The U.S. will decide in about a month whether to move forward to lease new federal ocean tracts off the central Atlantic coast to develop up to 8 GW of offshore wind energy, while setting Aug. 29 for the much-anticipated sale of the first large lease areas in the Gulf of Mexico. The intended expansion of U.S. offshore wind development areas comes as existing projects face new challenges over construction cost hikes.

A 30-day comment period opened Aug. 1 on the U.S. Interior Dept. proposal for lease sales of three central Atlantic areas between Virginia and southern New Jersey that total nearly 557 sq miles (see map, above). One roughly 101,767 acre-area, located 26 miles from the Delaware Bay separating Delaware and New Jersey, could hold at least 1.23 GW, says the agency. Another, about 78,285 acres and 23 miles off Ocean City, Md., has 951 MW of potential generation; with the third and largest at 176,506 acres located 40 miles from the mouth of the Chesapeake Bay off Virginia. It could generate nearly 2.14GW, Interior said.

The tracts are in relatively shallow water, but the agency may identify additional areas in deeper water once initial studies are completed. The three now eyed for development are a subset of areas totaling over 1.7 million acres that Interior had announced last year. The agency worked with the National Oceanic and Atmospheric Administration to develop “a comprehensive, ecosystem-based ocean planning model” to select the final tracts, focused on least impact to marine life, commercial fishing and navigation.

Talks are ongoing with the U.S. Defense Dept. and NASA to determine possible conflicts between agency activities and with turbine construction and wind farm operation, particularly near the Delmarva coast, Interior officials said.

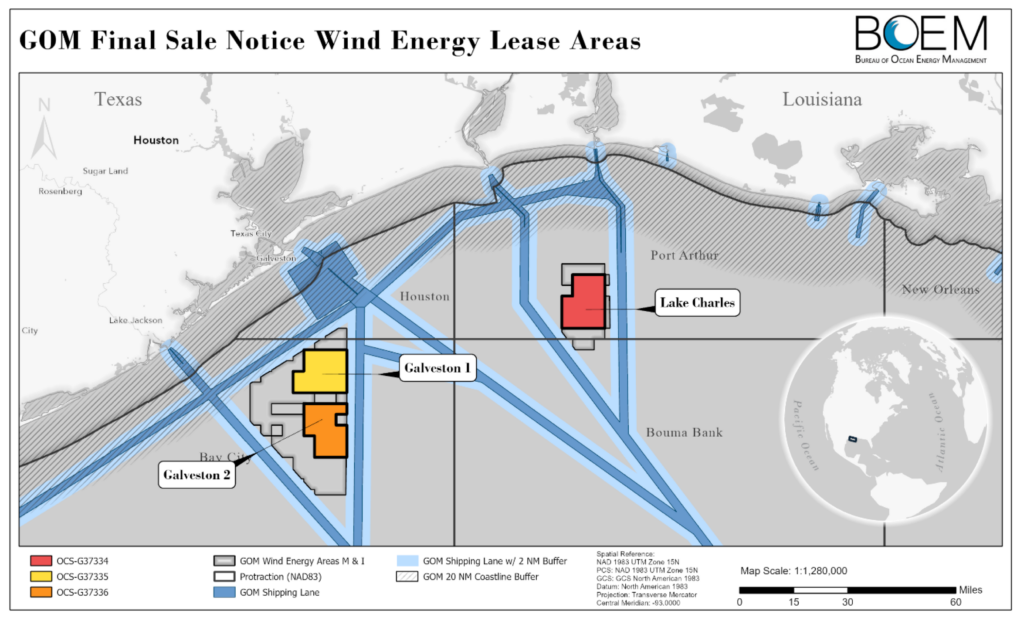

The first federal auction of Gulf of Mexico offshore wind lease sites, about 300,000 acres off Lake Charles, La., and Galveston, Texas, is Aug. 29. They could generate up to 500 GW of energy, officials say.

Map: US Interior Dept/.BOEM

But sector stakeholders raised concern that the announced area, in which Interior could hold lease auctions in August 2024, are insufficient to enable project capacity needed for nearby states to meet offshore wind goals.

