In today’s world of readily available aerial imagery from satellites and drones, the future of high-resolution aerial imagery taken from manned, fixed-wing aircraft might be questioned, but consumers of all three types of images say there is still a big role for manned-aircraft imaging services.

Such operations have several sweet spots that keep them viable and the competition hot, users say.

Fixed-wing aerial surveys can cover areas far larger than what is practical with a drone, for example. “If you have a 300-acre site, that’s the biggest you can do efficiently with drone acquisition,” says Chris Holmes, a mobile mapping project manager with Langan Engineering & Environmental Services, Canonsburg, Pa. He runs a drone-image-acquisition operation at Langan but calls in the fixed-wing operators, as needed. “If your goal is to get 1-inch-to-50 scale and to end up with a 1-foot vertical contour map, that’s not such a tough requirement for a drone anymore,” he notes. “But what’s tough is to do a site bigger than 300 acres or anything linear. Then, I call a fixed-wing aerial provider.”

Also, the services can collect high-resolution images of areas where drone flights are generally prohibited, such as airports and dense urban areas. The availability of cloud processing and data hosting services for huge image libraries gives some of the fixed-wing services an edge for fulfilling certain missions.

“Absolutely, there is still a place for fixed-wing aerial photography and the subsequent photogrammetry that comes from it,” says Holmes.

But not every purpose calls for great vertical accuracy. Images with a good horizontal resolution can deliver lots of observable detail that is useful for planning large tracts, such as understanding their relationships to surrounding areas and for tracking construction progress.

Some fixed-wing operators focus on delivering imagery suitable for survey-grade processing, while others stress frequency of updates and availability.

One of two companies bringing Australian technology to the U.S. market, EagleView Technology Corp. has acquired Australian company Spookfish Ltd., whose image-collection technology is primed for rapid acquisition of high-resolution images from multiple angles to support 3D model generation.

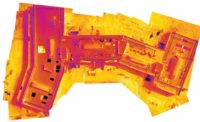

The other firm is Nearmap, whose primary selling points are a horizontal resolution claimed to be 2.8 in.—meaning, each pixel represents that large a spot on the ground—and that it frequently and repeatedly collects images over urban areas of the U.S., flying the same paths multiple times a year.

Nearmap customers buy flat-rate subscriptions that let them stream images from an in-the-cloud library for a certain number of drafts, as often as they require. The images integrate with industry-standard geospatial design tools and can be shared with the project team as base maps for refinement.

George Culver, director of GIS at LJA Engineering Inc., Houston, says that, after first testing in the Houston area, his civil engineering firm on Jan. 1 expanded to its regional offices use of Nearmap for land development and transportation feasibility studies.

“We always struggle with good base maps,” Culver says. “The Houston-area development rate is very fast, so timeliness and frequency are extremely important.

“With feasibility studies, accuracy is not hugely important.” he adds. “Once we move into the design stage and we get on a project, we send our surveyors out. That’s when we start lining things up.”

Post a comment to this article

Report Abusive Comment