After a year of gloomy construction market statistics, economists are cautiously closing their umbrellas in anticipation of a fairly sunny 2004. While industry prognosticators see only very moderate overall growth next year, they argue that with total volume at historically high levels, its nothing to complain about. Economists are optimistic that the market will strike a balance, as slowly accelerating office and manufacturing construction sectors make up for slowdowns in traditionally dominant housing and public works arenas.

If these predictions prevail, it would be a fundamental change from the recent past when the industry often met such transitions with wild cyclical swings. "During the 90s, construction adopted a much more muted cycle, and we are dealing with a more stable construction industry now," says Robert Murray, vice president of economic affairs for McGraw-Hill Construction Dodge. "Construction in 2004 will once again see an offsetting pattern by major sector, with a somewhat different mix of pluses and minuses than 2003."

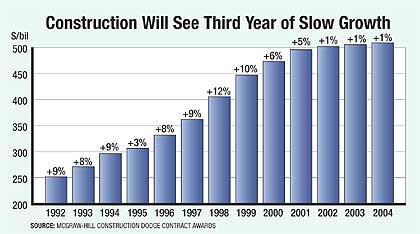

McGraw-Hill Construction expects the pluses to slightly outweigh the minuses and is forecasting total contract awards to increase 1% for the third consecutive year to $509 billion (see table below). The U.S. Dept. of Commerce is predicting growth for construction put-in-place to be even more moderate. It forecasts only a 0.2% increase in total construction in 2004 after this years 1.5% increase. Raleigh, N.C.-based construction management consultant FMI Corp., which also forecasts construction put-in-place, is looking for the overall market to increase 0.3%, following a 2.5% increase this year.

|

| Source: McGraw-Hill Dodge Contract Awards |

All three major industry forecasts are counting on a rather strong performance by the overall economy next year. McGraw-Hill Constructions forecast assumes the overall economy will grow 4% next year, compared to this years average 2.7% increase.

"We have already seen a big acceleration [in the economy] in the second half of this year," says Nigel Gault, economist with forecasting firm Global Insights Inc., Lexington, Mass. "The big difference for next year is that there will be more support from the business sector." He predicts a 9.4% increase in total fixed investment by business in 2004, compared to 2.4% this year.

"The further we get into this recovery the more the government will have to compete with the private sector for funds, which will drive [interest] rates up," Gault points out. "But while interest rates will begin moving up next year, we think that it is really more of a 2005 and 2006 problem."

The National Association of Home Builders, Washington, D.C., forecasts that fixed-mortgage rates will hit 6.2% next year, up from 5.8%, and then continue to climb to 6.7% in 2005. This will drop 2004 single-family housing starts by 4.9% to 1.36 million units, says NAHB.

McGraw-Hill Construction also says higher interest rates are fueling its forecast of a 2% drop in the dollar value of the single-family housing market next year. "We are not talking about a sharp decline, just a mild lost of momentum," says Murray. "Next years volume of single-family housing starts will still be the third-highest level of any year since 1978."

The housing downturn will be mild because a stronger economy will partially offset the impact of higher interest rates, says Patrick MacAuley, a Commerce economist. "Homebuilding has been pulling the economy along for the past couple of years, but in 2004, the economy will pull homebuilding a bit."

A stronger economy will also help snap some nonresidential building markets out of their "depression" next year. McGraw-Hill Construction expects its nonresidential category, which includes office and commercial buildings, to show new contract awards rebounding 9% next year. "A 9% increase is not that exciting compared to some of the increases we have seen in the past, but I do think we have turned the corner," says Murray. He already notes improvement in retail and hotel construction data. Office building is in the "initial stage" of increase, with further growth "going to be very gradual," says Murray.

After five consecutive years of sharp declines, the manufacturing market should finally post a modest gain next year. But again, Murray warns that the increase will still not rescue this market from its near-historic lows. "Manufacturing is going from 65 to 70 million square feet, but that is not a return to the good old days," Murray says. "This was a 191- million-sq-ft market in 1997."

