Companies seeking federal Paycheck Protection Program forgivable loans now have until Aug. 8 to apply, with legislation signed by President Donald Trump on July 4 extending the original June 30 application deadline.

There was $138.4 billion in PPP loan funding available at business close on June 30, the Small Business Administration reported.

Click here to view the text of the new bill.

The Trump administration is interested in working with Congress on another coronavirus relief and recovery bill in July, Treasury Secretary Steven Mnuchin said in a July 2 briefing.

Administration officials are seeking to “repurpose” remaining PPP money, he added. ”There is going to be a number of businesses that are particularly hard hit, and we’ll be looking to give those businesses additional money,” Mnuchin said.

[For ENR’s latest coverage of the impacts of the COVID-19 pandemic, click here]

The PPP, established under the Coronavirus Aid, Relief and Economic Security Act (CARES), was intended to help small businesses and nonprofit organizations struggling because of the financial impact of the pandemic.

The CARES Act originally provided $349 billion for the program, which was all committed in just 13 days. Congress added $310 billion in a later bill.

The legislation moved rapidly through Congress. The Senate passed it on June 30; House approval came the following day.

A PPP loan recipient can have a loan forgiven if funds are used for certain types of operating expenses. The prime requirement is that at least 60% of a loan amount must go for payroll.

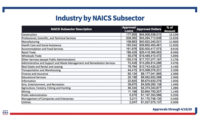

Construction sector companies have been major recipients of PPP loans. SBA reported that as of June 27, construction ranked third among all industries in the dollar volume of PPP loans received—$64.3 billion.

Industries labelled as health care-social assistance, and as professional, scientific and technical services, had larger PPP loan dollar volumes.

Post a comment to this article

Report Abusive Comment