Army Corps Of Engineers New military housing is designed to boost troops’ quality of life.

|

If fighting the Iraq war, maintaining a global presence and closing bases at home isn’t enough, the U.S. military has a new challenge reinventing itself. Updating its fighting style, adding thousands of recruits and revamping a decades-old quality of life now mandates a different footprint for the military, and that means billions of dollars in new construction over the next several years and a more enlightened, environmental and expedited approach to managing the building process.

For a military used to huge undertakings, this one is monumental, say service top brass. “The U.S. Army is undergoing the largest transformational change since 1942,” said its vice chief of e staff, Gen. Richard A. Cody last month in announcing the service’s plan to add nearly 75,000 active and reserve personnel by 2010, two years sooner than originally planned, with plans for a 547,000-person force. “We’ve changed our doctine, we’ve changed our organizational structure. This is absolutely huge what we’re doing.” Click here for briefing document (![]() 765 KB).

765 KB).

|

While the U.S. Navy, Marines and Air Force are also reshuffling personnel and building facilities, the Army faces the most massive reshaping. By the end of fiscal 2011, the service plans to restation one-third of its active global personnel, an effort that will affect 380,000 military and family members and affect 304 installation locations, Cody noted. Transforming the Army from a division-based force to a more agile one centered around smaller brigade-sized units will add thousands of personnel to locations with insufficient or no supporting housing, operational facilities and infrastructure.

Army Corps Of Engineers Construction of Whitside Barracks at Fort Riley, Kansas is a $56-million design-build project.

|

As such, the Army estimates it will spend in excess of $66.4 billion through fiscal 2013 to execute a construction mission that will generate at least 743 projects. The task includes building 23 brigade complexes around the U.S., 69,000 barracks spaces, 4,100 “family housing units” and 66 child development development centers to offer military families “a quality of life that is equal to the quality of their service to the nation,” says Cody. Even so, the herculean building program comes at a time when economic and political forces are buffeting the effort—and the private sector construction industry that is critical to helping the services complete projects in time to accommodate troop movements and recently accelerated growth initiatives.

| + click to enlarge |

|

Facility construction has been ongoing for several years under various iterations of the Base Realignment and Closing program (BRAC). But the workload is now reaching a new crescendo. “This peak year for us,” says Major Gen. Merdith “Bo” Temple, director of military programs for the Army Corps of Engineers, which is shepherding the building blitz for the service and other military “customers.” He says the Corps must award about $14 billion in construction work in fiscal 2008 alone to stay on track, twice its usual annual load. “That is pretty substantial,” he says.

The push has been hampered by funding uncertainties, aggravated particularly last year by battles between Congress and the Bush administration over the war in Iraq. The stalemate held up funds and contracting authority for months, delaying schedules and forcing tough choices for industry participants already inundated with work in a booming construction market still plagued by rising costs and personnel shortages. “The process is so difficult every year,” says a frustrated executive of one contending engineering firm.

|

| CODY |

Military construction officials acknowledge the tumult and frustration. “This is new ground for the Corps, our garrison customers and industry,” says Temple. “But we can’t stop and figure out how to get this perfect before we implement it. We’ve just got to get on with it, given this huge workload.”

But participants are heartened by what seems to be a smoother funding path this year that promises to plow a record amount of money into military construction coffers through next year (see chart). “We should expect the dollars to flow within the month or by the end of February, latest,” says Temple. Industry sources say the Defense Dept. has already passed fiscal 2008 funding to the services, and the Corps is starting to forward funding and solicitation authority to its districts.

|

| TEMPLE |

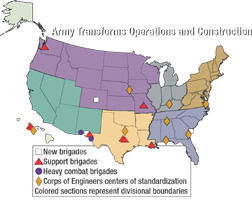

Key highlights of what construction funds will enable include stationing six infantry brigades at Fort Carson, Colo., Fort Stewart, Ga., and Fort Bliss, Texas; billeting eight support brigades such as military police, air defense and and battlefield surveillance at other bases, and eventually returning two European combat teams to Fort Bliss and White Sands Missile Range in New Mexico (see map).

Fort Bliss, a 1.12-million-acre installation near El Paso, is undergoing a $3.1-billion expansion to accommodate three times its current population and transform into a maneuver-training center by 2013. It will become a small city of 19,000 returning soldiers and 27,000 family members. The Corps Fort Worth district has awarded 24 contracts to 21 prime contractors, with capacity to reach more than $1.5 billion in five years.

|

| ISELIN |

While the expansion will bring a construction boom to El Paso, local firms complain that large-dollar contracts are going to out-of-town builders. “Most of the opportunities for local contractors will be through subcontracts,” says John Rodgers, chief of the Corps construction contracts branch in Fort Worth. “Subcontractors will definitely benefit.”

Only one El Paso company, JACO General Contractors Inc., has been successful so far in winning the chance to be in a pool of three minority-owned prime contractors that will vie for $40 million worth of work. But Steve Currier, chief estimator for Hensel Phelps Construction Inc.’s Austin office, which has $580 million in prime contracts at Fort Bliss, says, “We’ll be tapping into local resources as much as we can.”

Gilbane Building Co.

|

Army Corps Of Engineers

|

Army Corps Of Engineers Planned $750-million hospital for wounded military will be permanent addition to fort Belvoir, Va. but modular barracks expedites schedules.

|

The construction program’s deadlines and size are forcing the military to accelerate and broaden use of new tools and methods, many borrowed from the private sector. While many in industry welcome changes in traditional military procurement tedium and overspecification, others claim they are daunting to contracting staffs and base commanders.

One key change is the centralization of nationwide Corps contracting authority based on type of structure or function. For example, its Fort Worth district will manage the roughly $3-billion effort to build barracks at Army bases. There are eight “centers of standarization” across the U.S. (see map, above). Click here for more detail (![]() 765 KB). Temple acknowledges “short-term confusion” among military and industry participants as the Corps cements standardization this fiscal year. He says the centers are to have necessary contracting vehicles in place by July to make use of the standardized approach.

765 KB). Temple acknowledges “short-term confusion” among military and industry participants as the Corps cements standardization this fiscal year. He says the centers are to have necessary contracting vehicles in place by July to make use of the standardized approach.

There have been hiccups in concentrating procurement at one location. Industry executives fumed recently when the Corps Fort Worth district halted 21 separate “task order” barracks procurements without explanation. The solicitations were actually protested in the Court of Federal Claims by firms charging exclusion of small business. The protest claims the Corps contracts “are illegally limiting...

Related Links:

Related Links:

Post a comment to this article

Report Abusive Comment