Looking back 35 years to his job in Northern Virginia as an American Concrete Institute testing technician responsible for the quality of concrete delivered to building jobsites, civil engineer Rick Bohan recalls that concrete was called “mud.”

“Contractors would ask, ‘When is the mud arriving?’” says Bohan, senior vice president of sustainability for the Portland Cement Association (PCA). “It wasn’t in a pejorative way,” he adds. “Concrete was just another cost item, with no more value than anything else on the jobsite,” he explains.

In those days, mixing a mineral aggregate with a binder, such as portland cement, and water was simpler. Currently, with widespread use of high-strength concrete, many liken creating mixes for foundations, slabs, columns, beams and walls to baking cakes. Combining ingredients, such as admixtures—including superplasticizers—and supplementary cementitious materials (SCMs)—including fly ash and slag—involves precise measurement.

Green-building advocates are now further complicating matters by pushing sustainability as a performance metric for concrete. That’s quite an undertaking, considering concrete is about as bad for the environment as cakes can be for the waistline.

Concrete producer Ozinga plans to expand its low-carbon line, called CarbonSense, to all its offerings.

Courtesy of Ozinga

Cement is Most Damaging

Cement is the most damaging ingredient, accounting for 77% of CO2e emissions from concrete production, says Robbie Andrew, senior researcher at the CICERO Center for International Climate Research and the Global Carbon Project. The binder is responsible for more than 7% of global CO2e emissions and 5.5% of total global greenhouse gas (GHG) emissions. The U.S. Environmental Protection Agency’s carbon emissions data says the manufacture of cement accounts for 1.25% of CO2e emissions in the U.S.

Last year, worldwide cement production spewed out nearly 2.9 billion tons of CO2e, according to Andrew. This compares to about 1.4 billion tons of CO2e two decades ago.

Process emissions from the energy-intensive production of cement clinker—an intermediate solid created by sintering limestone and aluminosilicate materials—is the largest source of emissions in the cement-concrete-mortar chain, says Andrew. The runner up is the energy used to produce clinker.

The first step toward cleaner concrete, which looks the same as high-carbon concrete, is to optimize the design of a structure. But cleaning up concrete also requires the use of ingredients in the mix that inherently reduce the material’s embodied carbon.

The global shift to cleaner concrete is a tall order. The U.N. Environment Global Status Report 2017 projects construction of 2.5 trillion sq ft of new buildings by 2060. Most will contain concrete. The National Ready Mixed Concrete Association estimates 394 million cu yd of ready-mix concrete were produced last year. NRMCA expects producers to exceed 410 million cu yd this year. Of this, 80% to 85% goes into buildings.

One obstacle is that concrete production is local, with 6,500 batch plants in the U.S. supplying thousands of different mixes with varying quality raw material. That renders sweeping change challenging, says NRMCA, which alone has 430 concrete-producer members.

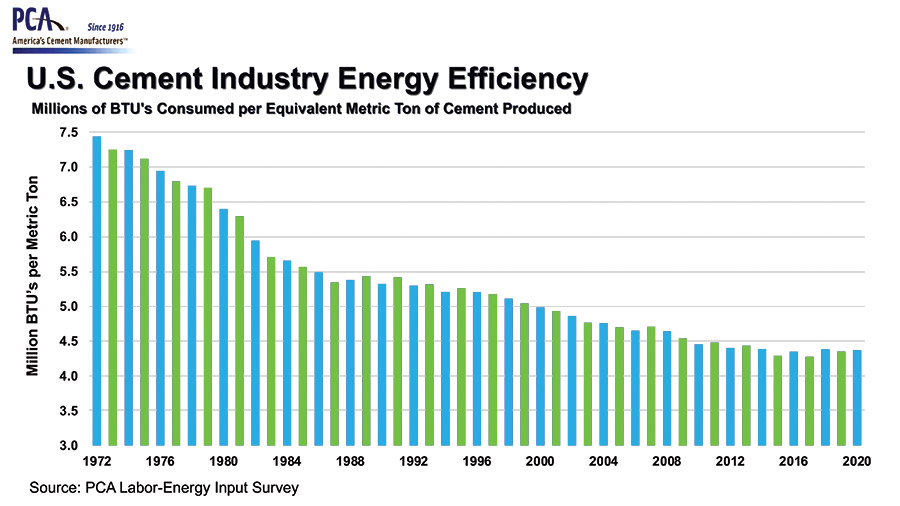

Total emissions attributed to cement production are decreasing. Still, worldwide cement production is responsible for more than 7% of global carbon emissions.

