A first for Canada and one of its most expensive infrastructure projects, a $15-billion high-speed-rail line in Ontario could get a boost from the government’s proposed public-works financing bank.

If approved by parliament before its summer recess, the $25-billion Canada Infrastructure Bank will decide how to help finance the project, says a spokeswoman for the infrastructure ministry.

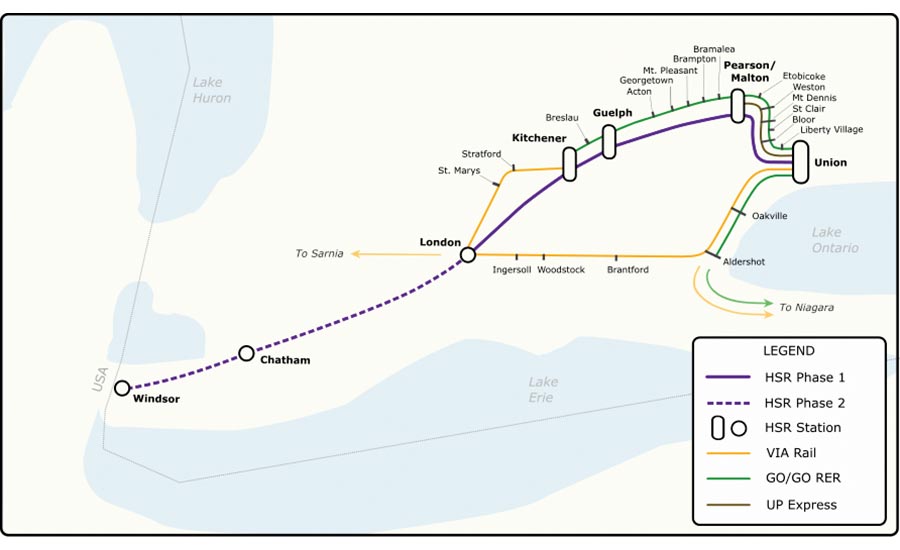

The planned 206-mile high-speed-rail system would connect Toronto with the cities in the province's southern tier in two phases, ending in Windsor, which borders the U.S. near Detroit.

It also would be the first high-speed-rail line in Canada, which has lagged behind the U.K. and Germany in the development of fast trains.

'Hard, Economic Infrastructure'

John Gamble, president and chief executive of the Canadian Association of Consulting Engineering Companies (ACEC), believes the Ontario high-speed-rail line fits the proposed bank's mission, which is to entice pension funds and other private investors to pump money into major infrastructure projects that might not otherwise get built.

The project is also the type of economy-boosting infrastructure for which ACEC has advocated. "It fulfills that definition of hard, economic infrastructure," Gamble said.

But Terrence Corcoran, a columnist for Canada's Financial Post, was critical of the plan. Citing transportation consultant Steer Davies Gleave's 2016 report for the Ontario Ministry of Transportation, Corcoran said the report's projections "make it clear that all versions of the rail scheme are guaranteed to be net-cash drains. Even after the big losses are fudged and massaged and manipulated by adding in so-called social and economic benefits, there is no financial or economic case for sinking billions into high-speed rail across [southern] Ontario."

However, private investors are not likely to have to bear on their own all the financial risks involved with building a multibillion-dollar high-speed rail line.

The Trudeau government has been quietly reassuring private investors that the new infrastructure bank will ensure a financial return on risky projects if revenues falls short of projections, The Canadian Press has reported, citing documents released under the country’s Access to Information Act.

Still, the revelation has given additional political ammunition as well to opponents of the bank proposal in Parliament, who have accused the government of trying to shield private investors at the expense of taxpayers.

The high-speed-rail line would cover the 206 miles between Toronto and Windsor at 150 miles per hour, stopping along the way at Guelph, Kitchener-Waterloo, London and Chatham, with a connection to Pearson International Airport.

There has also been talk of eventually hooking up Canada’s high-speed rail system with that of the U.S. in a link that would go through Detroit, though that would likely be years off, according to the Detroit Free Press.

First Step

In a first step, Ontario Premiere Kathleen Wynne has announced an $11-million environmental assessment of the project, with a request for proposals for preliminary design work expected to go out in the fall.

Other early stage studies will likely look at parking, infrastructure, travel demand, and current and future land requirements, according to a spokesman for the transportation ministry.

Other studies may include environmental and land use constraints, parking strategies and infrastructure, current and future land requirements, travel demand forecasting, and environmental impacts, according to Bob Nichols, a spokesman for Ontario’s transportation ministry.

Also under consideration is a “governance body” that would oversee the $15 billion high-speed rail project, Nichols wrote in an email.

The proposed high-speed-rail line would be one of the largest public-private infrastructure endeavors ever undertaken in Canada, with most P3 projects typically in the $260-million to $300-million range, Gamble said.

"In terms of the order of magnitude, this is a major undertaking," he said.

Infrastructure ministry officials said they also may look at financing a proposed Edmonton-to-Calgary high-speed-rail line in western Canada.

Typically, pension funds would prefer to put money into infrastructure that has been built and has a proven track record of spinning off revenue.

Jim Leech, former chief executive of one of Canada's largest public pension funds and now a special adviser to the proposed infrastructure bank, acknowledged the challenge but insisted it can be met.

"That is the whole rationale for the bank—to bridge the gap by redistributing the risk and reward to make a greenfield project interesting for an institution," he wrote in an email.

As debate continues over the proposed infrastructure bank, some critics arguing the federal government can borrow at lower rates now than the private sector can.

Debate in Parliament

Still, given that the Trudeau government now controls parliament, the main question is not whether the proposed bank will pass but, rather, what concessions will be made.

Industry officials hope the bank has the independence to pick which projects to fund, rather than having Ottawa select them.

While the federal government will pick the bank's leader, Gamble says he or she should have the ability to operate the bank without micromanagement or interference.

"It would be a disincentive for investors if the cabinet is picking projects," he said. "At some point, the government is going to have to take its hands off the steering wheel."