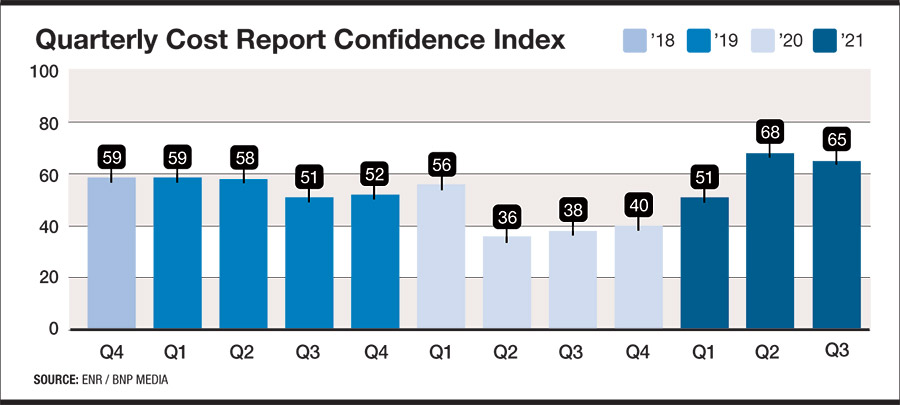

Worries over price inflation and persistent labor shortages have cooled optimism among construction executives, but overall confidence in the market remains strong. A cautiously optimistic view about a full market recovery can be seen in results of the latest ENR Construction Industry Confidence Index. The Index dropped three points to a rating of 65. This quarter’s regression follows a record 17-point gain in Q2.

Despite the drop, the index remains at its second highest level since the third quarter of 2018.

The index measures executive sentiment about where the current market will be in the next three to six months and over a 12- to 18-month period, on a 0-100 scale. A rating above 50 shows a growing market. The measure is based on responses by U.S. executives of leading general contractors, subcontractors and design firms on ENR's top lists to surveys sent between Aug. 9 and Sept. 20.

Confidence in the U.S. economy as a whole fell nine points to a 61 rating. Execs remain confident in the economy in the short term, but doubts have crept in about the medium term. Only 13.8% consider the current U.S. economy to be in decline, but that number jumps to 24.1% when considering the outlook in 12-18 months.

Individual market outlooks have stayed strong, including distribution/warehouses (an 84 rating), hospitals/health care (75), transportation (73), multi-unit residential (73), industrial/manufacturing (73) and water/sewerage (72). These remain well above their historical averages. The most notable drop was in the entertainment/theme parks/cultural market, down 13 points to 34 after a 25-point surge in Q2.

Still Trending Upward

A continuing positive trend can be seen in the results of the latest Confindex survey from the Princeton, N.J.-based Construction Financial Management Association (CFMA). Each quarter, it polls 200 CFOs from general and civil contractors and subcontractors about markets and business conditions. The Confindex is based on four separate financial and market components, each rated on a scale of 1 to 200. A rating of 100 indicates a stable market; higher ratings indicate market growth.

The Confindex rose to a 119 rating, up 3.5% from Q2’s 115 rating. The “business conditions” index continues to be strong, up 7.4% from last quarter to a rating of 130. It is up 83.1% over the same time last year. The “financial conditions” index stayed stable at 110, while both the “current confidence” and “year ahead outlook” indices rose, to 117 and 121 respectively.

Given the issues currently facing the industry, the survey results are surprising, says Anirban Basu, CEO of economic consultant Sage Policy Group and a CFMA adviser. “All we hear about is supply chain disruptions, [inability to] find construction workers," he says. "And yet what this survey says is demand for construction services is sufficient to offset them all.”

Demand for construction is being driven by liquidity, Basu thinks. He hypothesizes that “there’s almost a desperation among private equity firms and other investors to deploy available cash.” Real estate has become a space where investors are looking for value, the economist contends. “They’ve got to deploy the cash somewhere. The stock market is pretty pricey right now. Other asset classes are the same,” he adds. “Use it or lose it.”

Even so, prices remain high, with 92.7% of ENR’s Confidence Index Survey respondents seeing upward price pressure on materials. Supply chain issues also don’t seem to be going away. “Many people are now suggesting these supply chain disruptions will last into 2023,” Basu warns.

Where are the Workers?

“I’ve never seen [our members] beat the drum so consistently. Material prices and labor are the two things on everyone’s mind,” says Stuart Binstock, CFMA CEO. About 80% of association members say they are very or highly concerned about skill shortages. “Even when we asked them about other things, they still wanted to talk about skill shortages [and] material supplies, availability and prices,” he says.

The construction industry is down 232,000 jobs since February 2020, according to Basu. “So ostensibly there should be people looking everywhere for construction work. Where are they?”

For the industry, the shortage of skilled labor is as unavoidable as death and taxes, but this year it is part of a broader workforce trend. Workers across all U.S. industries are making new choices about where they want to work. “We have a hundred job openings for every 83 unemployed people,” Basu says. And yet only 235,000 jobs were added nationwide in August, according to U.S. Bureau of Labor Statistics data.

Dealing with issues such as discrimination, the high suicide rate among workers and jobsite bullying is vital to expanding the talent pool available, says Binstock. “If you’re in an industry that has all of those issues going on, it’s going to be hard to continue to recruit.” The issues particularly affect women and minorities. Addressing them is “not [just] the right thing to do,” he says, but a business imperative.

Post a comment to this article

Report Abusive Comment