Source: PCA Labor-Energy Input Survey

*Click the graphs for greater detail

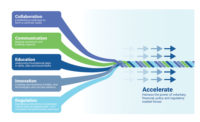

To support change in a risk-averse construction industry known for inertia, PCA, NRMCA, the American Concrete Institute, the National Institute of Standards and Technology, Building Transparency and other advocacy groups have, over the last few years, made pledges, formed initiatives, launched educational programs and developed tools to catalyze building teams and material producers to reduce carbon in concrete and cement.

50% Reduction by 2030; 100% by 2050

Their mission is to drive a 50% reduction in concrete’s carbon footprint by 2030 and a 100% reduction by 2050. “Reducing these emissions is the key to addressing climate change and meeting the 2015 Paris Climate Agreement, which targets a maximum increase in the global average temperature to 1.5° C above pre-industrial levels,” says NRMCA.

Designing mixes for either strength, durability, embodied carbon or resilience are “all false choices,” says Bohan. “Today, we can optimize across all options,” he adds. “We’ve got the resources and the know-how to make this happen.”

That said, progress toward widespread use of sustainable concrete has been “painfully slow,” says Chris Erickson, president and CEO of Climate Earth Inc., which sells digital environmental product declarations (EPDs). “We’re not even close to the goal” of zero-carbon emissions from the production of concrete, he adds.

Still, there are signs of progress. The 100-year global warming potential of cement, based on the 2016 industry-average EPD, was 1,040 kg CO2e, while the GWP of the 2021 EPD was 922 kg CO2e. The reduction in CO2e, which means CO2 plus equivalent gases, is more than 11%, says Bohan.

