|

| A two-year housing slump has pulled back some materials price escalation. overcapacity. |

It has taken nearly two years of steady declines in the housing market but the strong materials price escalation of the previous three years appears to have been knocked off balance. Inflation still has some strong niches, especially among metal products, but overall construction inflation is easing.

“Every month of this year, we have had to revise down our housing forecast, and with each new revelation of the housing bubble blow-up, we have become a little more pessimistic,” says John Mothersole, economist with the Washington, D.C.-based forecasting firm Global Insight. Housing starts declined 13% last year and Mothersole estimates they will fall another 25% during 2007. “The housing market still has further to fall and we are looking for another 15% decline in 2008,” he adds.

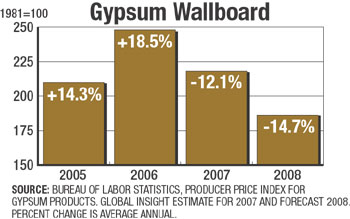

Unlike the peak inflation years of 2004 and 2005 when most prices were going up, the downturn in housing has undercut prices for materials such as lumber, plywood and most recently gypsum wallboard.

Wallboard producers held out the longest, managing to push prices up 18% last year, following a 14% increase in 2005. But by last July, falling demand and overcapacity forced prices 20% below 2006’s level, according to the Bureau of Labor Statistics producer price index. Global Insight predicts prices will continue to decline in 2008.

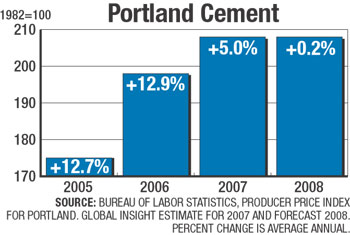

Housing traditionally accounts for 25% of the total domestic shipments for cement and that reached as much as 35% during the recent boom, says Ed Sullivan, chief economist with the Portland Cement Association, Skokie, Ill. Through the first half of this year, overall construction was down just 4.5% but the “intensity” of cement usage in projects fell 7.5%, while total cement consumption was down 12%, compared to the same period of 2006, he says.

Faced with such a large drop in demand, cement producers are finding it difficult to match the 13% average annual price increases tracked by BLS for both 2005 and 2006. “We expect the softness in [portland cement] shipments to transfer over into pricing,” says Mothersole. He predicts that the producer price index for portland cement will average a 5% increase in 2007 and show no gain in 2008.

|

| Wallboard prices have been hit by falling demand and large supply overcapacity. |

Price moderation tied to the housing recession is helping to temper the remaining inflationary niches, such as those in the steel market. During the first half of this year, reinforcing bar prices shot up, increasing as much as 11% during the second quarter. In recent months, rebar prices have started to ease and Global Insight predicts that prices will continue to soften throughout 2008.

A spike in structural steel prices lagged that of rebar by a few months. Structural steel prices jumped 11% this quarter and are expected to average a 14% gain for 2007, after increasing 15% in 2006. “Supply is pretty darn tight and I would be surprised if we don’t see a further spike in structural prices,” says John Anton, Global Insight steel analyst. He thinks that allocation in the structural steel market is a possibility.

The tightness in the steel market is adding to costs by forcing contractors to buy from warehouse stock rather than mill runs. This can add a price premium of 10% to 20%, says one estimator.

In general, availability is becoming as much of a problem as pricing. “The big question for estimators now is ‘Will it be there?’” says Ed Walsh, executive director of the American Association of Professional Estimators, Washington, D.C.

“Delivery is the biggest threat to our estimates right now,” says Donald Short, president of the estimating firm Tempest Co., Omaha. “Just to order tubes for light fixtures takes two weeks minimum and that use to be an in-stock item.”

|

| Cement producers are having a harder time pushing through large price hikes. |

The recession in housing also is altering the cost picture in other ways. Due to lower lumber, plywood and wallboard prices, “we are telling [owners] that wood framing is their most economical bet today,” says Short. That mostly impacts lighter structures such as strip malls and economy motels, he says. In addition, those are the types of projects that can take advantage of the idle labor pool created in the housing market. “We are seeing some crossover for carpenters and wallboard workers,” says Short.

However, this benefit is limited. “To a large degree, crafts in the residential market do not transfer very well to large commercial projects. The skill set is too different,” says Karl Almstead, the vice president who puts together the Turner construction cost index (see table p. 27). “Dealing with high-voltage in large commercial and industrial work is different from wiring a house.”

Mary Wallers, president of the Sierra WestGroup, which publishes two cost indexes, agrees. “The idle workforce in the housing market is not easing pressure on the commercial side,” she says.

However, both Almstead and Waller note that their indexes show an easing in construction escalation rates. “Costs have plateaued and everyone is rushing to get their jobs out before the climate changes,” says Waller. There is so much work in the pipeline that the current cost structure can’t hold, she adds.

Related Links:

Related Links:

Post a comment to this article

Report Abusive Comment