In a new sign of troubled U.S. real estate, Lendlease has paused work on a San Francisco mixed-use tower that broke ground 11 months ago.

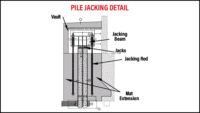

Called Hayes Point, the $1.2-billion structure was one of the company's biggest projects started in 2022. Key sub-structure work had been completed.

But in a conference call for investors held Aug. 15, CEO Tony Lombardo said the condominium and boutique office project would be put on hold until more tenants committed to leases or another investor would share the risk.

The move was portrayed as part of a turnaround effort Lombardo is leading to simplify Lendlease real estate development and construction businesses and control long-tail risks.

He told investors that the firm's fiscal 2022 construction efforts were "subdued" because of "supply chain difficulties, high inflation and subcontractor collapse."

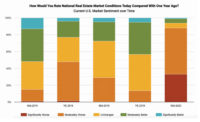

San Francisco's downtown office and apartment market had already slowed considerably from its pre-pandemic peak.

More broadly, the turmoil in office and retail property appeared to be entering a new phase. Hammered by rising interest rates and slow post-pandemic return to offices, numerous properties are in default on their mortgages. Sinking values have pinned losses on real estate investment trusts. The Wall Street Journal reported Aug. 15 that Wall Street investors were preparing to buy out distressed properties at bargain prices from developers in financial trouble.

In one example of the developing property selloff cited, an owner of a downtown San Francisco office tower that purchased a property for $107 million in 2014 recently sold it to a developer for a reported price of $41 million.

Post a comment to this article

Report Abusive Comment