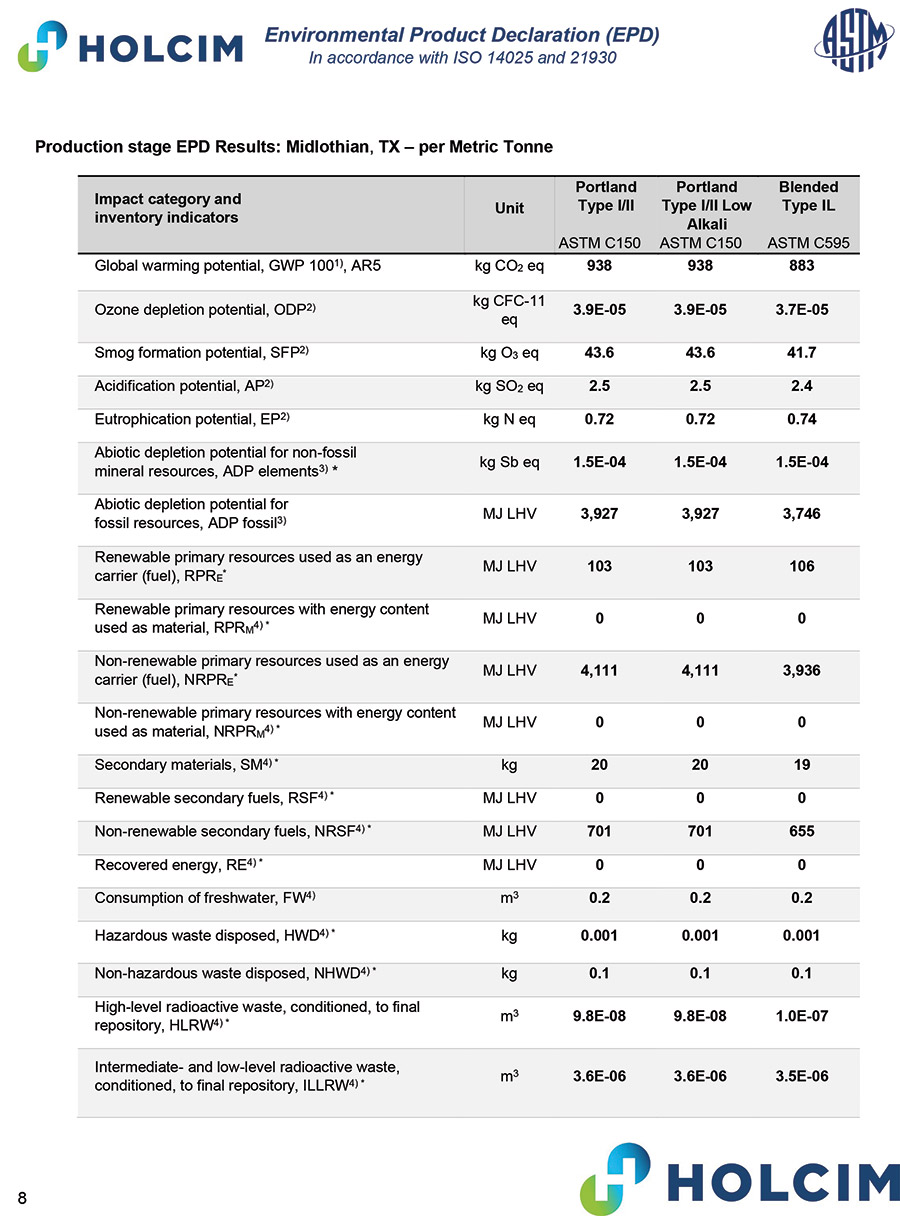

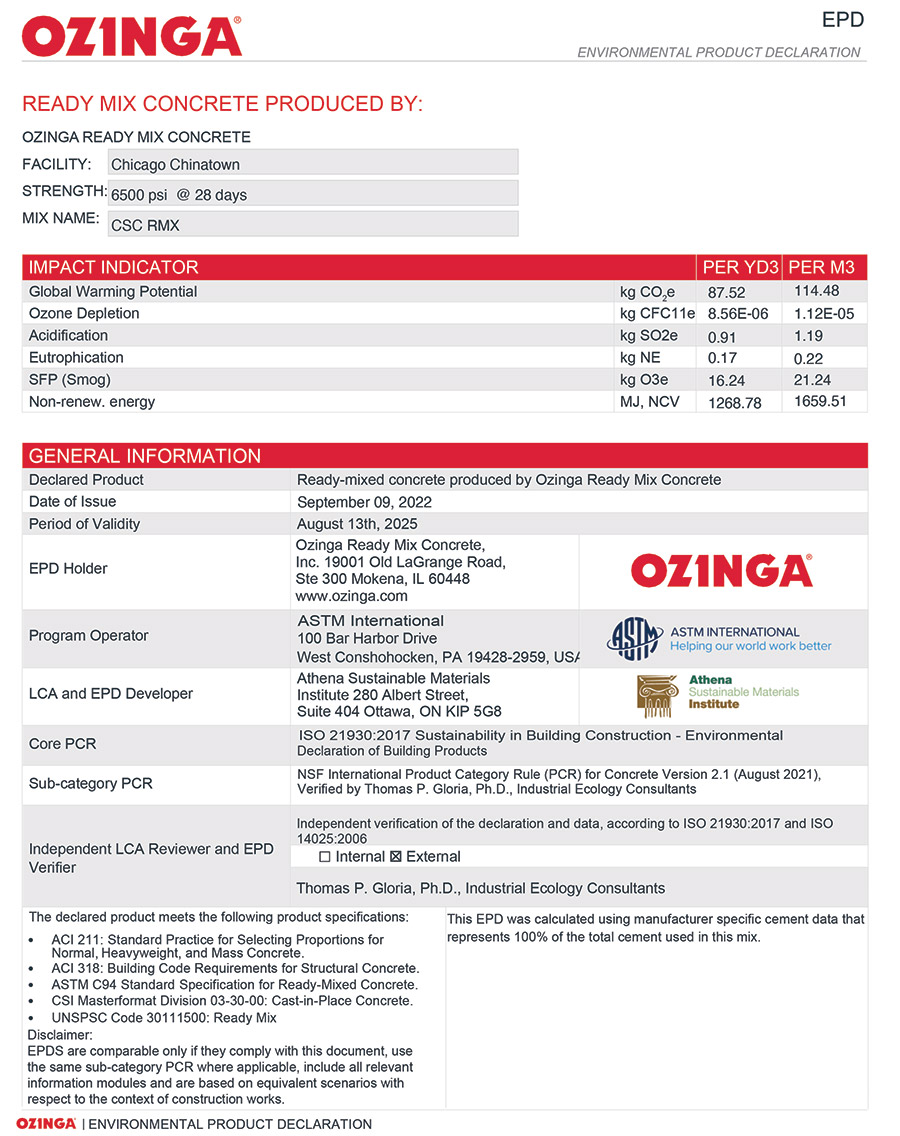

The increasing number of concrete product-specific EPDs since 2019 is another sign of forward motion. Third-party validated EPDs list the GWP and other negative environmental impacts of materials based on life-cycle analyses of emissions and other factors. They are used to compare carbon content of like and dissimilar products and materials, not only concrete and cement.

Carbon reductions of 30% or more have been proven in the markets that have EPD data, says Stacy Smedley, executive director of the nonprofit Building Transparency, which offers the free-to-use Embodied Carbon in Construction Calculator (EC3).

