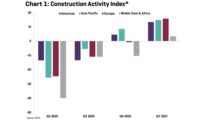

Global construction experienced significant COVID-19 impacts in the second quarter of 2020, reports the Royal Institution of Chartered Surveyors (RICS) Global Construction Monitor. Its Global Construction Activity Index, which measures current and expected workloads in residential, non-residential and infrastructure sectors, as well as company profit margins, registered at -24 for the quarter.

North America's index came in at -14, while Asia Pacific and Europe registered at -26 and -27, respectively. The index for the Middle East and Africa was the lowest at -40.

Respondents report a decline in private construction work in both residential and non-residential sectors, and expect further job losses in the coming months, particularly in Europe.

“The Q2 survey represents the first full quarter to experience the COVID-19 pandemic impacts. The concern and uncertainty it brings to the market place is reflected in these results," says Chris P. Caddell, president of cost engineers' group AACE International. "I am cautiously optimistic that the impacts will reduce with time, but there is so much we still don’t know.”

In the U.S., both private residential and private non-residential workloads are expected to drop in the next 12 months; the survey's net balance percentage came in at -16% and -14% for the respective sectors.

The lone positive, infrastructure and public works, reached 17%.

Only 24% of respondents cite the labor shortage as a concern, compared to 50% in the first quarter, while skill shortage worries have dropped from 65% to 31% in the same time period.

In Canada, the outlook is somewhat more optimistic. RICS reports that while private non-residential workloads will decline significantly, with a net balance percentage of -18%, private residential workload net balance is expected to stay nearly flat, at -3%. As in the U.S., infrastructure and public works are expected to rise, with a net balance of 39%. Concern about the labor shortage was of importance to 44% of respondents, while 38% noted the skill shortage.

"The feedback to the monitor highlights the challenges construction businesses in North America are likely to face over the coming year with workloads anticipated to be flat at best away from the infrastructure sector and profits remaining under pressure,” says Simon Rubinsohn, RICS chief pf economics.

Post a comment to this article

Report Abusive Comment