Tudor Van Hampton / ENR |

Estimators on public and private projects across the nation are struggling to keep projects moving amid an average increase in rebar prices of $297 per ton since Jan. 1, according to Schaumberg, Ill.-based Concrete Reinforcing Steel Institute (CSRI). Average rebar mill selling prices hovered around $624 per ton for standard A-615 reinforcing bar last spring, while many contractors around the country report current mill prices of more than $900 per ton of reinforcing bar. In some regions, contractors report prices of more than $1,200 per delivered ton.

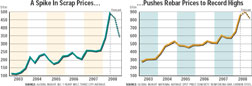

The surging price for rebar is being fueled by matching increases in scrap-metal prices, which jumped from an average $270 per delivered ton last fall to about $600 per delivered ton this month, according to Mark Azous, managing director at metals consulting firm Scrap Iron.com. “There have been price spikes before, but this is the worst I’ve ever seen,” says Azous. “It’s insane.”

The hikes come as major U.S. mills this month announced price increases for shipments of reinforcing bar in June. Irving, Texas-based Commercial Metals is raising price per ton by $40, and Tampa-based Gerdau Ameristeel is raising its price per ton by $60.

“Since last December, the national average price for rebar has gone from $575 per ton to $867, says John Anton, steel analyst for Washington, D.C.-based forecasting firm Global Insight Inc. “And there is more movement to come,” he says. He expects rebar prices to peak close to $1,000 a ton next quarter and hold there before easing in 2009.

| + click to enlarge |

|

A spike in scrap prices pushes rebar prices to record high. |

Steel prices have recently been holding to a two-year cycle and if the industry holds to that pattern there will be a price correction next year, says Anton. “The good news is that rebar prices will be coming down by next year but the bad news is that they remain pretty darn strong,” he says. Strong global demand and increased production costs will keep prices from falling below $750, he predicts.

Deja Vu

After surviving the destructive effects of a spike in rebar prices during 2004, contractors and suppliers are left wondering how they will stay afloat amid the current economic storm, which “is much worse than previous price increases,” says Pat Maillett, vice president at Harmac Rebar and Steel Co., Newington, Conn. “We are in uncharted territory.” The skyrocketing costs have cast a cloud of economic uncertainty on more than a dozen construction projects Harmac is currently performing, Maillett says. “It is slowing projects down and it isn’t over with yet.”

Chief among estimators’ concerns is how to plan projects when mills have drastically shortened time guarantees on reinforcing bar prices. “Guarantees for rebar prices used to be at least six months,” says Maillett. “Now they will only hold for about 30 days.” In some regions contractors report only 15-day price guarantees. “Since the 1970s rebar prices have fluctuated about $50 annually,” says Bob Risser, CSRI president. “Those days are gone.” Rebar suppliers “will only guarantee price on the first 2,000 tons,” he says. “This run-up has put a number of fabricators in a very precarious position.”

At West Palm Beach, Fla.-based Coral Steel and Supply Co. “We are screwed,” says president Lee Disbury. “Margins are squeezed 50% and sales are down by 50%. We try to share the pain with our clients, but we can’t pass the full price ...

lammed by unprecedented price hikes, contractors and metals suppliers are calling the confluence of events spurring record-breaking reinforced bar and scrap metal price hikes this year a “perfect storm.” The combination of surging global demand for scrap metal, diminishing domestic supply and a weakening U.S. dollar has caused prices for rebar and scrap metal to soar by more than 50% since January, say contractors. Related Links:

Related Links: