Germany's Hochtief AG now is in better shape for international business, according to Chairman Marcelino Fernández Verdes. The firm has worked to eliminate risk from its balance sheet, sold non-core assets and "made significant progress" in reorganizing units in Europe and Asia Pacific.

In Europe, the French market is recovering after falling sharply, says Stubler. "We see a long list of projects that are coming, both private and public." The metro-based Grand Paris program could generate $11 billion of rail work over the next decade, he estimates.

Many large European contractors believe that big-ticket infrastructure projects will bolster the market. For example, European Commission President Jean-Claude Juncker has proposed to create a fund to guarantee infrastructure projects that may stimulate $330 billion in projects over the next five years. "The Juncker package will most likely have a positive influence on our core markets, especially in regions with high refurbishment needs in the infrastructure sector, like Central and Eastern Europe," says Thomas Birtel, CEO of Austria's Strabag SE.

VINCI's U.K. focus is "more and more on [design-build] projects where we can generate value by the ideas we have," says Stubler. Otherwise, "it's challenging to be profitable in U.K." The U.K.'s "very good profits of the old days" are over, agrees Peter Wallin, Skanska's chief financial officer. But demand "continues to be good," adds Johan Karlström, CEO of Sweden's Skanska AB.

Bechtel Inc. last year completed one big railroad job in the U.K. and its involvement in the huge London Crossrail program is peaking. In looking for replacement work, "we have a pretty good footprint ... that gives us credibility in the market," says David Welch, president of Bechtel's Europe, Africa and Middle East region.

FCC aims to expand in the U.K. following its P3 contracts, including the current Mersey Gateway bridge. And after a deep recession in Spain, FCC's home market is on the upswing, notes Jurado. Increased Spanish infrastructure investment this year represents "a significant boost to the construction sector." Demand is forecast to increase by over 14% by 2019, he adds.

Russia is providing opportunities for select international contractors "Russia is still the biggest opportunity, especially for Turkish construction companies, even during this year economic crisis," says Bahattin Demirbilek, president of Russian-Turkish Esta Construction. He says Turkish contractors have been in Russia and the Commonwealth of Independent States countries for 25 years and relations between both government and private investors are strong.

Oil-rich Norway remains "a good civil market but competition is extremely tough," says Karlström. He reports "good revenues" in Sweden and Poland, while the weak Czech market has "stabilized." Stubler agrees "Poland is doing very well." But competition, mainly from local and Spanish firms, is tough, he adds.

But executives report depressing effects of low oil prices in exporting countries such as Norway. There, residential demand in Stavanger has "more or less stopped," says Karlström.

Impact of Cheap Oil

The drop in oil prices is definitely beginning to have an impact on international contractors in that sector. For example, Technip announced on July 6 that the oil-and-gas market was under pressure and that it foresees even greater challenges ahead. To address these challenges to its core market, Technip announced that it was planning on cost-cutting measures to save $925 million in expenses over the next two years, including the elimination of 6,000 workers worldwide and optimizing its asset base.

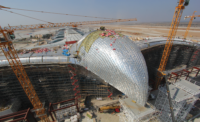

"The recent drop in crude-oil prices and widespread political instability have been reason for concern," says S.N. Subrahmanyan, senior executive vice president of India's Larsen & Toubro Ltd. However, he says most countries in the oil-producing Middle East region have already rolled out massive social and infrastructure projects. "Consistent funding for these projects, even under tough economic conditions, indicates that priorities are in place," he says.

Post a comment to this article

Report Abusive Comment