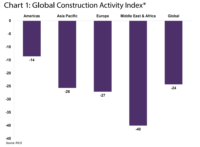

Recovery of construction worldwide continues, according to the Royal Institution of Chartered Surveyors Global Construction Monitor. Its latest activity index, which measures current and expected workloads in residential, non-residential and infrastructure sectors, as well as company profit margins, reached +25 in the second quarter of 2021, rising from +14 in the first quarter.

The index for the Americas stands at + 29, with the U.S. and Canada registered at +45 and +39, respectively. The European index reached +34, while Asia Pacific came in at +21. The index in the Middle East and Africa stand a +8.

“The U.S. construction industry does now appear in full recovery mode,” says Simon Rubinsohn, chief economist at RICS. “Although the private residential sector has been leading the way so far this year, the latest feedback suggests the upturn in workloads is beginning to broaden out.”

He says the US "is one of the few countries - along with Portugal, the Netherlands and Saudi Arabia - which is seeing significant growth in workloads within all market segments."

As workloads increase, 83% of survey respondents noted concerns over rising material costs, up from 66% last quarter. In the U.S., 74% point to the skilled labor shortage, as did 61% in Canada.

The survey said that overall construction cost forecasts are highest in the Americas, at 9%, compared with all other regions, with average forecasts at 7%.

“[Labor shortages] coupled with the ongoing issues around the sourcing and pricing of building materials suggests that the hoped for recovery in profitability, signaled by contributors to the survey, may take a little longer than envisioned to materialize,” says Rubinsohn. Against this backdrop, construction costs are seen as likely to continue to rise strongly over the next twelve months suggesting that any recovery in profitability in the near term is likely to be hard fought.”

Post a comment to this article

Report Abusive Comment