Among the companies that were able to lower federal taxes due to 2017’s tax code overhaul, AECOM is construction’s standout. Not only did the company benefit from the lower corporate tax rate. It was able to mobilize a handful of other tax benefits, including ones for research and development, along with the tax cut so that it paid no corporate taxes at all.

That earned AECOM a very public place near the top of the Institute of Taxation and Economic Policy’s list of 60 companies on the Fortune 500 that avoided all federal income taxes in 2018.

The institute's list "is misleading by using a narrow definition of tax expense, and AECOM continues to conform to all applicable tax laws."

– Statement released by AECOM responding to the Institute of Taxation & Economic Policy report

In total, the company earned a $122-million rebate on its fiscal 2018 federal taxes. That tied AECOM (NYSE-ACM) for third place on the institute's list with a negative tax rate (meaning the government pays the company, not the other way around) of 51% on $238 million in U.S. income.

Only newspaper chain Gannett, which topped the list of all Fortune 500 companies with a tax rate of minus 167%, followed by IBM, at number 2, with negative 68%, posted better tax rates, according to the institute’s calculations.

AECOM is also the only engineering or construction firm to make the list. The institute, a nonprofit think tank, emphasizes corporate tax avoidance in its flagship publication, Who Pays? The rankings published in it are reported in many media outlets.

Matthew Gardner, a senior fellow at the institute, said the story is not about any single company, but rather that 60 Fortune 500 firms either paid no federal taxes in 2018 or got multimillion-dollar rebates.

“When any particular business or individual isn’t paying some amount, that amount has to be made up in some other way,” Gardner says. “When you have a situation where some companies are paying a little and other companies are paying a lot, that undermines people’s view of the fairness of the federal tax law.”

AECOM Tax Ethics Policy

AECOM’s corporate tax ethics policy emphasizes the company’s obligation to pay all taxes it legally owes and notes the possibility of “reputational damage” for failing to follow the policy.

In a statement, AECOM called the Institute of Taxation and Economic Policy’s study “misleading,” especially for its focus on federal corporate taxes.

“The organization’s list is misleading by using a narrow definition of tax expense, and AECOM continues to conform to all applicable tax laws,” AECOM said in a statement. The 2017 tax reform law is one of “a number of factors” that helped lower the company’s corporate effective income tax rate, the company stated.

|

Related Articles |

At least one independent scholar unconnected to the institute or AECOM believes the study is imprecise in how it defines loopholes and avoidance.

Paul DeBole, an assistant professor of political science at Lasell College in Newton, Mass., says he is no fan of the current tax system. But he contends the think tank’s study is a bit heavy handed.

“It talks about loopholes but I get wary when people label a legitimate allowance as a loophole,” said DeBole, who has a background in accounting. “I don’t think they are being totally fair.”

Other industries are skillful at managing their taxes, too. Duke Energy, for example, topped the institute’s list with a $647 million federal rebate. And insurer Prudential Financial ($346 million), IBM ($342 million) and oil and gas concern EOG Resources ($304 million) all scored bigger tax rebates than AECOM.

Meanwhile, AECOM’s $122 million federal tax rebate, while substantial, doesn’t tell the whole story of the company’s tax situation. It only covers the U.S. portion, and the Los Angeles-based firm's final, global tax bill is based on worldwide revenue and operations.

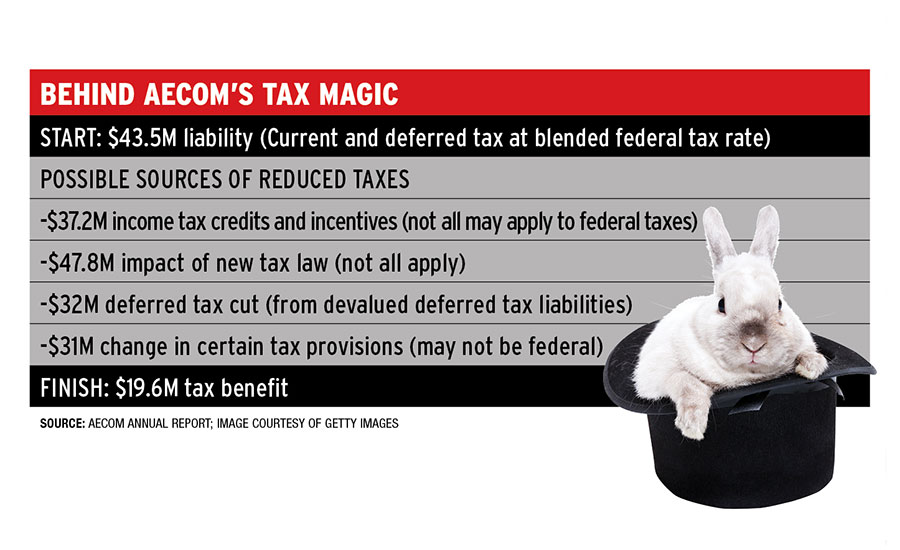

When all the taxes paid by AECOM to other governments across the world are taken into account along with its U.S. tax situation, the engineering giant still managed to stay in the black on its yearly tax liability, though at a more modest $19.6 million.

In a series of tables in its 2018 annual report, AECOM details how it went from a worldwide tax liability of more than $43.5 million to being owed money.

Exact Origin of Tax Benefits Unclear

The exact origin of some key tax benefits are never spelled out, however.

For example, the company notes that it had “income tax credits and incentives” which reduced its taxes by $37.2 million in 2018. But it doesn’t state how much of this relates to federal, as opposed to state or foreign, income.

Nevertheless, what is disclosed “strongly suggests that (unnamed) tax credits are a big part of” the company’s tax approach, says Gardner.

Then there is impact of changes in tax law, which reduced AECOM’s worldwide income taxes by $47.8 million. This could be current or deferred tax or a combination.

Then there is a $32 million deferred tax cut because their deferred tax liabilities (DTL’s) were devalued. (DTL’s are essentially IOU’s—taxes owed from prior years that haven’t been paid yet.

Since the IOU’s were all incurred at a time when the tax rate was 35%, now cut by the 2017 tax law change to 21%, the company can reduce the size of its IOU’s by the ratio

Another fact disclosed in the company’s annual report is called “Change in uncertain tax positions,” which reduced AECOM’s worldwide income taxes by $31 million. This means that AECOM had $31 million of tax breaks the company already claimed and perhaps believed could be lost, so AECOM likely made a settlement with a state, federal or overseas tax authority in 2018. This could help explain the zero tax if it’s federal, but, says Gardner, “we just don’t know.”

with Richard Korman