Following a period of strong recovery, construction activity has begun to cool, largely due to emerging COVID-19 variants, high materials prices, a shortage of workers and other challenges.

“Construction starts have hit a rough patch following the euphoria seen in the early stages of recovery from the pandemic,” says Richard Branch, chief economist at Dodge Data & Analytics. “The Delta variant has raised concern that the fledgling economic recovery is stalling out, undermining the already low level of demand for most types of nonresidential buildings.”

Julian Anderson, president of cost trends consultant Rider Levett Bucknall, expressed a similar outlook. “In my view, the U.S. construction industry has entered a period of heightened risk,” he says. Prices for construction inputs are rising faster than bid prices, Anderson adds, which “can only go on for a short time before economic reality bites.”

Branch noted that despite ongoing materials and labor issues, he expects activity to pick up in 2022. “Starts are likely to remain unsteady over the next few months,” he says. “However, the dollar value of projects entering planning continues to suggest that the recovery in construction starts should resume early in the new year.”

Multifamily Sector Strengthens

The dollar value of total construction starts is 11% higher than this time in 2020, year-to-date, Dodge reports. Residential starts rose 24% in the same time period, with the market shifting from single-family to multifamily construction. In the third quarter, the $374-million Victoria Palace Gateway Tower in Honolulu and the $223-million second phase of the Sendero Verde project in New York City were the largest projects in that sector to break ground.

“The single-family market has lost a good deal of momentum as material and home prices hurt affordability and sales,” says Branch, creating “an opening for the multifamily sector to stage a solid recovery following the decline in 2020.”

“The U.S. construction industry has entered a period of heightened risk.”

—Julian Anderson, President, Rider Levett Bucknall

In non-residential building, the dollar value of starts increased 3% year-to-date. Construction in the warehouse and manufacturing sectors continues to account for the majority of the gains, while education work declined. The largest non-residential building projects to begin in the third quarter were the $1.5-billion JPMorgan Chase office building in New York City and the $825-million REG Geismar Biofuels Plant in Geismar, La., Dodge reports.

In other construction sectors, the dollar value of starts is up 1% year-to-date. “Construction within the environmental public works categories are providing strength and offsetting weakness in streets and bridges and the utility and gas plant sector,” says Branch. In the third quarter, the $677-million Oak Hill Parkway in Austin and the $453-million third phase of a sewer overflow project in Pawtucket, R.I., were the largest projects to break ground.

Lumber Prices Cool Down

Materials prices “recently retreated from their peaks, as feverish homebuilding demand in the U.S. has cooled a bit and excessive steelmaking capacity worldwide is being reined in,” says Alex Carrick, chief economist at ConstructConnect.

After soaring for months, lumber prices have fallen sharply this quarter. IHS Markit’s third quarter forecast reports a 41% increase for softwood lumber in 2021, down significantly from last quarter’s forecast of 70.2%. In 2022 lumber prices are expected to decline 29.1%.

These changes are due to supply and demand corrections, says Frank Hoffman, consulting principal, economics and country risk, at IHS Markit. “COVID-induced restrictions kept supply depressed during the run-up, but capacity has come back online due to the combination of waning restrictions and the attractiveness of such high prices,” he says. “Meanwhile, demand has sharply dropped off, between the softening in the U.S. housing market and buyer resistance with buyers willing to wait or hold off entirely on projects such as new homes or home-renovation projects.”

Steel Prices Have Peaked

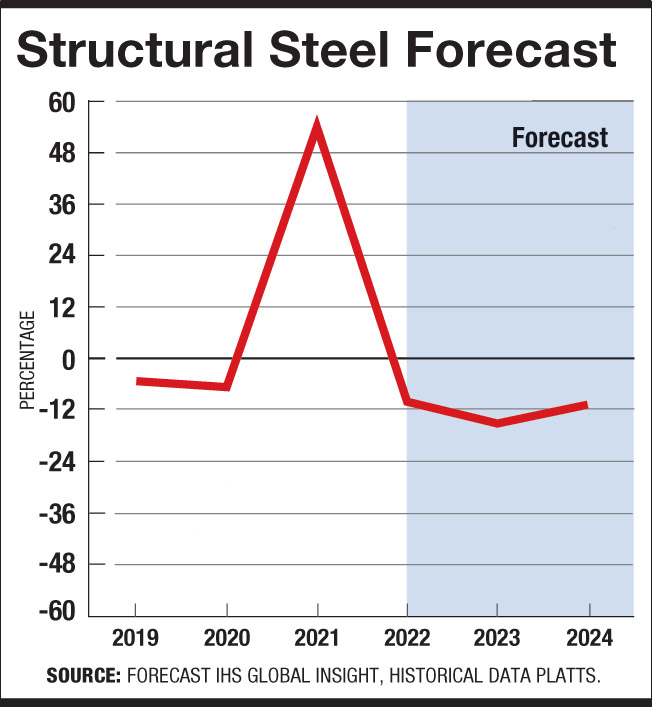

Structural metal prices are expected to rise 22.8% overall in 2021, while fabricated structural sheet will increase 23.8%, according to IHS Markit’s third quarter forecast. The numbers represent sharp increases from the 2nd quarter report, which forecast the two materials at 9.4% and 6.8%, respectively. John Anton, the firm's director of pricing and purchasing, expects that steel prices have peaked for the year.

“Steel prices are moving downward in much of the world, although those in the Americas are only flattening. Global steel production is fully recovered and exceeds pre-COVID-19 output, [and] even the U.S. is back to 2019 levels after months of underproduction,” Anton says. He also notes that changes to tariffs under Section 232 of the federal Trade Expansion Act against Europe, which currently are 25% on steel and 10% on aluminum, are on the horizon.

“The U.S. must move, or Europe will apply harsh retaliatory tariffs,” says Anton. “How the tariffs will ultimately be changed is unknown. A tentative date of Nov. 1 was announced some months ago, but U.S. steel companies are pushing back against that deadline.”

Post a comment to this article

Report Abusive Comment