The perfect storm that sent liquid asphalt prices through the roof in the summer of 2008, creating angst amid road builders and public-sector officials alike, has given way to an outlook for 2010 of stable prices, lower demand levels and less volatility going forward. Since their peak in summer 2008, liquid asphalt prices—the key factor in the cost of asphalt paving mixes—have dropped by nearly half this summer, sources say. The nationwide squeeze on road funding and the general lydown economy will likely keep prices moderate and reduce volatility in asphalt paving mixes through 2010.

Demand for asphalt has been down across the board in 2009 by about 12%, according to the National Asphalt Pavement Association, Lanham, Md. NAPA expects further declines in 2010, despite the stimulus, as states struggle with lower revenues and limited federal funding.

“It’s a very tough market across the nation,” says Jay Hansen, NAPA vice president of government affairs. “This has been a period of contraction, no question.” He says the 2010 outlook also is weak, even with an extension of current federal highway funding levels, because states are “limping along.”

Roughly 65% of demand for asphalt mix comes from the public sector, primarily state and local transportation departments, says Jansen. Of that, roughly 55% is for federally funded roadways and 45% is marked for state or locally funded work. The remaining 35% of demand is from residential and commercial developments. Private-sector demand has been “hit very hard,” he notes.

While liquid asphalt makes up only 5% of a typical asphalt roadway mix, the heavy oil binder is the tail that wags the dog in paving costs. Liquid asphalt is priced at hundreds of dollars per ton. By contrast, the remaining 95% of the mix —aggregate—ranges from $10 to $15 per ton and has a predictable local supply.

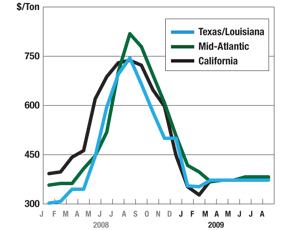

An unusual set of circumstances drove the 2008 price spike, says Ron White, chairman of Superior Paving Corp., Bristow, Va. Oil prices were already high in early 2008, and refiners were increasingly using Coker technology to refine more gasoline and diesel from each barrel of crude, leaving less heavy bottom for asphalt supply. As a result, by July 2008, liquid-asphalt prices spiked across the country. Then, Hurricane Ike hit the Gulf Coast in September 2008, disrupting production in the region and further tightening supplies.

In California, liquid asphalt hit a peak of $716 per ton in July 2008, says Chuck Suszko, chief of the California Dept. of Transportation’s Office of Construction Engineering, Sacramento. By contrast, the cost for liquid asphalt this September was down to an average of $337 per ton, he says. Like many states, Caltrans uses a monthly price index for liquid asphalt; the index is used to adjust payment to road builders based on the difference between the initial bid-day price and the actual price when the mix is placed.

One outcome of the 2008 price spike has been a more exacting use of contract adjustments and price indexing to mitigate risk for both paving contractors and DOTs, says Suszko. Contractors were pushing for a wider application of price adjustments after getting hammered in the 2008 spike, he notes.

Last December, the adjustment was expanded to include all projects, not just those longer than 120 days or more than 5,000 tons, and the threshold was reduced to a 5% price swing from the previous 10% trigger. Ironically, the new rules have helped Caltrans capture savings as liquid-asphalt prices have trended down this year. “Everybody rides the index; it’s a fair way to manage the risk,” he says.

The finer levels of adjustments are a good thing, says Superior’s White. “We do it pretty much the same way [with Virginia DOT],” he says. “Everything we produce is subject to an adjustment up or down based on the index. We don’t make money on it, but we don’t want to lose our shirts either. If we didn’t have that in 2008 we would have been devastated.”