The market for international contractors is slowly beginning to turn around after several years of sluggish activity brought about by plummeting oil prices and political uncertainties. However, recovering oil prices are not resulting in any quick surges in work. Further, internal national and regional stresses, and concerns over a potential trade war over tariffs, have many international firms wary.

The uncertainties in the international market are seen in the results of the ENR Top 250 International Contractors survey. This list ranks firms based on contracting revenue from projects outside of their home countries, measuring their presence in international commerce. ENR’s Top 250 Global Contractors list also ranks contractors based on total worldwide contracting revenue, regardless of project locations.

The Top 250 International Contractors reported $482.40 billion in contracting revenue in 2017 from projects outside their home countries, up 3.1%, from $468.12 billion, in 2016. This rise comes after three straight years of revenue declines among the Top 250. As a group, firms also reported $1.043 trillion in revenue from domestic projects in 2017, up 12.4%, from $927.94 billion in 2016.

Among regions, the U.S. was the biggest gainer, up 12.2%, to $60.14 billion, in 2017. Asia and Europe, the biggest regional markets for the Top 250, also saw gains in 2017, rising 6.1% and 6.4%, respectively.

The international market in the Middle East, the third-largest market for the Top 250, fell by 3.1% to $81.40 billion in 2017. Latin America, where many countries are in economic turmoil, saw the biggest decline among the Top 250, falling 12.1% last year. And the Canadian market, which is powered by its huge oil sands work, was down for the fifth straight year.

Related Links

ENR 2018 Top 250 Global Contractors

ENR’s 2018 Top 250 International Contractors

ENR’s 2018 Top 250 full PDF

(subscription required)

Markets Beginning To Stir

After several years of struggle, many large international contractors are experiencing a modest turnaround. For example, sales by Bechtel’s London-based infrastructure unit are “pretty steady.” But the firm is seeing “better diversity across our regions and sectors,” says division president Craig Albert.

France’s Vinci Construction is growing sales and backlog again, having “been through a crisis” caused largely by low oil prices and declining French demand, says Jérôme Stubler, chairman. “All our major markets are going up or are being stable at a high level,” adds Thomas Birtel, CEO of Austria’s Strabag SE.

Some contractors also report that the size of new projects is growing. The proportion of “really large projects is higher than we have seen before,” says Tomas Carlsson, CEO of Sweden’s NCC AB.

Italy’s Salini Impregilo SpA continues to focus on large complicated jobs, dominated by rail infrastructure. About 25% of its sales is in hydro projects, but it plans to increase that figure. Salini Impregilo believes infrastructure investments in the U.S., Australia and the Middle East will provide high-yield and low-risk opportunities, according to CEO Pietro Salini.

While contractors are bullish on demand, many fear rising project risks may erode margins. Operating in a “buyer’s market,” Bechtel is “saying ‘no’ to more things,” says Albert. Some bids by rivals are “below what we think is possible,” he adds.

Vinci also is bidding more selectively, and investing in productivity, to boost profit margins, says Stubler. With annual profit growth trending at around 20%, Vinci plans to double margins from its current 2.5%.

NCC also is striving for better margins. To achieve its target of 3.5% from 0.7% in this year’s first half “requires a long series of behavioral changes … it will take some time,” says Carlsson.

Sweden’s Skanska AB also is struggling with low margins, caused largely by a $58-million write-down on an undisclosed U.S. civil project, says CEO Anders Danielsson. Its operating margin fell to below 1%, which is 2.5% short of target. In the U.S., “we are taking a more selective approach,” he adds. “We know where our sweet spots are.” Skanska’s civil and building markets are strong but competition is “fierce.”

For many major contractors, competition from state-owned or supported contractors is putting pressure on margins. “I am still worried about contractors that are either government-owned or are supported economically by their governments, like in China and Korea,” says Samer Khoury, president of Greece’s Consolidated Contractors Group (CCC).

Albert agrees. “Chinese firms are very aggressive and proactive with financing,” he says. But “the work they do is not less expensive [than international rivals] and the quality not as high,” he adds. And “what gets left behind is the asset and not the stronger supply chain or capacity to do work.”

For Bechtel, competing internationally would benefit from more U.S. Export-Import Bank support. The Ex-Im Bank has been effectively neutered when Congress failed to confirm new board members to approve loans. A fully functioning Ex-Im Bank would “level the playing field with state-backed [rival] companies,” believes Albert. “The U.K. seems to be moving in this direction. We need the U.S. to do the same.”

Changes in currency exchange rates also are causing concern. “It has been an uphill battle to sustain cash flow due to hectic international markets and USD and Euro value fluctuations,” says Onur Kireli, general manager of Turkey’s Renaissance Construction. Inflation in such countries as Venezuela, Argentina, Iran and Turkey are adding to currency worries.

