A recent survey of American construction industry employers in all 50 states shows that the majority (71%) expects no change in their employment outlook for the Q1 of 2016, and another survey by the same group states that employers continue to be frustrated by the difficulty of finding certain talented professionals—including IT, engineering and—surprise, surprise—the skilled trades.

ManpowerGroup, Milwaukee, Wiss., a worldwide employment agency, conducted 11,000 interviews with U.S. based employers in the top 100 Metropolitan Statistical Areas, the District of Columbia and Puerto Rico. The questions aimed to gauge employer-hiring intent in the first three months of the year. To categorize the results, the U.S. was broken up into four geographic regions: Midwest, Northeast, South and West.

A second survey by the company queried 41,700 hiring managers in 42 countries on the state of the talent pool and the impact of a talent shortage on business.

Here are some U.S. construction industry highlights:

· Though the majority of construction responses across all regions indicated no expected change, 19% of respondents in the West predicted an increase in hiring.

· IT staff expectations were equally flat with 77% of respondents expecting no change, 18% had positive projections and 3% negative.

· The Midwest and Northeast regions had the most placid construction expectations; 14% of Northeast and 13% of Midwest construction employers expected a decrease in hiring. The South was slightly more optimistic with only 6% of Southern construction employers expecting a decrease.

· Southern and Western regions have the most positive expectations for IT staff, at 22% and 20% respectively.

· Out of 13 industries, the construction and mining sectors anticipated the greatest decreases in hiring. 10% of construction respondents and 14% of mining respondents expect to see a decline this quarter. Only 3% of IT employers expect declines.

· Leisure and Hospitality respondents had the brightest outlooks, with 34% expecting to see an increase in hiring.

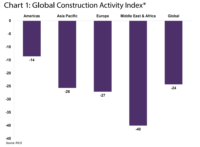

The global portion of the survey was similar. Surveyors interviewed 58,000 employers in 42 countries across 13 different industries to get the results.

Here are the global highlights:

· India, Taiwan, Japan, Turkey and the United States had the most positive forecasts.

· Brazil, Finland and France were the only negative forecasts.

· China’s slowing economy and decreased demand for raw materials are negatively affecting the global market.

Post a comment to this article

Report Abusive Comment