More than a year after Textura partnered with Turner Construction Co. on a national roll-out of its Early Payment Program for subcontractors, the system slowly is gaining adoption. The software firm, now owned by Oracle, says about 20 general contractors now use EPP, which rearranges construction’s payment order by moving subcontractors ahead of GCs in line for reimbursement, often within a week of a project owner’s approval of invoices.

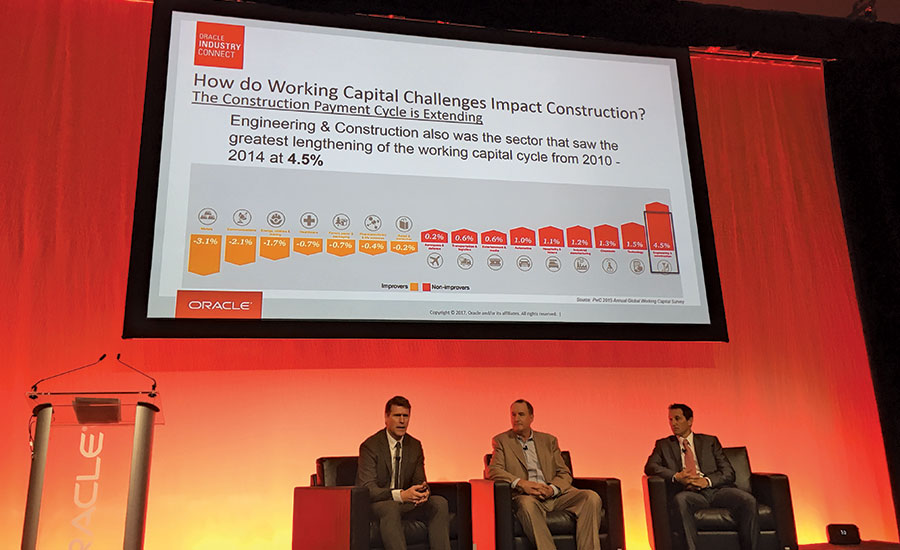

A session at Oracle’s “Industry Connect” user conference in Orlando, Fla., in March focused on the system.

The system is an attempt to create a supply-chain financing scheme for the industry. After a project owner approves monthly invoices submitted by the prime contractor, financial partner Greensill Capital pays each participating subcontractor, often on a defined date, minus a percentage-based fee, usually around 1%. Then, once the general contractor receives payment from the owner, the GC reimburses Greensill.

“It fosters more of a partnership relationship for all of the parties down the value chain, and that’s helpful,” says Mike Bruynesteyn, treasurer and vice president with Turner and leader of the Oracle session on supply-chain finance in construction.

Adam Nickerson, chief financial officer for Alston Construction Co., reported about 25% of its subcontractors participate in the voluntary program. Despite the potential advantages, some firms remain skeptical.

“They were nervous about whether we’d be able to pay them by a certain date, and that has not been a problem,” Nickerson says. “For the subcontractors that work for us, it has become a real competitive advantage.”

Another session participant, Roger Whitman, chief financial officer with Kast Construction, West Palm Beach, Fla., similarly noted that some subcontractors don’t seem to believe the program’s promise of payment certainty. Instead, he says, they sometimes incorrectly assume they will be charged a fee but won’t get paid as promptly as promised. He reports only about 20% of his subcontractors opt to use the system.

The hesitation may come from the program’s radical nature.

“When I talk to subcontractors, it’s a foreign concept,” says David Kelly, vice president for client services with Oracle Construction and Engineering. “It changes how commercial construction operates.”

While some individual subcontractors have used an invoice-based system of debtor financing, called “factoring to manage cash flow,” doing so can project a sign of distress, says Kelly. The Oracle Textura Payment Management Cloud Service, coupled with Greensill’s financial backing, enables general contractors to implement EPP systems projectwide and with much lower fees than factoring.

Further, Greensill is operating on the merits of the general contractor’s balance sheet, instead of the subcontractor’s.

“We’re able to receive our money a lot faster,” says Bob Merkel, president of Merkel Woodworking, Addison, Ill., which has used the system on several projects for Turner. “Once our invoice gets approval, in five days we get our money.”

Englewood, Colo.-based Big Horn Plastering has used the system on projects led by Turner as well as Catamount Constructors. The benefits are simple, says Debesh West, who handles the firm’s accounts receivables. “Getting paid in 30 days is a lot better than getting paid in 90 days,” he says. “That keeps suppliers off my back and keeps money coming in the door.”

Oracle touts the service as a game-changer for subcontractors.

“Giving a subcontractor a financing option that’s not based on their balance sheet and doesn’t have to be underwritten by their assets [and that] they don’t have to qualify for—it’s very unique,” Kelly says, adding, “We’d like to see this become normal across the industry.”

Post a comment to this article

Report Abusive Comment