When Elmhurst Group, a Pittsburgh-area developer, started collecting bids for a new mixed-use building last November, the price of the steel frame, roof and cladding panels for the $14-million project came in $382,000 higher than expected—a big enough disappointment to give Elmhurst pause. Overall material costs for the project were running more than $650,000 above what was originally calculated.

Eventually, says Brian Miller, Elmhurst's director of development, the company decided to rebid the steel portion months later to get a lower price. While "less than ideal for vendor relations," the steel rebid was needed because of the unprecedented overall material cost increases.

“It’s never been quite like this at all," says Miller. "Initially cost increases were in lumber, but then it migrated to just about everything,”

The spike in some material prices—and related shortages—has injected new tensions into supply-chain business relationships. While companies say they are managing the crisis with more creative procurement methods, they rarely speak about the more controversial layer of activity. It includes suppliers that rip up purchase contracts and demand higher prices, owners and contractors re-bidding already-bid contracts to get lower prices—a process that in sunnier times drives down their costs but hurts bidders—and price gouging.

The inflationary tide that is well-known in steel and lumber has also swept up other product classes, such as insulation and solar panels. The effect sometimes is project paralysis and deferred decisions to build.

Right now, owners and contractors can’t decide whether to wait for prices of some materials to fall, or to proceed with projects to avoid more delays—for some, a bigger issue than price.

"We have some contractors say they are going to try and wait this out for about 12 months or so, but there is still no guarantee that the prices or the supply chain issues will resolve in 12 months."

—Chris Smith, AGC of California

“We have some contractors say they are going to try and wait this out for about 12 months or so, but there is still no guarantee that the prices or the supply-chain issues will resolve in 12 months,” says Chris Smith, senior northern and central state government affairs manager for the Associated General Contractors of California. “We’ve seen material cost increases in the past that have lasted two years, but the main issue right now is the supply-chain side” and delays.

Historic Inflation Surge

The sources of inflation include backed-up shipping ports, adverse weather, tariffs, production cuts at the start of the pandemic and the effect of the stimulus on hourly workers.

