Home » Keywords: » Private Equity

Items Tagged with 'Private Equity'

ARTICLES

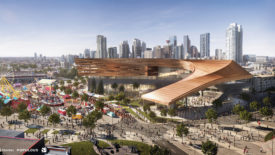

ENR Top 500 Design Firm Revenue Pushed by Private Equity

For the sixth consecutive year, total revenue for the Top 500-listed firms increased. A closer look at the numbers tells the full story.

Read More

The latest news and information

#1 Source for Construction News, Data, Rankings, Analysis, and Commentary

JOIN ENR UNLIMITEDCopyright ©2024. All Rights Reserved BNP Media.

Design, CMS, Hosting & Web Development :: ePublishing