While designers are still seeing workloads increase, slower growth is expected this year in the buildings sector. Of late, some firms have noticed a growing time gap between contract awards and nods to proceed.

“I think it is becoming more difficult for owners to secure financing,” says David Cooper, president of the 1,190-person buildings group of the multidisciplinary engineer WSP USA.

John O’Connell, CEO of 100-person architect Kendall/Heaton & Associates Inc. (K/H), suggests owners may be having more trouble signing tenants, among other factors.

Data from the American Institute of Architects backs up the lag between award and onset of design work. For three years, new design contract scores have exceeded billing scores, which implies that developers are a bit slower to pull the trigger on executing projects, says Kermit Baker, AIA’s chief economist.

After a marginal decline in January, the AIA Architecture Billings Index, a monthly survey of some 750 AIA member firms that has a 75% response rate, posted growth in design revenue for February, March and April. However, April’s ABI score was 50.9, down from 54.3 in March, says Baker. (Any score above 50 indicates growth.)

Related Link

ENR 2017 Top Design Firms Sourcebook

“The ABI suggests slower growth in design activities. Therefore, slower growth is projected for construction activity,” which lags design activity by nine to 12 months, he adds.

The AIA’s Consensus Construction Forecast predicts construction spending for non-residential buildings will grow 5.6% this year and 4.9% next year, down from 7% last year. The next CCF—a joint effort of AIA, Dodge Data & Analytics, Wells Fargo Securities, HIS-Global Insight, Moody’s Economy.com, CMD Group, Associated Buildings & Contractors and FMI—is due out this month.

“There is still growth but at a slower pace,” notes Baker.

Alex Carrick, chief economist for construction data provider Construct-Connect, agrees, saying, “There is optimism that construction will roll on,” but things are quieting down.

Baker adds that ABI reporting-firm backlogs averaged six months in the first quarter of the year, the highest level in a decade.

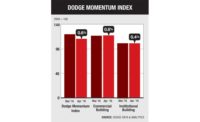

Dodge forecasts total 2017 spending on all buildings, excluding single-family housing, at $348.9 billion, with institutional buildings accounting for $127.8 billion, up 10% over 2016. This year, Dodge forecasts spending on multifamily at $88.9 billion, down 4% from last year.

The institutional side of the market will be “assuming a greater role in keeping the expansion growing,” predicts Robert A. Murray, Dodge's chief economist.

Murray expects increased spending on educational facilities and transportation terminals. These include the $3-billion Central Terminal at LaGuardia Airport, in New York City, and the $1.2-billion Terminal C project at the Orlando International Airport, in Florida.

Murray also expects health-care projects to stall because of uncertainty regarding the fate of legislation before Congress.

Cooper and O’Connell note that, in general, the work pace is much slower than it was in 2015 and a bit slower than last year. But O’Connell says requests for proposals have been plentiful this year for K/H.

Looking into his crystal ball, Carrick suggests developers are becoming more cautious about bricks-and-mortar construction. Telecommuting, e-conferencing and online commerce—that is, banking, entertainment, education, email and e-trading—are reducing the need for new physical space, except perhaps for warehouses and data centers.

“Technology is changing everything,” says Carrick.

Post a comment to this article

Report Abusive Comment