Confidence in forecasts for increased U.S. infrastructure spending will push the pace of mergers and acquisitions among engineering and construction firms, according to a recently released study by FMI Capital Advisors.

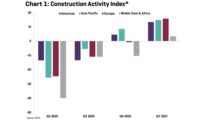

That trend already is evidenced by the nearly 50 deals announced in the global engineering-and-construction sector during the second quarter of 2017, including SNC Lavalin’s purchase of WS Atkins and AECOM’s acquisition of Shimmick Construction.

Alex Miller, a director at Raleigh, N.C.-based FMI and the study’s author, explains that a variety of factors are expected to keep the 2017 acquisitions market at nearly the same pace it has experienced for the past two years. Chief among those factors is the early reaction of the global investment community to President Trump’s stated commitment to more national infrastructure investment and the easing of regulatory requirements.

While many of the actual bid opportunities from these deals may not materialize for two to three years, Miller says the fact that state departments of transportation and other public-sector agencies already are making greater use of design-build and public-private partnerships for complex projects is a powerful incentive for large firms to acquire those capabilities now.

FMI’s report is based on analysis of recent AEC-sector mergers and acquisitions, as well as a survey of top industry executives about acquisition strategies and projections for more activity. The results provide insights into several factors contributing to what Miller calls “the most robust market for mergers and acquisitions we’ve seen in years.”

For example, the heightened competition for skilled labor across the design-and-construction sector has made more valuable than ever attributes such as local knowledge, access to resources and specialized expertise, says Miller. As such, acquisitions are increasingly more strategic, with many midsize firms seeking to grow or, in some cases, protect their existing market share from larger competitors.

“The labor shortage is a big piece of this trend,” says Darin Good, managing director at Headwaters MB LLC, a Denver-based banking firm that specializes in mergers and acquisitions. “Firms that have a solid workforce and have devised ways to reduce labor needs through automation and prefabrication are very much in demand,” he says.

Similarly, Miller says self-performing contractors and engineering and consulting firms with key geographic footprints are also highly sought-after partners for acquisition or, in the interim, as joint ventures. FMI identifies states in the West and Midwest as the most attractive areas for expansion, followed by those in the Southeast.

“There’s absolutely an appetite for acquisition of U.S. Firms at the international level.””

– Darin Good, Headwaters MB

AECOM Construction Services Group President Dan McQuade notes that the completion of the Oakland, Calif.-based Shimmick Construction purchase (expected in September) will provide the company with “leading civil construction capabilities across the western U.S. at a time when infrastructure spending is going to keep growing.” He points to newly enacted spending programs, such as more than $120 billion in recently approved ballot measures in California and Seattle’s just-approved ST3 measure, which advances $54 billion in rail-line extensions and other capital projects.

AECOM will incorporate Shimmick’s West Coast civil-construction expertise into its existing capabilities. McQuade adds, “That makes us ideally suited to pursue and win major infrastructure projects.”

In the coming years, domestic firms may well find themselves competing for acquisition targets with overseas firms seeking to establish or expand their U.S. presence. The FMI survey found that, of firms with non-U.S. headquarters or ownership, more than 80% indicated that U.S. acquisitions are a current component of their strategy.

“There’s absolutely an appetite for acquisition of U.S. firms at the international level,” Good says. “As many other economies have stalled, global firms are focusing their attention here.” He expects 2018 to be even bigger than 2017 for acquisitions, as firms eye possible changes in the U.S. tax code that will benefit their transactions.

Driven by Complexity

The FMI report also offers several indicators of how mergers and acquisitions will reshape the future engineering and construction landscape.

One trend is the continued uptick in the number of megaprojects, particularly in the transportation sector. This coincides with an increasing preference among owners for more integrated-project-delivery services—roles that, until now, have been the domain of large, technically sophisticated firms.

As a result, the survey says larger engineering and construction firms plan to step up their M&A activity to position themselves for these opportunities. Nearly 80% of firms with annual revenues of more than $1 billion cited acquisitions as part of their business strategy, as opposed to 40% for firms with less than $500 million in revenue.

Many of these deals likely will start as joint ventures, giving the participants an opportunity to size up each other’s capabilities and culture, Miller says. “As more joint-venture relationships evolve into acquisitions, a firm will become a more integrated provider and better positioned for projects of increasing size and complexity,” he says.

But with larger firms expanding through acquisitions, the potential exists for a commensurate decline in the number of middle-tier firms, a trend that presents their owners with new challenges. For them to remain competitive in current markets as project scopes evolve, “they may need to either do a joint venture or find a buyer,” Miller says.

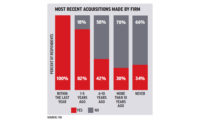

If a merger or acquisition isn’t the answer, keeping ownership in-house is. FMI’s analysis found that transferring ownership to family members or employees remains the predominant choice among engineering and construction firms, with companies increasingly looking to third-party capital to facilitate the transactions. Among the notable examples from 2016 were the acquisitions of Clark Construction Group and Structure Tone.

In addition, Miller says smaller firms are increasingly looking to outside capital as an alternative to seller-financed transitions, leveraging tools such as Small Business Administration loans. The FMI report concludes that firms should consider whether this approach makes sense for them, given the issues that can arise from bonding requirements and project-based revenue.

More Attractive Matches

Although many factors contribute to mutual interest among prospective M&A partners, other issues can stand in the way of consummating a deal. Prospective buyers cite a failure to integrate effectively as the biggest impact on a successful transaction, followed by the inability to find an adequate target.

However, another long-standing obstacle—the expectation gap between seller and buyer valuations—is showing signs of diminishing. This disparity, which Miller says was exacerbated by the recession, has eased recently in step with an overall rise in firms’ profitability, thereby justifying a higher valuation.

“More buyers are willing to pay fair value, rather than discounted value,” Miller says. Even with the current bull market for acquisitions, he cautions that prospective acquisition targets should keep their expectations reasonable as valuations depend upon what the firm has to offer.

Miller also advises buyers to be smart shoppers, looking at more than a target’s price tag and capabilities. Leadership and culture are equally critical. “Buyer and seller leadership philosophies should align,” he says, adding that a smooth integration plan is a must.

Commercial builder HITT Contracting Inc.’s recent acquisition of Trademark Construction, Houston, and GC American Construction, New York City, “were driven by having found great strategic partners locally,” observes Cullen Hitt, the firm’s manager for corporate development. “There was a strong fit not only in terms of construction expertise but [also in] culture and a similar mind-set in how best to serve our clients.” That alignment “has helped us transition in both cases and enabled us to hit the ground ready to build, maybe slightly quicker than had we tried to enter those same markets organically,” adds Hitt.

But an active market for mergers and acquisition does not always guarantee suitable targets, nor is it always the right fit for every firm’s long-term growth strategy. “The assumption that organic growth is cheaper and less risky may be true,” Miller says. “But if competitors are thinking about acquisition, then you need to think about it, too.”

Post a comment to this article

Report Abusive Comment