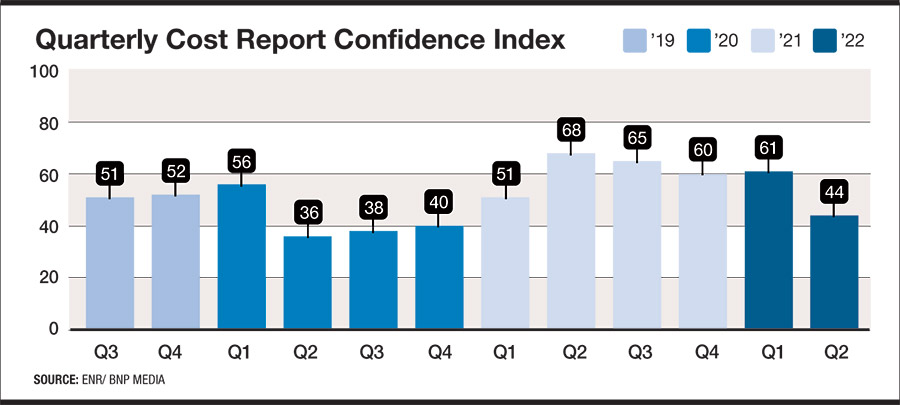

Over the past few years, the second quarter has been a time of reckoning for ENR’s Construction Industry Confidence Index. In 2020, it dropped 20 points in Q2 as the full effects of the pandemic became apparent. Last year, the index jumped 17 points as industry executives were optimistic there was light at the end of the pandemic’s tunnel. And now in 2022, with fears of a recession looming, it has dropped 17 points below the Q1 level, to a 44 rating.

The index, also called CICI, measures executive sentiment about where the current market will be in the next three to six months and over a 12- to 18-month period, on a 0-100 scale. A rating above 50 shows a growing market. The measure is based on responses by U.S. executives of leading general contractors, subcontractors and design firms on ENR’s top lists to surveys sent between May 9 and June 27.

Construction executives are more pessimistic about the economy as a whole. The economic confidence index halved between Q1 and Q2, falling to a rating of 23, from 46. That is the lowest economic index rating since the CICI started in the first quarter of 2009. The previous low was 25, from that first reading.

Labor shortages remain endemic, with 63.5% of CICI survey respondents reporting they were somewhat or much worse than one year ago. According to the May Job Openings and Labor Turnover report issued by the U.S. Bureau of Labor Statistics, there were 449,000 unfilled construction jobs as of April 2022—up from 329,000 one year before.

Confidence is down in most markets ENR tracks. Hardest hit is retail, down 12 points to a 30 rating, with K-12 education down ten points. Despite the drops, firms remain optimistic in many markets, particularly health care (71) and industrial-manufacturing (68). The distribution-warehouse sector also posted a 68 rating, even with a ten-point drop.

*Click the image for greater detail

CFO Confidence Stumbles

Results of the latest Confindex quarterly survey from the Construction Financial Management Association (CFMA) reflect a growing pessimism among CFOs in general and civil contractors and subcontractors about markets and business conditions. The Confindex is based on four financial and market components, each rated on a scale of 1 to 200. A rating of 100 indicates a stable market; higher ratings indicate market growth.

The Confindex fell 8.6% between Q1 and Q2 of 2022 to a rating of 106. The “current confidence” index also dropped five points to 112 and the “business conditions” index plunged 20.6% to 104. The “financial conditions” index rose three points to 105 from a downturn last quarter, but is still down 1.8% from Q2 2021.

*Click the chart for greater detail

The most significant number is the “year ahead outlook,” down 15 points to a 100 rating, says Stuart Binstock, CEO of CFMA. “Longer term, [our respondents] usually have a more favorable view on things. That is not the case here,” he says. That sentiment is also reflected in ENR’s CICI survey. Only 19% of firms currently see a declining construction market, but that number jumps to 43% when looking ahead 12 to 18 months.

The expected recession has already hit in some markets, says CFMA economic adviser Anirban Basu, also CEO of economic consultant Sage Policy Group. “We already had a negative first quarter in terms of GDP growth,” he notes. “It’s possible that the second quarter will also be negative, but if it’s positive it will be barely so.” That gives the Federal Reserve little room to slow the economy without driving it into recession. “They just started hiking interest rates in March. There are many more to come,” Basu adds.

The economist thinks that the recession will be a long and deep one, but unfortunately, also necessary. “It’s a cliche, but the cure for high prices is high prices,” he contends. “If we want to get back to 2% inflation, we’re going to have to take our medicine.”

Energy Sector Concerns

High prices are yet to result in either demand destruction or increased supply in the crucial oil & gas sector. The cutoff of Russian oil and tight OPEC output quotas are obvious factors, but Basu is puzzled by the domestic response to high prices.

“We were producing 13 million barrels of oil a day in this country, pre-pandemic. Now we are at 11.6 or 11.8 million,” he says. Even allowing for lead time necessary for production to pick up again, Basu is surprised by the lack of rapid response. The incentives are not in favor of increased production, he thinks.

“I have to buy more equipment, get more permits, hire more workers,” the analyst points out. “We’re making a ton of money. We produce what we produce.” Basu also sees the accelerating energy transition from fossil fuels as a factor. “[The federal government] wants me in wind and solar battery technology. Members of my board don’t want me producing more oil,” he says.

Basu also believes that public sector projects could be put on hold in hope of more favorable bids a year from now. “This is a great time to plan projects, not build them,” he says.