While commodity prices have begun to stabilize following the extreme volatility of the past several years, recession fears continue to mount. Inflation and labor shortages remain ongoing issues within the construction industry as well as the broader U.S. economy.

“Bid price increases on a year-over-year basis have finally caught up with material cost increases, which will bring smiles of relief to many contractors,” says Alex Carrick, chief economist at ConstructConnect. “Furthermore, expectations of an onrushing recession, due largely to climbing interest rates, are causing pullbacks in some key commodity prices. This is especially apparent in forestry products that go into new homebuilding. But it’s also being seen in some other raw materials, such as copper.”

Following the drop in materials prices, Carrick expects costs may rise in other areas. “Perhaps the bigger concern will soon shift to compensation and workplace issues, as the shortage of skilled workers is returning more leverage to labor. Tensions in new contract negotiations are almost sure to become more overt.”

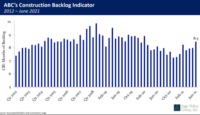

Richard Branch, chief economist of the Dodge Construction Network, says “as 2022 has moved passed the mid-point of the year, the construction sector is at a crossroads. The Dodge Momentum Index, a leading indicator of nonresidential building construction activity, is at a 14-year high as developers and owners start the planning process for hotels, offices, schools and hospitals. This suggests that the nascent recovery in construction starts from the pandemic will continue unabated despite rising costs and labor shortages.”

This enthusiasm, he says, will be “tempered by rapidly rising interest rates and fears that a recession will put a stop to projects in the planning cycle.” The Dodge forecast predicts that while a recession will be avoided in 2023, there will be a considerable slowdown in construction starts in residential and commercial markets. The market for schools, hospitals, manufacturing and infrastructure should remain stable, Dodge expects.

“The nascent recovery in construction starts will continue unabated despite rising costs and labor shortages.”

Richard Branch, chief economist, Dodge Construction Network

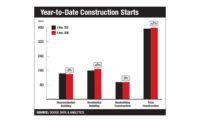

Overall, the dollar value of construction starts is up 6% over the first half of 2021. Single family starts fell 3% as “a noticeable chill has come over the single family market as higher mortgage rates and rising prices have further eroded affordability,” says Branch. Multi-family housing, however, “has flourished,” up 23% over the first six months of last year. Among the largest multi-family projects to begin work in the second quarter of this year were the $800-million Two Bridges building in New York and the $329-million Reston Next, a mixed-use building in Reston, Va.

Manufacturing Starts Shoot Up

Non-residential starts increased 13% year-over year, with growth in office and hotel construction. Institutional work such as education and healthcare has been mostly flat. “Manufacturing starts though have been the real star of the nonresidential sector as increased reshoring has pushed construction activity to new heights,” says Branch. The $10-billion Intel Fabrication plans in Chandler, Ariz., and the $400-million Exxon LaBarge carbon capture plant in Fontenelle, Wy., began construction this past quarter.

On the non-building side, construction starts are down 2% compared to the first half of last year. “Highway and bridge starts are bucking that trend, while electric power, sewer and water starts are all lower,” Branch adds. The $1.7-billion Samson Solar project and the $523-million Danish Fields solar farm, both in Texas, were the largest non-building projects to break ground in the second quarter.

Lumber Prices Drop

After skyrocketing for the past few years, lumber prices are finally on the decline. “Prices [for softwood lumber] corrected rapidly in June as demand slowed and buyers waited for better pricing,” says Deni Koenhemsi, associate director at S&P Global Market Intelligence. “Volatility is expected for the remainder of the summer as people re-stock inventories. Nevertheless, we do not expect pricing to consistently go up.”

The S&P Global Market Intelligence forecast predicts a 4% drop for softwood lumber in 2022, followed by a steeper 27.2% decline in 2023. Plywood is expected to rise 1.8%, with a 23.7% decrease in 2023.

prices are also on a downswing. “Prices for bar and rod in the U.S. are falling in the second quarter due to lower raw material prices, but supply chain bottlenecks remain,” says Christos Rigoutsos, senior economist at S&P Global Market Intelligence. “Higher quantities of imported products and high capacity utilization are pushing prices down in the beginning of summer.”

Reinforcing bar prices are still expected to rise overall in 2022, at a rate of 20%, according to the S&P Global Market Intelligence forecast, before falling 8.8% in 2023. The forecast for structural shapes follows a similar trajectory, rising 23.1% this year with a 14% drop expected next year.

Formula for Calculating ENR Indexes

The formula we use to create our two major cost indexes, the ENR Construction Cost Index and the ENR Building Cost Index, has four inputs: Portland cement, structural steel, lumber and labor. Labor forms the largest component of each index.

The labor data we use to compute our index is union wage rate data. Union wage rates are typically set by annual contracts. Therefore, the labor rates in our indexes only fluctuate once per year, which is a major factor in why the indexes behave the way they do.

Once each year, in our first quarterly cost report, we publish pie charts that show the proportions of each of the four inputs in the total index.

Post a comment to this article

Report Abusive Comment