survey respondents appear to be moving in the same positive direction. The number of respondents who see a declining market 3-6 months from now (19.5%) is nearly halved from the Q4 2023 reading (38.9%). Nearly 40% of firms see an improving market 12-18 months from now, up from 28%.

‘It’s Not This Year’

The reason for the increased optimism among construction execs seems pretty straightforward—deals are starting to flow. “Throughout 2023 we heard from contractors that project owners were telling them: ‘We’re not going to move forward right now. My pro forma no longer pencils out,’” says Anirban Basu, Sage Policy Group CEO and CFMA advisor. But a booming stock market and evidence of improved credit conditions have CFOs thinking those postponed projects will be initiated, the Sage CEO believes.

CICI survey respondents report improved financing access for their clients. While 48.7% report that their client access to financing is somewhat or much tougher than it was a year ago, that is a significant improvement from last quarter, when that number was 63.9%.

Stability seems to be the key word. “One of the things that we saw in [the Confindex survey] is that materials prices are incredibly stable relative to history,” explains Basu. “We had a high proportion [of respondents] saying they’re staying the same, which speaks to a lack of volatility. They’ve become predictable.”

The flow of money from the Infrastructure Investment and Jobs Act has increased as well, further fueling optimism, says Basu. “If you look at the construction spending data for categories like highway and street water and sewer, you’ve seen a meaningful pickup on a month-by-month basis since late 2023,” Basu says. The economist sees the election cycle as helping that trend. “Many congresspeople are running for re-election. So guess what happens? All of a sudden people are able to work through the bureaucracy and money starts hitting the streets.”

Basu is “pessimistic about the optimism.” Indicators like the consumer price index and the producer price index show that inflation will remain higher for longer, he says. “There was a conventional wisdom that the Federal Reserve would cut rates six times this year. Now it’s maybe two, maybe three, maybe zero.” He also points out a 1.4% increase in material prices in February 2024.

Even so, execs seem to be saying “there might be a downturn in front of us, but it’s not this year,” concludes Basu.