Among EC3 users, carbon emissions from concrete are down 18% since EC3’s launch in late 2019, according to digital data from EC3’s nearly 25,000 registered users. EC3’s database contains nearly 80,000 ready-mix concrete-specific EPDs and more than 350 cement EPDs.

However, EC3’s concrete-specific EPDs are from only 8% of the producers. “Concrete production is so scattered,” Smedley says. By comparison, 60% of steel suppliers have EPDs.

The EC3 database also has over 150 EPDs for aggregates and 12 for SCMs. There are no admixture EPDs in the U.S.

Slag takes some grinding, so there is an industry-average EPD for slag. Fly ash is considered a waste product, so there are no EPDs. But companies are starting to mine fly ash from 100-year-old pits as well as natural pozzolans—materials that when mixed with water develop cementitious properties. “We will begin to see EPDs from [mined materials] very soon,” predicts Climate Earth’s Erickson.

One reason for the uptick in mix-specific EPDs is the availability of on-demand web-based EPD systems—first offered by Climate Earth. Smedley calls this “a breakthrough” for it allows comparison of carbon content in real time, as a mix is prepared.

Digital EPDs have a cost. Climate Earth currently charges a set-up fee of $1,320 per batch plant. Its annual fee of $748 per plant includes an unlimited number of EPDs and an annual data refresh, says Erickson.

$250 Million for Construction EPD Development

More construction EPDs are likely coming. The Inflation Reduction Act of 2022 includes $250 million to support their development and standardization through grants and technical assistance to manufacturers. The act also contains $100 million for low-embodied carbon labeling of materials in federally funded transportation and building projects.

The good news is that a 70% or better reduction in concrete’s carbon, below industry averages, is achievable with current technologies, says Lionel Lemay, NRMCA’s executive vice president for structures and sustainability. “There’s no silver bullet to get to zero carbon,” but rather a combination of strategies “to get pretty darn near,” he adds.

The low-hanging fruit, which reduces cement’s carbon footprint by 10%, is portland limestone cement, rather than traditional portland cement. From 2020-21, production of PLC, which has the same properties as traditional cement, tripled to 4.5 million metric tons from 1.4 million, says Bohan.

The most effective overall strategy is to combine several blended cements, such as PLC, with SCMs, such as fly ash, slag cement, natural pozzolans and/or ground glass, says Lemay. Other approaches include adding admixtures such as water reducers, strength enhancers and carbon mineralization.

Existing Technologies Not Fully Utilized

Currently, existing technologies are not fully utilized, mainly because most projects don’t have carbon reduction goals, says Lemay. With widespread use, there won’t be enough supply of materials to support carbon reduction, he adds.

There are opportunities to increase supply, especially of SCMs. But for fly ash, for example, improved infrastructure is needed to get supply directly from power plants, says Lemay.

According to the American Coal Ash Association (ACAA), in 2020, 26.5 million tons of fly ash were produced by electric power plants, but only 17.1 million tons were used, of which 11 million tons were used to make concrete.

In addition, there is an estimated 2-billion-plus tons of coal ash, some of which is fly ash, that could be harvested, processed and used in concrete. According to ACAA, there may be enough supply for 100-plus years, says Lemay.

There are nearly 80,000 concrete-specific EPDs and 350 cement EPDs in the three-year-old EC3’s database.

EPDs courtesy of Holcim and Ozinga

*Click the images for greater detail

Caution is necessary. Mixes with reduced cement can take longer to set and gain strength, potentially slowing schedules. The “trick” is to make concrete with less cement and maintain the quality, says Ryan Cialdella, vice president of innovation and market development at Ozinga, a ready-mix producer most active in and around Chicago.

Low-carbon concrete is not always appropriate for every application, adds Alana Guzzetta, U.S. Concrete’s national research lab manager at Vulcan Materials Co., a ready-mix producer. For each job, the concrete producer “needs to be part of the conversation” with the team early on, to understand needs, she says.

There also can be a cost premium to remove carbon. Ozinga, which sells a line of low-carbon concrete products called CarbonSense, is trying to trim the price to be competitive with traditional concrete. “Our plan is to use these reduced-carbon mixes across our entire portfolio of work,” says Cialdella.

One new approach among some cement producers is to replace limestone with materials that are already decarbonated, says Bohan. The best example is the use of slag as a raw material at the cement plant. “This reduces a plant’s carbon footprint because we don’t need to drive the CO2 off of the slag, as we do with limestone,” he says, adding that PCA’s aim is to aid cement producers to double the use of decarbonated materials.