"Already in the Central Atlantic, states have set targets for 21 GW of offshore wind generation — a number that will only increase as Virginia’s energy demands grow, states like Delaware enter the market, and other states work toward their own clean energy goals,” said industry advocacy group The Business Network for Offshore Wind in a statement.

Maryland boosted the state offshore wind goal in April to 8.5 GW by 2031, up from 2 GW, while New Jersey Gov. Phil Murphy last September raised the state target to 11 GW from 7.5 GW. Both states also are seeking transmission infrastructure upgrades, with work already underway.

In Virginia, regulated utility Dominion Energy now is building a record 2.6 GW project for the state, which has an offshore wind goal of 5.6 GW by 2034. Republican Gov. Glenn Youngkin announced a new $2.5-million grant program last month to lure small manufacturers into the state offshore wind supply chain—calling it “a strategic investment that supports our plan to guarantee abundant clean energy for Virginia’s future.”

Roy Cooper, governor of North Carolina, which has set an 8-MW by 2040 offshore wind goal, termed selection of the chosen extended lease area excluding his state "extremely disappointing," but he expects a fix as Interior considers adding to the announced areas.

Gulf Auction Gains Potential Bidders

In the Gulf of Mexico, Interior’s upcoming auction will seek bids on one lease area off Lake Charles, La., and two off Galveston, Texas—totaling over 300,000 acres (see map, above). The National Renewable Energy Laboratory estimates these have up to 500GW of commercial wind energy potential, but also noting lower wind speeds, less stable seabed conditions and stronger and more expensive infrastructure needed in a hurricane zone.

Project proponents note the location near a major oil and gas manufacturing regional hub with an already existing supply chain, as well as plans for green hydrogen production and decarbonization.

Louisiana has set goals of 5 GW of offshore wind capacity by 2035. Economic development agency Greater New Orleans last year won $75 million in federal and state grants to develop offshore wind-powered green hydrogen. Under a law enacted last year that expands oil and gas development, state officials also opened areas up to three nautical miles offshore for wind projects.

Gov. Jon Bel Edwards told a recent industry conference in New Orleans that the state has received up to three bids to develop sector projects “several years before they can be successful in federal waters.”

Texas has become a U.S. leader in siting onshore wind, now generating about 30,000 MW and producing nearly 114 billion kilowatt hours of power last year, says the U.S Energy Information Administration. But the state has not been as active in offshore wind development.

Interior Dept. documents indicate, however, that more than a dozen developers—mostly global oil and gas producers—have prequalified to bid for the federal Gulf leases, with an active session predicted. Among listed bidders are Norway-based fossil and clean energy developer Equinor ASA; French oil firm TotalEnergies SE; Avangrid Renewables; Shell New Energies and a unit of South Korea power giant Hanwha. U.S. renewables firm Invenergy and German wind developer RWE are a bidding team.

New Orleans-based Gulf Wind Technology, a wind turbine rotor technology firm, has partnered with Shell New Energies to accelerate development of a Gulf-specific turbine in 2024, said James Martin, CEO. It also has a shipyard on the Mississippi River set to become a hub for Gulf offshore wind activity, the company said.

Shell has operated in the Gulf for more than 60 years and sees opportunities to develop offshore wind, including deep water technologies, said Amanda Dasch, vice president of offshore power Americas.

According to Interior, the leases include credits of up to 30% to bidders who commit to support workforce training, domestic supply chain growth and fisheries compensation. Still to be determined are marine wildlife mitigation rules.

Interior anticipates up to 18 commercial and research wind energy projects by 2025 in the Gulf that could generate more than 27 GW of power.

Detailing the Costs

But developers of some existing East Coast projects say lengthy permit delays, inflation effects and supply chain backups are causing a steady rise in development cost, mostly for the first time, with power agreements in Massachusetts cancelled or soon to be. as well as a project in Rhode Island.

Avangrid CEO Pedro Azagra told investors in late July that for its Commonwealth Wind project off Massachusetts, utilities "have filed termination documents with the [state] Dept. of Public Utilities, under an agreement that limits our financial impact solely to the project security deposit,” previously stated as $48 million.

