Construction's volume of federal Paycheck Protection Program loans has jumped 42% since mid-April, updated Small Business Administration data show, but construction's ranking slipped to third among industries, from first place after PPP's first round of funding.

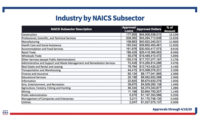

The latest SBA ranking, which includes data through June 12, shows that construction has received a net $63.6 billion in PPP loans since the program was launched on April 3. [View SBA report here. Scroll down to see industry ranking.]

That represents an increase of $18.6 billion, or 42%, from SBA's earlier ranking, which was based on data through April 16, when the first round of PPP funding ran out. [See 4/17/2020 ENR story here.]

The $63.6 billion in loans puts construction behind just two other sectors among the 21 on SBA's list. Health care-social assistance was tops, with a net $66.3 billion in loans, followed by professional, scientific and technical services, with $65.3 billion.

Construction's amount also equals 12.4% of the net total $512.3 billion in PPP loans.

[For ENR’s latest coverage of the impacts of the COVID-19 pandemic, click here]

Despite construction's increased PPP loan volume in the past couple of months, the industry's rank declined from first in the April SBA list.

Construction had $44.9 billion in approved PPP loans as of mid-April. Professional, scientific and technical services was second, with $43.3 billion, and manufacturing was third, with $40.9 billion.

The loan program was created in the Coronavirus Aid, Relief and Economic Security, or CARES, Act and was aimed at helping small businesses and nonprofit organizations ease the financial blows from the coronavirus pandemid.

The CARES Act, which President Trump signed into law on March 27, provided $349 billion for the PPP. But applicants rapidly gobbled up those dollars, prompting Congress to add $311 billion in follow-up legislation, enacted on April 24.

In terms of the number of PPP loans approved, construction ranked fourth, with 438,921.Professional, scientific and technical services led the way, with 595,293 loans.

The “other services” category was second, with 484,161, and health care and social assistance was third, with 479,650.

The latest SBA figures on PPP are for net loan volume. Since the program began, some borrowers have returned loans to the government in the wake of criticism over news reports that publicly held and large companies had been approved under PPP. The Treasury Dept. and SBA then tightened up on their guidance documents for implementing the program.

Treasury Secretary Steven Mnuchin told a Senate hearing on June 10 that PPP borrowers had returned about $12 billion in loans

The deadline for applying for PPP loans is June 30. SBA reported that as of the end of day on June 12, $129.7 billion in PPP funds was still available.

Post a comment to this article

Report Abusive Comment