Developers are awaiting approval by the California Public Utilities Commission to begin construction on 770 MW of four-hour lithium-ion battery energy storage systems for Southern California Edison in what is seen as one of the the largest such U.S. procurements.

The systems will support new clean energy projects for which the utility has signed contracts with four developers, also subject to regulators approval. These will replace capacity of aging natural gas power plants being retired.

Solar and wind poweradditions will require energy storage to maintain system reliability. The procurement’s cost was not disclosed.

Most of the selected battery projects will be co-located with solar plants to charge the batteries.

“This is just the first part of a two-part process,” says William V. Walsh, SCE vice president of energy procurement and management. The utility expects to procure more capacity over the next six months.

NextEra Energy Resources has three storage system contracts totaling 460 MW, while Southern Power won two totaling 160 MW; LS Power is contracted for 100 MW and TerraGen Power will build 50 MW. All contracts have a commercial online date of Aug. 1, 2021.

“California has a pretty aggressive mandate to have 100% of their electricity coming from renewable-energy sources by 2045,” says Tim Grejtak, analyst for Lux Research Inc., and battery systems are “getting bigger. . . . We’re now getting into the triple-digit-megawatt range for these installations.”

SCE’s procurement represents a huge acceleration in the rate of energy-storage growth in the U.S.

BloombergNEF reports that 293 MW went on line last year across the country. A 300-MW Moss Landing project is due to open this year in central California and the 409-MW Manatee Energy Storage Center in Florida is scheduled to open late next year.

“We believe that asset scales are now at a tipping point,” Grejtak says, and that may make other energy-storage solutions more attractive than lithium-ion. Vanadium redox flow batteries have a different scaling factor and performance variable from lithium-ion, which makes them attractive beyond 100 MW, he adds.

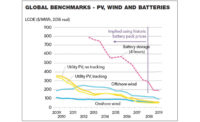

“The levelized cost of electricity from a battery is equal to that from a gas-peaker plant now, and the battery prices are falling steeply,” says George Crabtree, director of the Joint Center for Energy Storage Research at Argonne National Laboratory. Peaker plant costs are flat and the technology is mature.

SCE's anticipated 2021 operation date "is really fast, and you would never get a gas-peaker plant in operation that fast,” he adds.

Post a comment to this article

Report Abusive Comment