Guy Lawrence/ENR

|

As a college student, David L. Richter dreamed of being a developer of urban skylines and an entrepreneur á la Trump and Rouse. He became an engineer and lawyer instead and landed in the family business—claims consultant and project manager Hill International Inc., Marlton, N.J. But now, as a key half of Hill’s top management team along with his father Irvin E. Richter, David aims to create a project management megafirm and is altering landscapes around the world as well as in the construction industry.

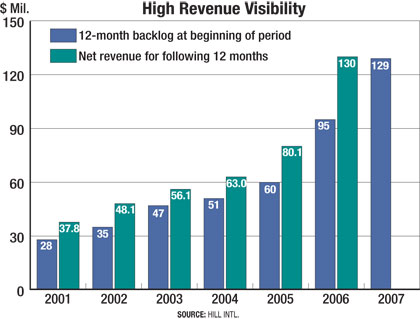

In the last three decades, Hill International has morphed from a one-person claims consulting firm that the senior Richter started at home to a global project manager with 1,500 employees in 70 offices and projections of $300 million in 2007 revenue. The firm rose seven places on ENR’s List of the Top 100 Construction Management-for-Fee Firms, with $197.6 million in revenue last year.

Hill went public last year in a nontraditional way to finance acquisitions and top-tier talent hires that will propel it into new markets and a chance to become a billion-dollar project management firm in the next decade. “Most other PM firms are small, but the marketplace is looking for size,” says 62-year-old Irvin, who founded the firm in 1976 and is chairman and CEO. “We want to be more vertical and do what we do well.”

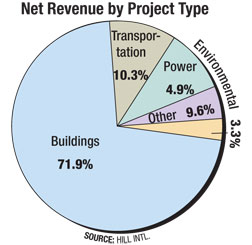

“Everything I learned about business, do not become a jack of all trades,” adds David, 41, a business, engineering and law graduate of the University of Pennsylvania who became president and COO in 2004. “We’re best in the world at two things, claims and project management, and will stay focused on those.” Elevated by a booming construction market, PM now makes up more than 75% of Hill’s revenue.

Micheal Goodman/ENR

|

Michael Goodman/ENR

Hill is managing numerous projects across the Persian Gulf region, including this $550-million mosque in Abu Dhabi.

|

Hill currently manages 15 skyscrapers, of which 14 are in the Middle East, says David. Some competitors question the firm’s depth of experience and management capacity there. “They don’t know how to move work forward,” says one. David Richter acknowledges the staffing challenges. “When you go from 20 people to 400,” as the firm did in the Gulf region, he says, “you will have some bad people and some unhappy clients.” But he insists that some owners in the region had “unrealistic expectations, and you have to tell them what they don’t want to hear sometimes.”

Jobsite relations seem to be proceeding more smoothly for Hill as project manager for the $435-million, 57-story Comcast Center in Philadelphia, an office-retail center and corporate headquarters for Comcast Corp. that will be the city’s tallest building when completed later this year. Using innovative risk analysis, the firm found scheduling issues that could have been costly, says project engineer Shawn Pressley.

“The Hill team is an integral part of our overall project management team,” says John Gattuso, senior vice president and director of national and urban development for Liberty Property Trust, one of Comcast Center’s developers. “It has provided outstanding service and greatly enhanced the depth and extent of our technical capability on what is an extremely complex, technical project. Hill has been especially helpful in scheduling oversight and cost control.”

Hill’s ability to move into the top tier of CM and project management received a major boost last year when the firm completed its move into the realm of publicly held firms. Unlike industry peers that are doing initial public offerings of stock in a bullish market, Hill chose what some experts might consider a less prestigious approach: a merger with an asset-laden shell company called a special purpose acquisition company (SPAC). “It’s a very inartful name for a very good thing,” says David Richter, adding that the technique was faster and less risky for a smaller firm like Hill.

|

In exchange for selling one-third of itself to the SPAC and allowing the merging entity two of seven board seats, Hill gained a listing on the NASDAQ stock exchange and $35 million in cash, says Richter. “When you get public, you get public,” he says. “If I had to do it all over again, I’d do it exactly the same way.” Richter says he knows of other industry firms that are exploring the SPAC approach. “We’ve also opened the door to the investment community to learn more about construction,” he says. “They had viewed the industry as high-risk contractors or low-margin engineers.”

|

|

|

Richter says the firm’s stock has risen in value by nearly $2 per share since the firm went public, with institutional investors such as Wells Fargo now among the key shareholders, with a 7.7% stake. Even so, the Richter family, which includes son Brady, 37, a hedge-fund manager and one-time college chess champion, still owns more than 60% of the firm. “In most public firms, management has to be constantly auditioning for their jobs every quarter based on how well the company did in the prior quarter,” says David. “Owning 60% of the company gives us a lot of freedom not to get into the Wall Street mentality.”

Public ownership has raised Hill’s Sarbanes-Oxley compliance costs. “Our audit fees went up tenfold,” says David. But he notes that the law will “force us to do what we should be doing anyway as far as the financial controls and systems in place to manage our business. We’re not the SOX-haters.” But being public has also revealed more financial information, such as compensation. Earlier this year, Hill’s board raised Irvin Richter’s salary to $900,000 and David’s to $500,000.

Public ownership has fueled Hill’s ability to accelerate growth through acquisition, including U.K.-based James R. Knowles (Holdings) plc, a major player in global claims consulting. The $13-million purchase, completed last September, opened new markets in Canada, Asia and Australia and gave Hill 350 “very talented people,” says David. Hill management sees the firm’s claims expertise as critical to its project management success. “It is a real differentiator because we know how to avoid claims as well as resolve them,” says David.

And last month, Hill acquired KJM & Associates Ltd., a 120-person project management firm in Bellevue, Wash. The $9.3-million deal provides Hill with a western U.S. base and a number of major public clients in transportation, education and energy.

The link offers a larger venue and a cultural match, says KJM founder and CEO Karen J. Mask, who remains president of her firm, as a wholly owned Hill subsidiary, and now is a senior vice president in the parent firm. “We did talk to other firms, but we didn’t want to be part of an engineering or construction firm,” says Mask. “We would be second priority, and I was concerned about that.”

People Assets

Hill’s newly acquired financial assets also have allowed the firm to lure a more diverse and experienced array of human assets. The firm hired Hans A. Van Winkle, a former Corps of Engineers deputy chief and retired Army major general, as president of its project management group in the Americas, a job David Richter once held. Also recently brought on board was Robert C. Hixon Jr., who formerly...

Post a comment to this article

Report Abusive Comment