Inflated costs, crunched schedules and materials delays are driving a greater interest in alternative project delivery methods, firms say—which is reflected in last year’s rise in design-build and construction management-at-risk revenue. But a lack of trust is still preventing widespread adoption, according to some. With a potential recession poised to compound market challenges, firms say collaborative delivery methods are key.

After years of ongoing market challenges, Burns & McDonnell Chairman and CEO Ray Kowalik says more owners are willing to share in risks to keep projects moving forward.

“Risk-sharing is a necessity now,” he says, because it is difficult to nail down how project costs might fluctuate. With a more flexible delivery method, the firm can focus on the best outcome, he explains.

“Integrated design-build provides what our customers want,” says Kowalik, and the company is “seeing many more sole-source integrated design-build opportunities in the markets we serve.”

Related Links:

ENR Top 100 Design-Build Firms 2023

ENR Top 100 Construction Management-at-Risk Firms 2023

View complete 2023 list, with full market analysis

(Subscription Required)

However, despite an abundance of potential opportunities to adopt alternative project delivery methods, companies can only move at the “speed of trust,” explains Erik Gunderson, CEO of Primus Builders. To build trust among owners and subcontractors to offer integrated services, “relationships mean more in our space now than ever,” he points out, explaining that the company has recently introduced a new design-build-automate method for its cold storage business sector.

“This is a perfect example of how Primus continues to update our project delivery methods to meet the evolving needs of our customers,” Gunderson says. “As more cold storage providers are incorporating automation into their warehouses, Primus works with them to develop an intralogistics plan that moves product through a facility faster, safer and more efficiently.”

At Gray Construction, President and CEO Stephen Gray says clients are requesting collaboration in areas beyond project delivery, such as process and packaging engineering, controls integration, automation and equipment prefabrication. In response, the company has evolved to offer clients end-to-end integrated services that help implement smart manufacturing initiatives that can maximize return on investment through process improvement.

“On the owner side, speed-to-market is always paramount,” says Gray. Although some front-end project costs can be more expensive with higher quality partners on board, “the result is a higher quality build, with higher production rates,” he explains. “The net result is big savings. The customers that realize this in today’s market come out on top every time.”

*Click the image for greater detail

Driving Alternative Adoption

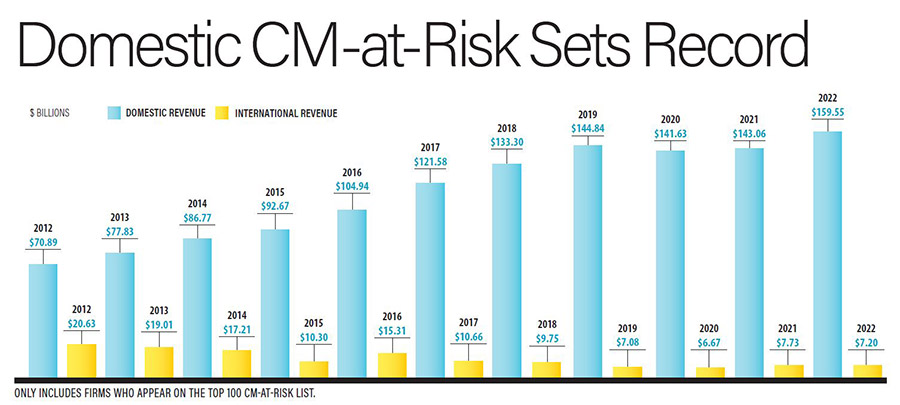

In the domestic market, overall Top 100 design-build revenue increased 12.45% last year to $108.84 billion, its highest since 2014. Construction management-at-risk (CMAR) revenue rose 10.54% to $166.75 billion.

As the first round of funds tied to the Infrastructure Investment and Jobs Act (IIJA) began hitting public agencies last year, dollars were moving slower than the industry anticipated, says Ron Williams, Jacobs senior vice president and general manager, Americas. However, the company has seen “opportunities come fast” as grant programs have opened, he says.

*Click the image for greater detail

*Click the image for greater detail

Jacobs is helping its public clients quickly position for funding as programs accelerate in IIJA’s second year, says Williams. “The funding is predictable and set for the life of the bill, but clients are seeking help in planning ahead to secure funding and deliver infrastructure projects within their cities and communities,” he explains.

Alternative project delivery is a natural fit for projects tied to IIJA funding because of their speed-to-market value, but more education is needed in the public sector around alternative delivery, says George Pfeffer, CEO, DPR Construction. The company is ranked No. 3 on the CMAR list and No. 22 on design-build.

*Click the image for greater detail

“We must continue to show the value gained via more collaborative delivery methods,” says Pfeffer. Although the company does not do a large volume of public work, “Speaking generally, there needs to be more public understanding of design-build and collaborative delivery,” he says. “The public doesn’t know the nuances of design-build and that can lead to an unwillingness to embrace the method.”

“We must continue to show the value gained via more collaborative delivery methods. ”

George Pfeffer, CEO, DPR Construction

Some markets are inherently riskier than others, says XL Construction CEO Richard Walker. He adds that there is also a general risk in employing an alternative delivery method for the first time. The company is ranked No. 90 on the CM-at-Risk list.

“Success requires a behavioral shift as well as a contractual shift,” he explains. “We are seeing more public entities adopt CM-at-Risk or other alternative delivery methods. The change is an increased understanding of how these methods can drive better value while reducing risk, including the risk of disputes.”

