Falling oil prices are definitely a concern for us in the short to medium term, says J.P. Chalasani, group CEO of India's Punj Lloyd. "However, as Punj Lloyd is present across many countries in the Middle East where there is no change in the capital spending, it is in a comfortable space," he says

Plummeting oil prices also are having an effect on social infrastructure spending. Turkey's Aslan Yapi ve Ticaret has enjoyed a strong government-supported multiunit housing market in the North Africa, says Mustafa Cihad, Aslan's general manager. However, he is concerned the decrease in oil prices may cause a decrease in housing and other construction.

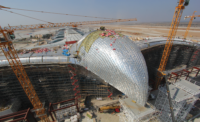

Stubler reports a significant sales drop in African oil-based markets though the backlog remains stable. "We have projects which are signed [but] the difficulty is to get started," he says. Russian business is also affected and a large Saudi Arabian stadium program has been scaled back.

It's not all bad news, explains Welch. "For some economies, low oil prices are a benefit." Nevertheless, with its wide involvement in Middle Eastern oil, gas and petrochemical sectors, Bechtel is being affected by oil prices, he adds.

In the Middle East, "we are now, for the first year, ranked as number one in Qatar," says Stubler. VINCI is landing major contracts through the company it jointly owns with Qatari Diar, part of the government's sovereign wealth fund. But the relationship provides no unfair competitive advantage against other contractors, he adds.

Bechtel remains busy on Saudi Arabian projects, including industrial cities and Riyadh's new metro, where tunneling started recently. Among targets for new contracts are oil- and gas-related projects in Saudi Arabia, the Emirates and Oman, as well as transportation work in the region, Welch says.

However, some international contractors complain that the level of competition in the Middle East makes it tough for good contractors. "In the recent past, the oil-and-gas space in the Middle East has been crowded with too many contractors. Competitors have secured projects at unreasonably low prices to establish their presence in the market," says Chalasani of Punj Lloyd. He says that the firms with robust health and safety programs and quality standards often cannot afford to bid against these mew competitors.

One new development in the Middle East is the growing use of public-private partnerships to help finance projects. "Public-private partnerships and various versions of [build-operate-transfer] schemes are getting increasingly popular, especially for large infrastructure projects, as the cost of funding for such projects increases," says M. Sani Sener, CEO of Turkey's TAV Group. Nowadays, he says, many transportation projects in the Middle East are financed with P3s and BOTs.

Other contractors also have seen the trend toward P3 projects and risk transfer. "Sacyr sees a clear international tendency toward new schemes and forms of procurement, such as [design-build, design-build- finance or design-build-finance-operate-maintain], where the owners are clearly transferring risk to contractors-concessionaires and seeking new ways of financing projects," says José María Orihuela Uzal, CEO of Sacyr Construction. He says Sacyr has worked on more than 90 such projects in 11 countries.

For Iranian contractors, the prospects of an end to economic sanctions may boost international work. Mohammadreza Ansari, chairman of Iran's Kayson, says that Iranian firms are anxious to show what they can do in the international market. He notes that Kayson is building as many as 1,000 residential units a month in as part of a 10,008-unit contract with Venezuela's Bolivar Republic. And Roham Vagehi, marketing executive for Iran's Sunir Co., says that the end of sanctions will open up Iran as a major international market to upgrade the country's aging infrastructure.

The Chinese market has been tough for international firms, and the country's economic woes are making it even tougher. But "the effect of China's construction slump has brought down the price levels of bulk metals like reinforcing steel to more attractive levels," says Subrahmanyan. "However, the huge advent of Chinese contracting companies is further crowding an already crowded market space."

South East Asia continues to attract Europeans. VINCI is "developing well" in countries, including Vietnam, Singapore, Indonesia and Malaysia, says Stubler. VINCI recently acquired a contractor in New Zealand, which "has a lot of road, rail and infrastructure to be built."

Post a comment to this article

Report Abusive Comment