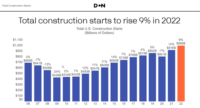

Despite inflation, labor shortages and other troubles plaguing the construction industry, some sectors continue to thrive, but others face difficulties as demand for growth slows.

“The U.S. economy is chugging along despite significantly higher interest rates,” says Richard Branch, chief economist at Dodge Construction Network, but “this is a mixed blessing.”

“The resilient economy has kept the construction sector moving forward, but it has also resulted in inflation not slowing enough for the Fed’s liking,” says Branch. “The result will be at least one more interest rate increase before the year is through. This will add to the pressure already building in the construction sector and the economy at large.”

A recession is still unlikely over the next year, according to Dodge, but the possibility remains “uncomfortably high.” While the public sector is thriving due to funding from the infrastructure act, the CHIPS Act and the Inflation Reduction Act, the private sector faces high interest rates, tighter credit rules and lower demand. “The construction market is a tale of two cities—the haves and have-nots,” he says. The outlook for total starts for the year is flat, according to Dodge data.

Housing Starts Fall

*Click the image to see greater detail

The residential sector “is at a crossroads,” says Branch. Overall residential work fell 25% through the first six months of the year, largely due to a sharp drop in the multifamily market.

Single-family starts have grown slightly after “bottoming out” in the first quarter. “The interest rate trajectory, however, will likely result in a crab-like movement in the second half of the year,” Branch says. “Starts will not get measurably worse, but neither will they show strong growth.”

Multifamily starts declined 23% in the first two quarters of the year after reaching their highest point in the fourth quarter of 2022. The largest multifamily projects to break ground in the past quarter were the $549-million, 36-story Mana’olana Place mixed-used building in Honolulu and the $500-million 7112 Park Ave building in Flushing, N.Y.

Manufacturing Soars

“The resilient economy has kept the construction sector moving forward, but it has also resulted in inflation not slowing enough for the Fed’s liking.”

Richard Branch, Chief Economist, Dodge Construction Network

In the non-residential market, manufacturing is “the star of the show,” Branch says. While starts declined slightly since 2022, they remain three times higher than in 2019, according to Dodge data. Institutional starts are also strong, up 9% year-to-date as of June, which Branch attributes to education and airport terminal construction. The largest nonresidential building starts in the second quarter were the $2.6-billion JetBlue Terminal 6 at JFK airport in New York City and the $1.9-billion Steel Dynamics aluminum plant in Columbus, Miss.

Commercial work, however, declined in the first half of the year, at a rate of 11%. “Nowhere is the market bifurcation more present than in the non-residential building sector,” says Branch.

Julian Anderson, president of consultant Rider Levett Bucknall, shared a similar outlook regarding recent activity in the commercial sector, noting that “big shifts in activity continue to be away from office, retail and hospitality.” Anderson attributes the decline in office construction to continued work-from-home policies and suggests the drop in hospitality work can be traced largely to reliance on smaller banks, which have been “pulling back” on sector loans.

*Click the image for greater detail

Anderson notes the strong activity in the infrastructure market, as does Branch. “Starts are clearly trending positive” in the sector, says the Dodge chief economist, as its data reports a 29% increase year-to-date as of June.

“Funds from the Infrastructure Investment and Jobs Act are steadily making their way to state and local areas,” says Branch. “The Inflation Reduction Act is also helping construction activity in the sector as a growing number of utility-scale wind and solar plants get started thanks to the extension of tax credits.”

In the second quarter of the year, the two largest infrastructure projects to begin construction were the $5.3-billion Port Arthur LNG facility in Port Arthur, Texas, and the $1.5-billion Southeast Connector Interchange project in Fort Worth, Texas.

*Click the image for greater detail

Lumber Prices Down in 2023

“Lumber demand remains quite low this year as construction spending—especially residential construction—declines compared to last year,” says Luke Lillehaugen, senior economist at S&P Global. “Supply should remain in line with demand, but the wildfire season in Canada has been the worst on record through early June and many major fires are still burning uncontrolled.”

“If wildfires continue to burn at record paces in Canada, [lumber] production will likely decline far enough to push up prices in the second half of 2023.”

Luke Lillehaugen, Senior Economist, S&P Global

He adds: “If wildfires continue to burn at record paces in Canada, or fires start spreading in the U.S., production will likely decline far enough to push prices up in the second half of 2023.”

Softwood lumber is expected to drop 30.7% overall in 2023, according to S&P Global, before rising 1% in 2024. Plywood prices are predicted to fall 19.1% this year, with an additional decline of 4.5% next year.

As for steel prices, John Anton, director, market intelligence, at S&P Global, says: “Wait to buy steel in the U.S., or consider much lower priced tonnage from imports. Prices are extremely low in East Asia and in Europe, but are high and falling in the U.S.”

S&P Global forecasts structural metal products to stay flat this year, following a 22.4% increase in 2022 and a 25.1% jump in 2021. “[Prices] never fully retreated from 2021 and 2022 record spikes but are becoming cheaper each month,” says Anton. “Look for price to find a bottom in mid-winter or by mid-2024. Risk is to the downside if buyers turn more quickly to outside supply.” Prices are expected to drop 7.5% overall next year, according to S&P Global’s forecast.

.jpg?height=200&t=1671747499&width=200)

Post a comment to this article

Report Abusive Comment