International design-build revenue is up 24.45%, and median firm revenue rose 19.3% to $593.35 million. Of 97 Top 100 design-build firms that filed this year and last, 78.4% reported increased design-build revenue. But the total also includes a nearly $1.3 billion drop in design-build revenue by Swinerton, which sold off its renewable energy division to private equity firm American Securities. Most of that division’s projects were delivered using design-build.

On the CM-at-Risk list, international revenue dropped 6.86% but median CMAR revenue is up 26.5%, to $933.04 million. Similar to the design-build list, of 97 ranked firms that filed both this year and last for the ranking, 77.3% report a year-over-year increase in revenue.

Managing Risks

As more IIJA money is generated for public agency use, Roscoe Green, partner at construction law firm Adams and Reese, urges that teams not enter into alternative project delivery methods lightly.

From the owner’s perspective, “Design-build is generally a good method because they have one point of contact,” he says. “It certainly helps limit the finger pointing and it allows really for the fast tracking of these projects.”

However, the delivery method oftentimes puts a greater onus on the owner to make sure the program is well-designed, which might require resources public agencies don’t have, Green adds.

“A lot of issues arise when the owners program doesn’t align with the actual project design,” he says. “It puts a lot of risk on the design-builder. The allocation of risk is not really spread evenly. Some of our clients have shied away from doing design-build projects because of that, because it can result in substantial losses.”

“Success requires a behavioral shift as well as a contractual shift.”

Richard Walker, CEO, XL Construction

A qualifications-based selection provides more options and could deliver a better design-build result for public projects, explains STO Building CEO Bob Mullen. “In many cases, a negotiated GMP or design-build budget can provide a better experience and product than the lowest price lump-sum approach typical of many public projects, which can often lead to delays and large claims,” he says.

Rich Jacobson, COO and executive vice president of Kraus-Anderson Construction Co., says that under the CMAR delivery method, the company manages risk by shoring up its preconstruction efforts, including prequalification.

“We prequalify all subcontractors for financial and workload capabilities, review proposals and contracts in detail, and put a work plan together that includes a detailed schedule,” he explains.

Derek Alley, CEO of VCC, says managing risk and liabilities also begins at preconstruction. “Working closely with clients and partners who have a clear vision, we are proactive in identifying any project issues that arise,” he says. One example would be discrepancies in design documents. “We further manage risk when we apply rigid pre-qualification of trade partners, retain skilled job site superintendents and practice strict adherence to site-specific safety plans.”

Multi-unit Residential | By Jonathan Keller

Photo by Pavel Bendov, courtesy of Rrban Atelier Group

Urban Atelier Group (No. 100) provided construction manager services on the just-completed Olympia in Brooklyn’s DUMBO neighborhood. The 405,000 sq-ft condominium was designed by Hill West Architects.

“We are seeing a huge interest in legislative authority for progressive design-build, and we have started to review the legislation.”

Lisa Washington, Executive Director, DBIA

Building Public Trust

As firms prepare for an influx of public projects to reach the market, executives say owners are looking to more bespoke delivery methods to work around market challenges.

“Savvy clients look to package design and construction efforts so that early procurement of long lead items can occur while the design is progressing,” says PCL Construction’s Deron Brown, who is president and COO of U.S. operations. “Delivery models like progressive design-build, progressive public private partnership and CMAR allow for early procurement to happen.”

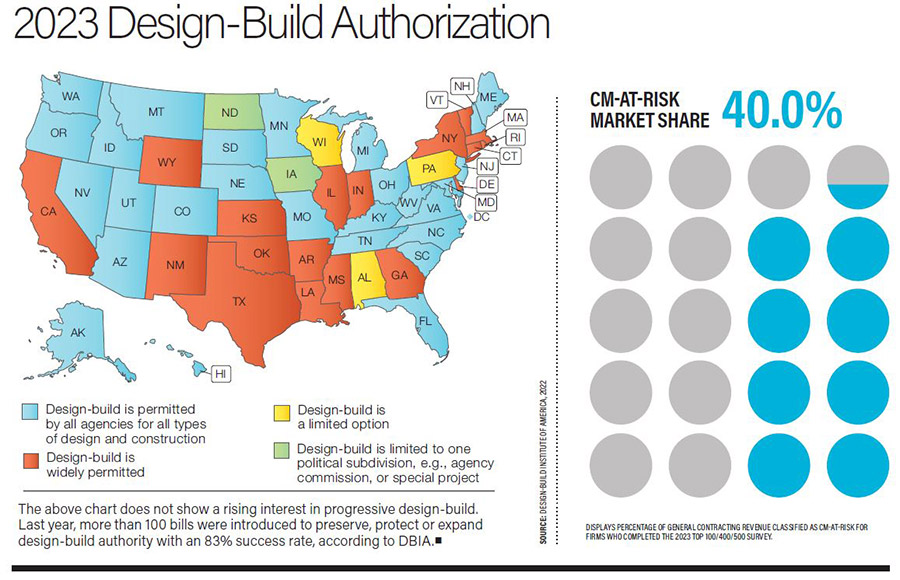

With 48 of the 50 states now having some level of design-build legal authority, a rising interest in progressive design-build has become an alternative method within an alternative, explains Lisa Washington, executive director of the Design-Build Institute of America.

“We are seeing a huge interest in legislative authority for progressive design-build, and we have started to review the legislation,” she says. More options are a win for firms and owners in terms of project flexibility, according to Washington. “People want more options because they need to base that on the project, internal capabilities and culture of the owner that is purchasing design and construction services.”