However, some contractors believe that some of the pressure on margins may be waning. “Our industry is cyclical, and we are now coming out of the low cycle,” says Khoury. “Many companies got burned, and they will no longer [bid] low prices, nor will they accept poor/unfavorable contract conditions.”

“Our industry is cyclical, and we are now coming out of the low cycle. Many companies got burned, and they will no longer [bid] low prices, nor will they accept poor/ unfavorable contract conditions.”

– Samer Khoury, President, Consolidated Contractors Group

Regional Matchups

North America remains a “weak point” for Vinci, says Stubler. Vinci was successful with privately financed bids early this decade for the Ohio River East End Crossing project, Indiana, and Canada’s Regina Bypass project, but has had less luck since, he adds.

Turkey’s ANT Yapi is targeting the U.S. and U.K. markets. “Our focus is luxury multifamily and commercial buildings because investors are increasing their investments in these markets,” says Kadir Tokman, chairman.

Another company establishing itself in the U.S. is Spain’s FCC. FCC sticks to nations with “political, legal and monetary-fiscal stability,” like the U.S., says Manuel A. Olivares, bidding and commercial director. FCC is working on the new $1.3-billion Gerald Desmond Bridge in Long Beach, Calif.

The European market seems to be coming around after being stagnant for several years. “The economic rebound in Europe will allow for a renewal of activities in the infrastructure segment in which investments have been low in recent years,” says Pierre Sironval, managing director of Six Construct, a unit of Belgium’s BESIX. He says this benefits BESIX as its expertise is in “complex infrastructure works.”

U.K. infrastructure is now one of Bechtel’s priorities, providing railroad and aviation opportunities, says Albert. Despite the U.K.’s planned departure next March from the European Union (Brexit), “we think it’s a very robust [infrastructure] market,” he adds.

Brexit will not immediately affect Strabag, which has no permanent British presence. However, losing the U.K.’s contribution to EU budgets “could be a dampening factor” in the region, says Birtel.

For Skanska, Brexit has slowed its U.K. commercial buildings market, although the civil business remains “strong [and] stable,” says Danielsson. Vinci’s U.K. private sector activities also are slowing, but the firm is busy on major projects, including the London-Birmingham high-speed railroad.

In Nordic countries, NCC’s Norwegian business has decreased as the firm bids more carefully, says Carlsson. Losses in the Norwegian civil engineering sector were “more a leadership question,” he adds.

Skanska also is remedying Norwegian problems dating back to 2011, says Danielsson. The firm reports Nordic margins of 3.9% in this year’s first half and 4.6% in Sweden.

“Germany will have a very strong infrastructure market for the next 13 to 15 years,” says Birtel. Having acquired two large German contractors in the last 20 years, Germany is Strabag’s largest market. After Germany and Austria, Birtel sees Poland as its next big real estate market, which is “promising” in the Warsaw area.

In Africa, European contractors “have a chance again,” says Birtel, citing waning Chinese dominance. China’s “strategic interest [in Africa] isn’t that strong anymore,” he adds.

Political and economic uncertainty is at the root of much of the concern about the African market. “African countries are under great pressure due to increasing debts. Insolvency of some of them dampens the confidence of financial institutions and private investors,” says a spokesperson for China State Contracting and Engineering Corp.

Many international contractors say Africa is a down market. “Megaprojects take ages to get moving. Some of the reasons for these delays are the lack of government capacity to handle megaprojects, the huge bureaucracy and the multinational financing agencies taking their time to approve projects,” says Khoury of CCC.

Many firms are shifting away from troubled regions to focus on Asia and Australia. For example, Salini Impregilo’s African sales fell to 13% of group total last year from 70% in 2008. Salini Impregilo now is preparing three Australian infrastructure bids worth more than $7 billion.

Vinci’s Stubler is “very happy” with the French firm’s two acquisitions of contractors in New Zealand and Australia since 2015. Using Vinci’s resources, the firms are growing rapidly, he adds.

Bechtel’s recent investment of staff and resources in Australia’s infrastructure market has paid off with its recent win for the Western Sydney Airport, says Albert. “The Australian market is going to be really big for a long time,” he adds.

Luxembourg’s Jan de Nul Group also is finding new markets in Asia. It has won contracts for two major offshore wind farm projects in Taiwan. “Jan De Nul Group is a pioneer in exporting the wind farm expertise outside Europe,” says Mieke Fordeyn, director of the international division.

Middle East Uncertainties

New laws in oil-dependent nations in the Middle East are creating turmoil for contractors. Oil prices have rebounded, but the market has not broken out yet. Many of these countries are passing new laws and policies to make up for budget shortfalls and to wean themselves off their dependence on oil revenue.