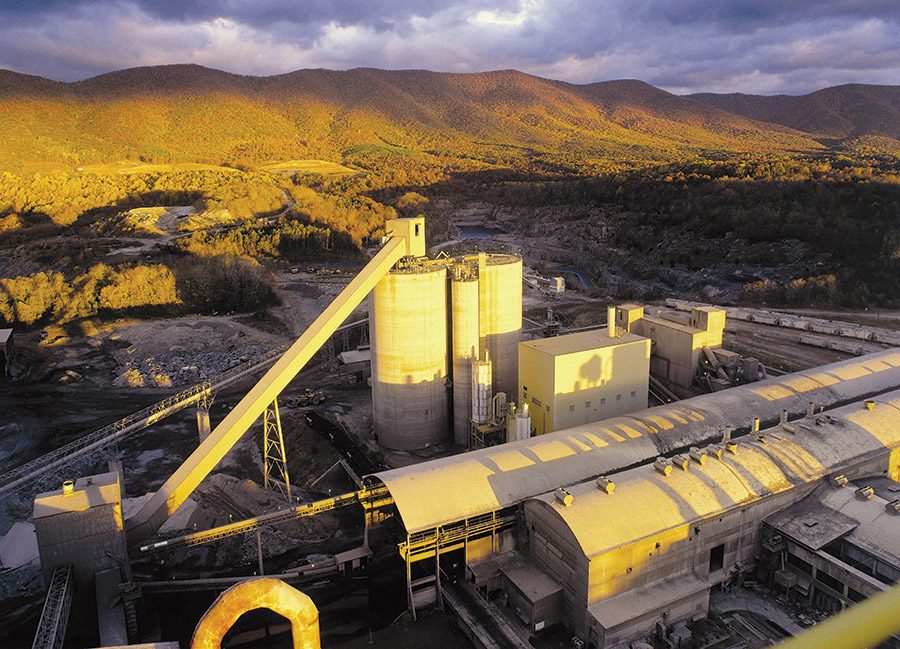

Transformational Fuels

Also at the cement plant, a goal is to replace traditional fuels, such as coal and pet coke, with transitional fuels, such as natural gas, and then replace those with transformational fuels. These include alternative fuels, such as engineered fuels, refuse and waste-derived fuels, municipal solid waste, construction and demolition debris and, ultimately, hydrogen.

Alternative fuels not only reduce reliance on fossil fuels, they divert materials that would normally end up in a landfill. “If those materials are organic, then ‘landfilling’ them ultimately produces methane, which is far more damaging than CO2 in terms of global warming,” says PCA’s Bohan.

One obstacle to use of innovative fuels is the permitting of cement plant operations. PCA would like to see permitting that expands alternative fuels to include industrial scrap and off-specification items. Examples are paper and cardboard streams, non-PVC plastics and fabric, fiber and fillers from the recovery of carpet, textiles, fabrics, upholstery and furnishings.

“Improvements at cement plants won’t take place unless permitting [officials] can provide clear and certain requirements,” says Bohan. “Uncertainty and ambiguity in the permitting process prevent changes” helpful to all, he adds.

Lack of infrastructure in the U.S. also is seen as an obstacle, even to transitional fuel use. “We need a robust and reliable electric grid to deliver the increased demand for and use of renewable energy or for the increased energy required by carbon capture or onsite hydrogen generation,” says Bohan. There is a need for pipeline capacity either to deliver fuels including, in some areas, natural gas and, in the future, hydrogen, and pipelines to transmit captured CO2, he adds.

A goal at cement plants is to replace traditional fuels with transitional fuels, such as natural gas, and ultimately replace those with transformational fuels, including hydrogen.

Photo courtesy of PCA

Optimize Mixes

Though more upbeat than ever, clean-concrete boosters do not wear blinders. “We need more options for concrete mixes to get this to scale,” Building Transparency’s Smedley says. And “we need to get building teams to optimize their mixes, which can reduce emissions by 30% without novel products.”

Cialdella adds that “a resounding theme is that a true performance spec is needed for carbon neutrality.” Otherwise, producers cannot be creative with mixes, he adds.

On the supply side, there is agreement that cement and concrete producers can’t take advantage of new carbon-reducing technologies in a vacuum. They need support from owners, developers, design professionals and contractors.

Beyond workability, durability and strength, carbon is slowly “emerging as a fourth performance metric,” says Climate Earth’s Erickson.

Cialdella adds, “We don’t see this going away.”

---Urban-Mining-Industries-Pozzotive_ENRready.jpg?height=200&t=1663257031&width=200)

Post a comment to this article

Report Abusive Comment