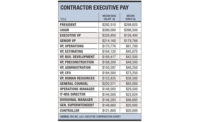

With many contractors seeing a return to healthy margins at a time of high construction activity, executives are reaping the rewards. On top of strong salary increases, bonuses are being paid out at all levels. Company presidents were the first to see the bonus bump when market conditions improved, but last year vice presidents and other executives also saw big jumps in bonuses, according to statistics by industry compensation specialist PAS Inc.

In its 2018 analysis of contractor executive compensation based on previous-year data, the Saline, Mich., firm found that bonuses for chief financial officers rose 27% from 2016. Senior vice presidents saw a 25% jump in their added pay, which went up 21% for operations vice presidents during that same period. By comparison, presidents, who saw steady bonus hikes in recent years, received a comparatively modest 9.5% average increase. The firm says it surveys nearly 3,000 individuals in 18 executive roles.

“I see these individuals achieving the upper level of the bonus structure,” says Dan Pauletich, senior managing director of industry executive search firm Specialty Consultants, Pittsburgh. “Executives who have successfully led expansions into vertical silos [are] getting their bonuses paid out—in some cases, even 100% of base salary,” he notes, “It’s been a great year for growth and profitability.”

Outpacing Other Sectors

Salary increases are also holding steady at a high level by historical standards, says PAS president Jeff Robinson. Last year, executives averaged 4.1% hikes in base salary. He says annual executive salary increases have hovered around 4% since 2013. “We’ve got a good run going here,” Robinson adds, noting that construction is significantly outpacing average salary increases across other industries, which was 3.2% in 2017.

Base pay for presidents increased 5.5% last year compared to 2016, while CFO base pay was up 6.5%. Robinson says the CFO pay jump comes after three years of relatively stagnant salary increases. He notes that many CFO positions opened up in recent years, as many long-term employees stepped down as their retirement packages benefited from an improved stock market, although with younger replacements, average salaries can appear to flatline.

According to the PAS survey, companies estimate offering pay increases of 3.6% this year. However, Robinson notes that firms typically underestimate hikes by about one-half of a percentage point. “Based on everything I’ve heard, I can’t imagine 2018 being less than 4%,” he says.

But for some executives, even those increases may not be enough. Recruiter Michael Ketner says demand for top talent is high and executives know they can command higher salaries by switching employers. Someone “who makes $100,000 per year can walk across the street and get $115,000 to $120,000,” he says. “There’s such a demand for chief estimators they could get 20% to 25% [more in salary]. If someone gets a 4% raise, it takes years to come close to what they could get by walking across the street. That 4% is almost an insult.”

Bidding War

Ketner notes more counteroffers are also driving higher salary offers. He says that out of the 93 senior-level searches he filled last year, 78 of them involved counteroffers. “I just talked to a guy in Texas, who told me he doesn’t care what he has to pay the [candidate],” he says. “He can’t afford” to not have the employee.

With many top contractors at full employment, the pool of available candidates is small. Pauletich says he might have to recruit 300 to 400 people for an available position, when in the past it might have been 150 candidates. As a result, search assignments can take longer to complete. “The thought of finding a highly qualified unemployed person in this market is a fairy tale,” he says.

Vice presidents of construction are in the highest demand among his contractor and real estate clients, says Pauletich. He says employers seek executives with experience in alternative and emerging delivery methods. “We’re currently doing 60 variations of this position on my books,” he adds. “I’ve got searches for three in New York, two in Los Angeles, two in Houston, three in Florida … It seems that we’re seeing that in every sector.”