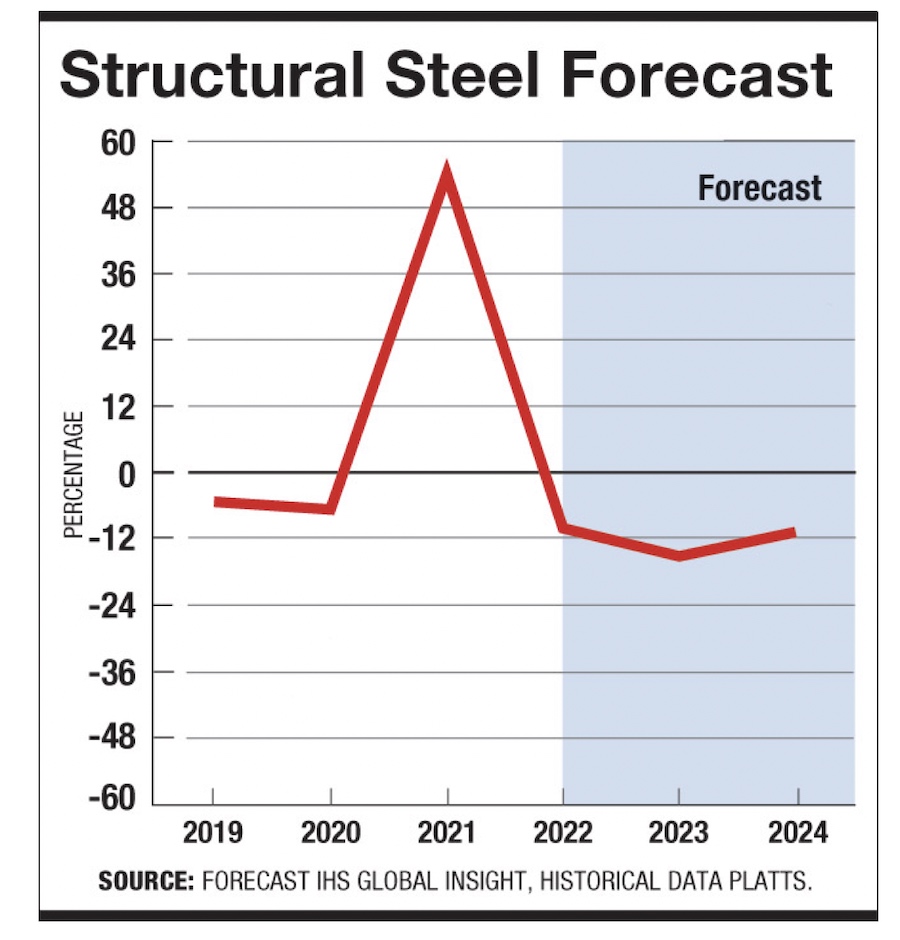

Although some analysts foresee steel prices retreating as pandemic-idled capacity comes back online, structural metal prices are expected to rise 22.8% overall in 2021, while fabricated structural sheet will increase 23.8%, according to IHS Markit’s third-quarter forecast. The numbers, which are likely peaks for the year, represent sharp increases from the second quarter report, which forecast the two materials at 9.4% and 6.8%, respectively.

To be sure, the doubling of some steel prices since the beginning of the pandemic in 2020 has not wrecked steel construction, which has experienced its most dramatic price leaps since 2004-2008, when price spikes of 50% were seen and the American Institute of Steel Construction first promulgated language for price escalation clauses in contracts.

Depending on the project type, steel materials represent a limited part of the overall cost of a steel-framed building—about 10%, depending on the structure.

Rebidding as a Cost Strategy

But for Elmhurst Group, the Pittsburgh-area developer, cost-control is vital. Its new "Innovation Center," a combination of office and warehouse space suited for research and development, will eventually consist of three-story structures. It is being built in two 85,000-sq-ft phases.

When the steel bids came in high, Miller says, “we had to go back and bring in new bidders to see if we could get the price down.” A new bid pared $222,000 off from the $382,000 steel cost increase, with Miller glad he was able to lock in the lower price.

“I was told that in two or three months, the steel costs would have been a $500,000 increase,” he said.

Inflation has stalled or cast uncertainty on transportation projects, too.

George C. Delano, Granite Construction California Valley region project executive, says original estimates for Caltrans' planned redecking and rehabilitation of the American River Bridge in Sacramento are now out of date. It has pipe piles and sheet piles in its substructure and steel girders in the superstructure. The big question is whether to delay work in hopes that prices will tumble.

Rehab and re-decking of the American River Bridge in Sacramento could be delayed over steel prices. Photo: Courtesy of Caltrans

Some analysts foresee such a decline, noting that global production actually exceeds pre-COVID-19 output and the U.S. is back to 2019 levels after months of underproduction.

The decision, Delano wrote in an email, “is a difficult call" because prices may stay the same or even go higher.

Inflation has cornered other project developers into making tradeoffs between cost and schedule.

K. Cyrus Sanandaji, managing director of San Francisco-based developer Presidio Bay Ventures, says one of his company’s general contractors had a project designed with pan decking and metal trusses, where the normal six-month delivery lead time now is one year and threatens to delay the project.

By redesigning to I-beams and purchasing pan decking from multiple manufacturers, the project was kept on schedule.

Under the new scheme, steel costs climbed 10%—an acceptable amount with the schedule now under control. If the project had been rebid, says Sanandaji, the costs would have increased by more than 15%.

Insulation Shortages, Too

Other product types are scarce and threaten to delay projects, too, including polyiso sloped roofing insulation for commercial projects. It now has a current lead time of more than 20 months, Sanandaji says, and “we may need these products in less than half this time” from when it is ordered.

So that means looking to other materials that may be equivalent, such as cellcrete or expanded polystyrene, which may have “faster lead times with costs that are cost neutral or minimally more.”

Elmhurst’s Miller says his company recently learned from one of its general contractors of another type of problem involving wall and roof insulation—price gouging.

