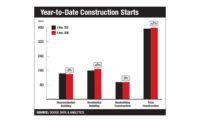

The pace of construction has stayed fairly steady in the first half of 2018, despite the continued uncertainty that changing Trump administration tariffs on steel and aluminum have injected into the marketplace. According to Dodge Data & Analytics, construction starts are down 3% year-to-date, but as of May, they remain 1% above the level of one year ago. Total starts are expected to rise 2% to 3% by the end of the year.

“On balance, the pace of total construction starts is staying close to the levels achieved over the past year, when activity grew 5%,” says Robert Murray, Dodge chief economist and vice president. “The construction industry is facing increased headwinds, such as higher material prices and the recent pickup in interest rates, but these are not yet having much of a negative impact on the pace of construction starts.”

Driving growth are natural-gas pipeline projects, such as the $3.5-billion Mountain Valley line expansion in Virginia and West Virginia, the $2.1-billion Mountaineer Express project in West Virginia and the $1.8-billion Gulf Coast Express pipeline in Texas. Transportation projects reaching the construction-start stage include the $1.4-billion Westside Purple Line extension section 2 in Los Angeles and the $1.2-billion rail portion of the Long Island Rail Road expansion in Nassau County, N.Y.

While multifamily housing construction starts have declined, warehouses and office buildings have held steady, and public works “should soon benefit from increased federal funding for transportation projects included in the March 2018 federal appropriations bill,” says Murray. He says bank lending standards for nonresidential projects “have eased slightly, and the recent rollback of Dodd-Frank [Act] constraints on mid-size regional banks” may boost near-term project funding.

West Coast Stands Out

Julian Anderson, president of cost consultant Rider Levett Bucknall, believes construction is slowing on the East Coast, but that West Coast activity remains above the national average. “Just a busy, busy market,” he says. Anderson expects construction to peak this year before slowing in 2019 and 2020. “The risk of recession in 2020 is rising,” he notes, adding that the downturn should be “relatively mild.”

Lumber prices continued to rise with ongoing shortages due to earlier Canadian tariffs. IHS Markit predicts a 12% increase for softwood lumber in its second quarter forecast. That number represents a large jump from the first quarter’s forecast of a 4.5% increase. The ENR 20-city average price for lumber is 8.9% higher than this time last year. IHS Market economist Thomas McCartin believes that lumber prices may finally be peaking. “Softwood lumber prices have risen more than market fundamentals suggest they should,” he says. “We expect prices to fall in the second half of the year.”

ENR’s 20-city average for steel is 1.8% higher than this time last year, as the industry braces for the impact of steel and aluminum tariffs that took effect June 1 for products from Mexico, Canada and the European Union (see related story, p. 16). IHS Markit predicts steel prices will rise 12.9% in 2018, up slightly from the 11.6% hike seen last quarter. “Quotas versus tariffs mean significantly different price changes, but it is not even clear that we have a final answer on which countries will get which treatment,” says McCartin.

On the labor side, ENR’s 20-city average price for common labor is 3.5% higher than this time last year, while skilled labor is up 2.3%. Anderson says the labor shortage is pushing employment of underskilled workers.

Brad Saylor, president of cost consulting firm Leland Saylor, predicts that a wage hike to attract skilled labor will happen sooner rather than later, particularly in the west. “We expect labor costs to climb rapidly after the first set of increases from new multiyear union labor contracts is applied starting in July,” he points out. “This will be acutely felt in California.” Anecdotally, he says the Bay Area electricians’ union was able to negotiate a nearly 8% wage increase for the 2018-19 contract year.

The Construction Labor Research Council, which tracks union wage trends, reports a projected 2.5% labor shortage for 2018, up from last year’s 2.1% forecasted rise. Welders are particularly sought after, with 32% of CLRC survey participants reporting they are difficult to find.