The firm “remains committed to constructing our offshore wind pipeline” in New England, Azagra said, with plans to bid the project under a different power price setup in a later energy procurement round.

Controversy also is building over a just-enacted New Jersey law that enables key wind developer Orsted to retain federal tax credits estimated at $1 billion for construction of the 1.1 GW Ocean Wind project off the state’s southern coast, With recent final federal approval, construction is set to begin this fall. With concerns that ratepayers now will be on the hook, opponents have sued the firm, claiming the law is unconstitutional. Legal battles also are escalating between the firm and state municipalities over offshore cable landing permits.

Developers of four New York projects key to the state 9-GW offshore wind goal by 2035 have petitions pending for an “inflation adjustment,” seeking a state regulator's decision by Oct. 31. In an unusual step, the agency will allow comment on the petitions until Aug. 28.

In a statement, Teddy Muhlfelder, vice president of Equinor Renewables Americas and lead for its 3.3 GW of awarded projects, said power price agreements dating to 2019 no longer meet current cost realities due to inflation, supply chain disruptions, permitting and interconnection delays, rising interest rates and “other outside factors.” He added, “While we have worked to manage these … this is an industry-wide issue that cannot be overcome at the project level.” Orsted and utility Eversource cite similar issues affecting their 924-MW Sunrise Wind project planned off Long Island.

Developers seek an adjustment similar to one the state offered bidders in its current offshore wind solicitation, based on a 23% cost hike that occurred since the first bids were submitted in 2019, as well as a grid connection cost tweak.

But an early August counter petition by New York City and large state energy consumers claiming too many redacted cost details in developer filings generated updates on Aug. 7.

Jay Goodman, an attorney for the intervenors, said while the revised petitions still kept most cost specifics undisclosed, the most significant increases are in the cost of foundations, turbines, export cables, and substations and in component transport and installation.

interconnection costs have risen from $22 million, as determined originally by a third-party engineering firm, to $115 million currently estimated by the New York Independent System Operator, which Sunrise Wind developers said was accepted.

The revised filing said that for Equinor's Beacon Wind project, developing a 345-kv substation would “save two to three years" on the overall construction schedule and "provide reliability benefits,” although the change would cost about $120 million and cause a one-year delay.

The original and revised petitions also noted project delays of one to two years from earlier estimates, but commented one developer, “the advanced stage of the projects provides New York with greater cost and timing certainty than alternative supply options.”

Despite the cost issues and uncertainties, the latest offshore wind procurement rounds—closing earlier this year in New York and last week in New Jersey—produced active responses from developers.

Taking the Broad View

But the offshore wind cost-hike overhang is not just a U.S. problem.

In a June sector cost inflation survey by UK-based Westwood Global Energy Group, nearly 75% of 28 sector respondents said they had started reviewing project viability in light of the increases, with over 90% noting slowed project decisions as a result.

More than half of respondents were Europe-based, but two-thirds said they were in were in roles with a global focus and 18% were engineering consultants.

“At this stage, most of our respondents appeared committed to the offshore wind industry and were not seeking to reduce headcount or withdraw," said Peter Lloyd-Williams, Westwood senior commercial wind analyst. "Whatever happens next, industry players will be closely watching how a period of cost inflation affects a sector that has been defined by falling costs for some time.”

In an Aug. 1 opinion, Bloomberg columnist Liam Denning said the cost escalation "isn’t surprising given that, unlike traditional fuel-burning generation, the cost of generating renewable power skews heavily toward upfront construction." But he agreed it is "a shock given the long history of falling costs for wind and solar projects, which has become a critical part of the pro-renewables case alongside combating climate change.”

Despite Denning's U.S. statistic that one-third of about 15.5 GW of state-contracted offshore wind power projects “was in dispute as of mid-June,” he says “the need to meet decarbonization targets, both in practical and political terms, means the industry won’t drown entirely.”

Paul Patterson, energy sector analyst at Glenrock Associates, says for offshore wind energy, “the question remains how high prices will go before they dampen the enthusiasm of those promoting it.”

Post a comment to this article

Report Abusive Comment