It took the form of “a sudden request” by the manufacturer to a subcontractor and included a threat not to ship and to cancel the order if a $105,000 increase was not agreed to. That raised suspicions.

Miller says he and his staff investigated and found all was in line with the general contractor's order, which allowed 12-plus weeks to actually furnish the material. Once Elmhurst had done that, however, the insulation supplier/vendor claimed “force majeure,” stating that its manufacturer-supplier pricing was beyond its control.

Insulation similar to that used in this New York State industrial building project has been subject to delays and possible price gouging. Photo: Richard Korman for ENR.

Elmhurst refused to passively accept the force majeure claim, but it may have few choices. To protect the general contractor who may be stuck with such sudden price increases, Miller now pledges that all Elmhurst new purchase orders and subcontracts will include language to lock in pricing based on issuance and acceptance dates.

“We cannot keep going down this road with sudden and unexpected cost increases that ultimately affect our ability to competitively lease space in the market,” he says.

Tearing Up Contracts: Legal Views

Lacking escalation clauses, steel mills and steel service centers sometimes, like the insulation supplier, simply tear up the purchase contracts and demand more money. It is unclear, however, how many steel fabricators cross-out agreed prices or have escalation clauses.

There is little contractors can do about such breaches of purchase agreements, since the steel supply industry enjoys and takes advantage of what may be a temporary market power tilt in its favor, attorneys say.

Stephen A. Hess, an attorney at Sherman & Howard, says skyrocketing steel prices have triggered “substantial misbehavior under supply contracts, ranging from outright refusals to honor contracts to demands by suppliers for payment in excess of agreed-upon contract prices.”

Contract law nominally provides some protection to buyers, but contractors rarely want to pursue even promising litigation when capitulation is a more expedient – albeit painful – alternative, he says.

Market power and a lack of price competition may encourage or allow steel mills to shift price risk to contractors via escalation clauses.

If a beam or product of a specific size is needed and only one steel mill or service center in the area can supply it, the supplier enjoys an edge.

So far, steel fabricators and erectors and steel supply centers have been reluctant to publicly discuss the behind-the-scenes adjustments to the steel price spike. The Metal Service Center Institute, the association whose members include steel service centers, the service-oriented distributors for steel mills, declined to answer questions.

In some cases, the pricing “tactics are predatory,” says Hess. “In other cases mid-stream suppliers have little choice as they are caught in fixed-price supply contracts with contractors but are compelled to purchase steel at ever-increasing market prices; honoring their contracts may ruin their businesses.”

In some circumstances, suggests Steven Henderson, a construction attorney with Stites & Harbison, all companies in the supply chain—steel supplier, fabricator-erector, and general contractor—may be better served by cooperatively absorbing cost increases that cannot be passed up the contractual chain to an owner.

“If orders can’t be fulfilled at contract prices, and there is no material cost escalation clause, parties are forced" to look for a legal remedy, he says. But forcing another party to pay for cost increases due to market fluctuations in material prices "generally isn't helpful," he says

“There’s nothing fundamentally wrong with breaching a contract, but there are consequences that extend far beyond a particular contract dispute.”

Rather than put on the gloves and retreat to their corners, Henderson suggests that parties may be better served by approaching the dispute as a business negotiation. Suppliers and contractors who work with a mutual goal of convincing the owner to pick up the expense, “may find it's worth the extra dollars to preserve business relationships,” says Henderson.

Owners benefit from sharing cost risk, too, because contractors are more likely to provide realistic pricing without exorbitant markups necessary to account for the risk of volatile material costs.

Partnerships and Contingencies

David Alford, regional vice president of preconstruction at McCarthy Building Cos., agrees that cooperation is the best approach.

He says his company is currently “working with many of our steel trade partners and their suppliers to understand the current material market” to buy at the right time.

Just in case cooperation doesn’t prevail, a new kind of emergency fund may be needed.

“We try to come up with a secondary contingency—an inflation contingency,” said Elmhurst’s Miller. “It’s painful because investors don’t like to see that.”

Post a comment to this article

Report Abusive Comment