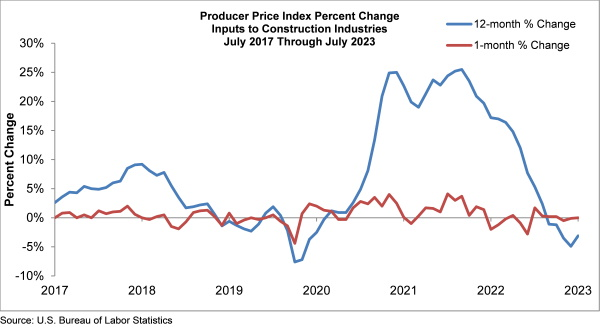

Prices for many construction materials have stabilized and some have begun dropping, although costs still remain higher than since the start of the COVID-19 pandemic, according to industry group analyses of the latest U.S. Bureau of Labor Statistics Producer Price Index data released Aug. 11.

Inputs to nonresidential construction fell by 0.1% in July and were down 2.7% over the past 12 months, according to the Associated Builders and Contractors. But those inputs were still up 39.1% compared to February 2020, before the coronavirus severely impacted supply chains. Anirban Basu, ABC chief economist, attributed the price stagnation to improved supply chains and a “sluggish global economy.” He predicted that most construction material prices, not including energy prices, should be mostly stable in the coming months.

“As supply chains have normalized, unmet demand has been more readily satisfied,” he said in a statement. “That has propelled transactional volume and economic growth. At the same time, the improved supply chain has helped push prices lower, contributing to the disinflation observable both in yesterday’s Consumer Price Index and today’s Produce Price Index release.”

In another analysis of the PPI, the Associated General Contractors of America highlighted major declines in costs for diesel fuel, down 8.4% in July, and steel mill products, down 7.6%.

Costs for some commodities have continued to rise. Despite a 0.1% drop in price in July, concrete product prices were still up 9.6% compared to a year ago, according to ABC’s analysis. AGC pointed to persistent price increases for materials including asphalt coatings, lumber and plywood. Both groups also raised concerns about long lead times for machinery and equipment, which saw costs rise 1.6% in July and were up 9.3% from a year ago.

“Many contractors continue to complain about lengthy lead times for equipment as the nation continues to expand spending on infrastructure,” Basu said.

Chart courtesy of Bureau of Labor Statistics via Associated Builders and Contractors

Chart courtesy of Bureau of Labor Statistics via Associated Builders and Contractors

Meanwhile, Buy America requirements included in the rollout of the Infrastructure Investment and Jobs Act threaten to increase material costs by inhibiting contractor ability to take advantage of a diversified supply chain, said Stephen Sandherr, group CEO. “Infrastructure is needed now, and until we have the capability of keeping all manufacturing on U.S. soil, we need to take advantage of all resources available,” he said.

Post a comment to this article

Report Abusive Comment