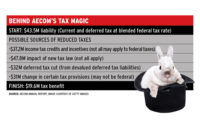

AECOM’s success in reducing its 2018 corporate tax liability from potentially tens of millions of dollars down to zero may seem like magic. But the engineering giant’s ability to avoid federal taxes—which landed it on the Institute of Taxation and Economic Policy’s list of 60 Fortune 500 companies that avoided all federal income taxes last year—is based partly on the combination of Congress’s corporate tax cut and tax credits, including those available for research and development, tax experts say.

|

Unlike tax deductions, each tax credit dollar knocks a dollar off a firm’s tax bill. And while R&D credits are typically associated with biotech or defense firms, engineers and architects qualify based on money spent through trial-and-error process improvements and new technology. AECOM (NYSE-ACM) is the only engineer and contractor on the list.

In total, AECOM earned a $122-million rebate on its fiscal 2018 federal taxes. That tied it for third place on the institute’s list with a negative tax rate (meaning the government pays the company, not the other way around) of 51% on $238 million in U.S. income.

The institute, a nonprofit think tank, draws attention to corporate tax avoidance. Matthew Gardner, a senior fellow at the institute, said the story is not about any single company, but rather that 60 Fortune 500 firms either paid no federal taxes in 2018 or got multimillion-dollar rebates.

“When any particular business or individual isn’t paying some amount, that amount has to be made up in some other way,” Gardner says. “When you have a situation where some companies are paying a little and other companies are paying a lot, that undermines people’s view of the fairness of the federal tax law.”

Ethics Policy Covers Taxes

AECOM’s corporate tax ethics policy emphasizes the company’s obligation to pay all taxes it legally owes and notes the possibility of “reputational damage” for failing to follow the policy. In a statement, AECOM called the institute’s study “misleading,” especially for its focus on federal corporate taxes. The institute compiles its list “using a narrow definition of tax expense, and AECOM continues to conform to all applicable tax laws,” the company said in a statement.

Meanwhile, AECOM’s $122-million federal tax rebate, while substantial, doesn’t tell the whole story. It only covers the U.S. portion, and the Los Angeles-based firm’s final, global tax bill is based on worldwide revenue and operations. When all the taxes paid by AECOM to other governments across the world are taken into account along with its U.S. tax situation, the engineering giant still managed to stay in the black on its yearly tax liability, though at a more modest $19.6 million.

AECOM also got a big boost from the 2017 Tax Cuts and Jobs Act, which revamped the federal tax code. The company statement said it helped lower the corporate effective income tax rate.

Like other companies, AECOM was able to bring forward $58 million after the 2017 legislative changes unlocked the value of past R&D credits the company had stored up, said Barry Fischman, CPA and a partner in the tax and business services unit of accounting firm Marcum LLP. In particular, the legislation allowed companies to much more quickly capture tax write-offs related to the depreciation of assets and equipment, in some cases over the first few years.

This was potentially fertile ground for AECOM, which had undertaken a number of acquisitions over the past few years that in turn allowed the company to claim the benefits. And, like other companies, AECOM benefited from the reduction of the corporate tax rate to 21% from 35%. With millions in deferred taxes, this opened up significant savings for AECOM, which essentially got to knock 14% off its pent-up tax obligations carried over from recent years, according to Fischman and Michael D’Addio, a principal in Marcum’s tax and business services unit.

Despite AECOM’s tax success, Fischman discounted the idea that it relied on much beyond the confluence of a number of favorable factors, including the 2017 federal tax system overhaul. “It’s hard to just categorically say this company employed focused tax planning to reduce their taxes,” Fischman said. “They are all legitimate tax savings flushing through the current year.”

Post a comment to this article

Report Abusive Comment