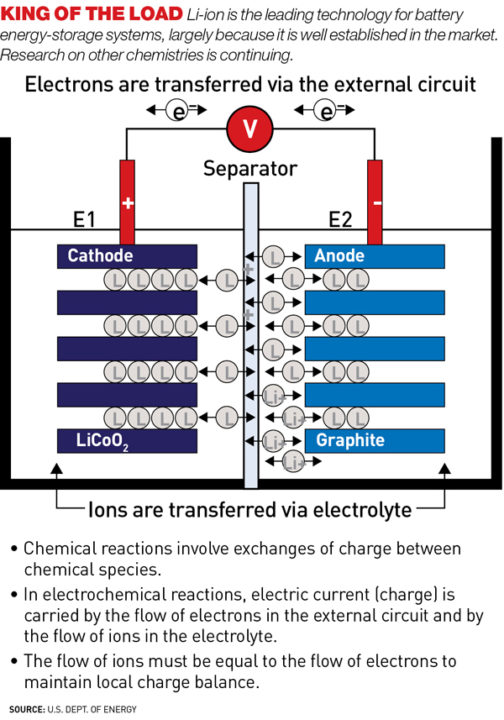

Most widely used for grid-level energy storage are batteries that use a variety of chemistries. "Each energy-storage technology has its benefits and issues," Babbitt says. "Presently, the grid energy-storage market is dominated by Li-ion batteries."

In March, RES announced the operation of the company's first energy-storage system, consisting of a plus-or-minus 4-MW—or 8-MW total range— 2.6-MWh Li-ion battery facility in Sunbury, Ohio, providing frequency regulation to the PJM. RES conceived, developed and constructed the energy-storage system and will own and operate it. The facility's two containers house batteries weighing 20 tons each. A third container converts the direct-current output to alternating current for the grid.

In August, the company obtained final certification for an identical system in Canada to provide frequency regulation to Ontario's Independent Electricity System Operator. The plant, called Amphora, was developed in response to a request for proposals seeking up to 10 MW of regulation from alternative sources. The Amphora plant will allow the operator to acquire experience with battery technology.

"The advantage of Li-ion is, you can use it in a lot of cycling applications," but, historically, Li-ion batteries have been designed for short-duration use, says EPRI's Kamath. "On the grid, in any application that's less than two hours, Li-ion makes a pretty good battery. If you need more than a couple of hours of stored energy, then you've got to look for some of the more advanced technologies. Flow batteries, aqueous intercalation and high-temperature sodium batteries are perhaps the most compelling," but they are not yet mature or cost-effective for wide-scale use, he says.

Robust Growth Prediction

By far, the bulk of the $50-billion energy-storage market Lux has forecast for 2020 will be in batteries for electric vehicles and consumer electronics, says Cosmin Laslau, Lux analyst. But revenue for stationary energy-storage applications will grow at an eye- popping 23% compound annual growth rate, to $2.3 billion, in 2020, he says. Residential applications will lead with $1.2 billion, up from less than $100 million today. Uninterruptible power supply (UPS) and backup power will reach $700 million and shift $300 million of renewables, says Laslau. Li-ion batteries, flywheels and supercapacitors will meet UPS requirements, he adds.

|

| LASLAU |

Burns & McDonnell has done "a fair amount of business-case planning for municipal utilities and investor-owned utilities [IOUs] to help them identify the best applications of energy storage," McIntosh says. There is industry buzz about energy storage, and some utilities are asking how they should use it.

In October 2013, the California Public Utilities Commission (CPUC) jump-started the nation's first-ever energy-storage mandate, ordering the state's three IOUs to procure 1,325 MW of energy storage by 2020 and complete installations by 2024. CPUC's edict also limits utility ownership to 50% of the storage in the utililities' procurement targets, opening the door to creation of merchant assets and customer-owned assets.

"Energy storage has the potential to offer services needed as California seeks to maximize the value of its generation and transmission investments: optimizing the grid to avoid or defer investments in new fossil powerplants, integrating renewable power and minimizing greenhouse emissions," Commissioner Carla Peterman explained.

Grid energy-storage applications are changing, says Lucas McIntosh, senior project manager of business consulting at Burns & McDonnell. "Pumped storage was originally utilized for the shift of load in large quantities," he says. "Nowadays, the main roles of storage are more about the integration of renewables and the stabilization or frequency regulation of regional or local grids."

Post a comment to this article

Report Abusive Comment