Global contractors are doing well in the world market, but signs of concern about economic stability are beginning to accumulate.

In early July, Saudi Arabia sold its first issue of sovereign bonds in eight years to cover projected budget deficits caused by falling oil prices. Russia on Aug. 10 announced its gross domestic product contracted by 4.6% in the second quarter of 2015, again because of falling oil prices. About the same time, China devalued its yuan, causing worry across the world's financial markets. For large international contractors, economic uncertainty does not bode well for the market.

The uncertainties in the international construction markets can be seen in the results of the ENR Top 250 International Contractors list. On the ENR Top 250 International Contractors list, firms are ranked based on contracting revenue from projects outside of their home countries, measuring their presence in international commerce. ENR's Top 250 Global Contractors list ranks contractors based on total worldwide contracting revenue, regardless of the projects' locations.

The ENR Top 250 International Contractors had $521.55 billion in contracting revenue in 2014 from projects outside their home countries, down 4.1% from $543.97 billion in 2013. The Top 250, as a group, also had $909.26 billion in revenue from domestic projects in 2014, up 4.3% from $871.50 billion in 2013.

On a regional basis, Africa was the biggest gainer, with international revenue from projects in Central and Southern Africa growing 14.7% in 2014 over 2013. Strife-torn North Africa rebounded from several years of decline with 12.4% in international contracting growth. The U.S. market also showed strength, rising 5.7% in 2014 to $51.15 billion.

On the other hand, the international contracting market in Canada took the biggest hit, falling 13.5% to $29.58 billion. Europe also saw a double-digit decline, dropping 10.4% in 2014. The Asian-Australian and the Middle East markets both saw 6.3% declines in international contracting revenue, while the Latin American market fell 7.2%.

Part of the Top 250's overall decline in international revenue can be attributed by the absence of a few large firms that did not participate in the survey this year. For example, Korea's Samsung Engineering Co. Ltd., which reported $7.1 billion in international revenue last year, did not participate.

Germany's Bilfinger SE, which reported $6.85 billion in international contracting revenue last year, also did not participate. Bilfinger currently is in the process of divesting itself of its contracting assets. In December, it sold its part of its construction group to Swiss-based Implenia. Then, in June, Bilfinger sold its infrastructure division to Austria's Porr AG.

Europe Still Building

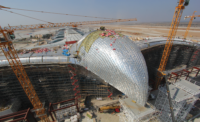

For many large European contractors, the market is upbeat. "Markets are still booming in terms of mega infrastructure projects ... in many places of the world and we see every year more and more," says Jérôme Stubler, chairman, Paris-based VINCI Construction SA. The firm's backlog now includes 54% foreign work, up 5% from last year.

For Spain's FCC Construccion SA, international business is "one of the reasons we were able to weather the [Spanish economic] crisis," says Chairman Miguel Jurado. FCC's portfolio includes projects in the Americas, Europe, the Middle East and North Africa.

FCC's group international sales last year accounted for 44% of the total, 8% more than at the start of the crisis in 2007, he adds. In construction, foreign sales made up just over half the business unit's total.

Post a comment to this article

Report Abusive Comment