...increases on.” Disbury says rebar prices at his yard have gone up nearly $320 per ton in the past five months.

A new approach to bidding and delivering projects has ensued. Suppliers are shoring up risk, putting pressure on contractors to shorten project time frames. “We are staying away from projects with long duration,” says Disbury. Contractors are following suit, trimming programs and schedules wherever possible.

Changes

“There is a real transition happening in the way we work in this industry,” says Kevin LePage, president of Canton, Ohio-based reinforcing bar fabricator and installer Whitacre Engineering Co. “We used to be able to buy materials in advance, but we are facing severe financing problems now. We are having to be more selective in who we work with and are staying away from any new clients. Many are just not bidding at all.” Project budgets once were balanced between materials and labor, says LePage. “Now materials costs are two-thirds of the budget, so everything has shifted.”

| + click to enlarge |

|

Small fabricators, or those with small inventories, are facing big problems, many say. “I am fortunate to have enough inventory on hand that I can survive this,” says Jay Guertin, owner of fabrication shop Rebar Ranch, Malibu, Calif. “But prices for a ton of scrap metal here have gone from $375 last year at this time to about $1,000 per ton now. It makes it difficult to estimate a job.”

Public-sector programs, particularly state highway projects that use more rebar than any other construction sector, are sitting ducks for the volatility, LePage notes. “There is real concern about the slowdown among states, they did not foresee this,” LePage says. “Public projects are being stopped and redesigned to get them accomplished.” Contract-escalation clauses commonly used by state transportation departments to stem prices hikes on aggregates and asphalt do not apply to steel and reinforcing bar prices, LePage notes.

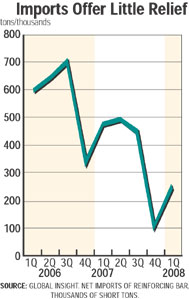

There is consensus in the industry that current conditions are a harbinger of things to come. “This won’t correct this time,” says Azous. “It is being driven by global demand and that is only going to grow.” Voracious hunger for scrap metal in Asia and the Middle East has “sucked up scrap from the coasts,” Azous says. “With fuel prices so high it’s more profitable for mills on the coasts to ship metal across the ocean than across the country.” However, demand is so strong that “it takes up to three weeks for a scrap supplier to get a cargo spot on a vessel.” Azous says.

In the U.S., effects of global demand are compounded by dwindling domestic supply. “With manufacturing moving overseas the scrap mine in the U.S. has diminished,” says Disbury. Some economists “have tied the price of rebar to the price of scrap, but scrap is just one of the components; It’s not the whole picture,” says Risser. “The global dynamics are the other part of the picture.”

Industry stakeholders are scrambling to stop the bleeding. CSRI has announced it will propose a dialogue with the Federal Highway Administration to urge the use of steel price adjustments on public projects, and are working to establish an industry-wide price index for reinforcing bar, according to Risser. “We need to get the message out to owners, contractors, and suppliers that we are going to have to work together to make it,” he says.

Post a comment to this article

Report Abusive Comment