Although crude oil prices have been rising, “we have to wait and watch for strategic infrastructure projects that will be announced,” says S.N. Subrahmanyan, CEO of India’s Larsen & Toubro. Most Gulf Cooperation Council (GCC) countries “seem to be on a ‘wait-and-watch’ to finance large infrastructure projects [to] maintain cash flows, [and] that could lead to stretching of timelines for approval and execution of both current and fresh projects.”

GCC countries “seem to be on a ‘wait-and-watch’ to finance large infrastructure projects [to] maintain cash flows, [and] that could lead to stretching of timelines for approval and execution of both current and fresh projects.”

– S.N. Subrahmanyan, CEO, Larsen & Toubro

“The engine of growth in the Gulf region is infrastructure, which is largely government-financed,” says Kayihan Bagdatli, Kuwait country manager for Turkey’s Limak Insaat. But he says competition for new work remains intense and bureaucratic, and firms face localization and security-political issues.

New tax policies in Middle Eastern countries have many contractors concerned about pricing jobs as some nations have increased taxes and tariffs and introduced value-added taxes (VAT). “These factors have affected both our operations and cash flow. I think we need a couple of years to adjust to these,” says Khoury.

For example, the six GCC member states agreed in 2016 to impose new VAT. Both Saudi Arabia and the United Arab Emirates introduced a 5% VAT at the beginning of the year and Qatar, Oman, Bahrain and Kuwait have until Jan. 1, 2019, to impose their own VAT. In addition, “Saudi Arabia has levied fees on expatriates’ dependents of all nationalities. Corporate income taxes have also been imposed in some of the Gulf nations,” says Subrahmanyan.

The GCC countries also increasingly are worried about high levels of unemployment among native-born young people and now are requiring foreign companies to hire more local citizens. For example, the Saudis have developed the Nitaqat system, which grades companies’ ratio of employment of Saudi nationals and can affect their ability to gain future visas. “Saudi Arabia localization is seeking to accelerate the diversification of its economy away from oil and gas and to develop skilled jobs for Saudi talent,” says Subrahmanyan.

But the profusion of localization policies among other GCC countries has caused many companies and financial institutions to pause their investments in the GCC countries. “The hasty implementations of newly introduced localization policies have made those markets unpredictable,” says Georges Hage, CEO of Lebanon’s C.A.T. Group. “New regulations have not been thoroughly prepared across the whole supply chain.”

The result is that few projects have been awarded, says Hage. This has resulted in “unreasonably aggressive” competition on mid-sized projects by firms hoping to secure a minimum cash flow to be able to wait out the problem.

Worker Abuse

International contractors also are concerned about widespread reports of the exploitation of foreign workers. Many Middle East countries make the in-country sponsor, usually the employer or labor broker, responsible for the visa and legal status of foreign workers with little government oversight.

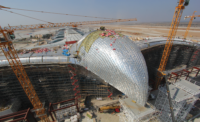

Migrant worker abuse accusations became worldwide headlines after the release of an Amnesty International report about working conditions and accommodations for foreign workers on the upgrade of Khalifa Stadium in Qatar for the 2022 World Cup.

International contractors are coming together to fight such abuses. A recent example is a consortium consisting of Bechtel, Fluor and Jacobs from the U.S., Vinci from France, Wood from the U.K. and Multiplex from Australia that formed “Building Responsibly,” a group that pushes for better worksite conditions and to insure competitiveness does not come at the expense of the workers (ENR 7/23-30, p. 19).

“Our people’s welfare is a key priority at BESIX, as it should be in the whole industry.”

– Pierre Sironval, Managing Director, Six Construct

Another group is Building and Wood Workers’ International (BWI), a Swiss-based union, which has developed “Corporate Social Responsibility” standards to ensure fair worker treatment. Many international contractors have signed on with BWI’s protocols, including Germany’ Hochtief, Sweden’s Skanska, Salini Impregilo of Italy, Royal BAM of the Netherlands and FCC, Ferrovial, Dragados, OHL, Sacyr and Acciona of Spain.

Belgium’s BESIX signed the BWI agreement in December. BESIX subsidiary Six Construct is a joint venture partner of Qatari contractor Midmac on the Khalifa Stadium project that came under fire. The joint venture was praised in an Amnesty International report on migrant workers for intervening with the subcontractors to provide workers with better housing, and for requiring remedial action and inspections.

BESIX says the adoption of the BWI standards reaffirms its commitment to workers’ rights. BESIX signed the BWI agreement “because we are committed to creating the best possible working and living conditions for our employees, both on construction sites and in corporate offices,” says Sironval. “Our people’s welfare is a key priority at BESIX, as it should be in the whole industry.”

Post a comment to this article

Report Abusive Comment