The House has passed legislation, by an overwhelming margin, that would loosen some restrictions for implementing the federal Paycheck Protection Program, or PPP, which provides forgivable loans to assist small businesses stay afloat during the coronavirus pandemic.

The bill, which has strong support from engineering and construction contractor groups, was approved on May 28 on a 417-1 vote. It was the first use of a newly installed House rule allowing lawmakers to vote by proxy. [View bill text here.]

The focus now will turn to the Senate, where a proposal that would make more modest changes than the House version surfaced just before the Memorial Day break.

A key element of the House measure, authored by Reps. Dean Phillips (D-Minn.) and Chip Roy (R-Texas), is a change in how PPP loan recipients must spend the proceeds.

Under the bill, at least 60% of the loan dollars must go for payroll. That's down from the 75% minimum share for payroll now.

An earlier version of the bill would have removed the current 75% payroll requirement altogether.

But that provision drew sharp criticism from a coalition of 17 labor unions, including the operating engineers' and painters' unions, both affiliates of North America’s Building Trades Unions.

Business groups would have preferred the original language ending the 75% mandate.

Peter Comstock, Associated Builders and Contractors director of legislative affairs, said in an interview, “Ideally, we would like businesses to have the flexibility they need to use these funds the way they see fit and the way that will ensure that their businesses are able to survive.”

But Comstock calls the final version’s 60% payroll minimum “a fair compromise.”

Among the House bill's other provisions is language to permit companies receiving PPP loans to have proceeds forgiven for expenses incurred during a 24-week period, compared with an eight-week period now.

Borrowers still would have the option to stick with the eight-week span.

In addition, PPP borrowers who don't seek or qualify for loan forgiveness would see their loans mature in five years, compared with two years now.

All PPP borrowers also would be able to fully defer payroll taxes through December.

ACEC, AGC comments

Jeff Urbanchuk, a spokesman for the American Council of Engineering Companies, said via email that the extension of the forgiveness period to 24 weeks “is particularly needed, as it gives engineering firms the ability to fully use the loan proceeds on allowable expenses.”

ACEC also supports the provision extending the repayment period to five years and language allowing the use of the eight-week period for forgiveness if borrowers prefer.

Brian Turmail, an Associated General Contractors of America spokesman, said via email that the House measure "is exactly what we would like to see enacted."

AGC said the House legislation should create construction jobs and help financially struggling firms, through provisions such as the extended 24-week coverage-period and loan maturity, as well as the 60% payroll minimum.

Senate proposal

In the Senate, a bill backed by Sens. Marco Rubio (R-Fla.), Ben Cardin (D-Md.) and Susan Collins (R-Maine), among others, includes the extended deadline for applying for PPP loans.

But it would allow borrowers to use PPP loan funds for just 16 weeks, compared with the House version's 24 weeks.

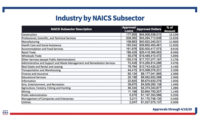

Congress created PPP in the Coronavirus Aid, Relief and Economic Security, or CARES, Act, which President Trump signed into law on March 27. The CARES Act provided $349 billion for the program, but all of that money was committed in less than two weeks. Construction firms received the largest share of that sum among industries, with $44.9 billion.

Congress then added $310 billion for PPP in a new measure, enacted on April 24.

The Small Business Administration, which administers PPP, says that through May 27, $510.5 billion in loans had been approved for the two rounds combined.

Post a comment to this article

Report Abusive Comment