Public works also will bounce back from a bad year in 2003. While the near-term effect of the federal budget deficit has not yet been too severe, the same cannot be said for the impact from reduced state funding. The latter was the primary culprit for this years 10% decline tracked by McGraw-Hill Construction.

"Tight budgets will still be present in 2004, but its expected that there will be less in the way of funding dislocations coming from the states," says Murray. As a result, McGraw-Hill Construction forecasts a 2% increase in the public works sector in 2004. This sector should get a boost from increased funding for transportation projects. However, market conditions for water supply and sewer projects will remain restrained.

|

McGraw-Hill Construction (Contract Awards in $ mil.) | |||||

| TYPE OF CONSTRUCTION | ACTUAL | PRELIMINARY | FORECAST | PERCENT CHG. | |

| 2002 | 2003 | 2004 | 02-03 | 03-04 | |

| TOTAL CONSTRUCTION | 501,704 | 505,625 | 508,900 | +0.8 | +0.7 |

| Residential | 247,844 | 266,750 | 264,200 | +7.6 | 1.0 |

| Single-Family Housing | 214,212 | 230,500 | 225,975 | +7.6 | 2.0 |

| Multifamily Housing | 33,632 | 36,250 | 38,225 | +7.8 | +5.5 |

| NONRESIDENTIAL | 154,175 | 150,725 | 156,700 | 2.2 | +4.0 |

| Office Buildings | 19,760 | 18,025 | 19,750 | 8.8 | +9.6 |

| Hotels and Motels | 4,676 | 5,325 | 6,100 | +13.9 | +14.6 |

| Stores and Shopping Centers | 18,222 | 19,450 | 20,800 | +6.7 | +6.9 |

| Other Commercial | 16,589 | 13,875 | 15,975 | 16.4 | +15.1 |

| Manufacturing | 5,259 | 5,500 | 6,000 | +4.6 | +9.1 |

| Educational Buildings | 42,065 | 43,350 | 42,550 | +3.1 | 1.9 |

| Health-Care Facilities | 16,020 | 15,025 | 14,775 | 6.2 | 1.7 |

| Other Institutional Buildings | 31,584 | 30,175 | 30,750 | 4.5 | +1.9 |

| NONBUILDING CONSTRUCTION | 99,685 | 88,150 | 88,000 | 11.6 | 0.2 |

| Highways and Bridges | 43,455 | 41,000 | 41,800 | 5.7 | +2.0 |

| Sewers and Water Supply | 20,037 | 17,650 | 17,700 | 11.9 | +0.3 |

| Other Public Works | 24,153 | 20,200 | 21,000 | 16.4 | +4.0 |

| Electric Utilities | 12,040 | 9,300 | 7,500 | 22.8 | 19.4 |

| Source: McGraw-Hill Construction Dodge | |||||

Click here for regional breakout

BUDGET BATTLES

Construction companies that rely on work from federal agencies are used to year-to-year uncertainty over funding. Fiscal year 2003 began on Oct. 1, but as of early November, engineers and contractors still didnt know what final numbers Congress would approve for many key federal construction programs in fiscal 2004.

As of Nov. 6, only three of the 13 annual appropriations measures had been signed into law: those for the Dept. of Defense, the Dept. of Homeland Security and the legislative branch. The measure funding the Interior Dept. had received final congressional approval at ENR press time but awaited President Bushs signature. House and Senate conferees had reached agreement on two others: military construction and energy and water programs.

That leaves seven measures as candidates for folding into an omnibus package. Those seven fund most of the large construction programs, notes Peter Loughlin, the Associated General Contractors executive director for congressional relations and federal markets. "Its too early to tell how construction will fare," he says.

The news isnt much better for construction areas farther along in the budget process. Many programs will be cut for 2004. The new homeland security department received $29.4 billion from lawmakers in its first-ever appropriations bill. The total is up 2% from what the departments component agencies received in 2003. But appropriators still cut the Transportation Security Administration budget 10%, to $5.2 billion. Even so, TSAs allocation includes $150 million for seaport security grants and $250 million to help airports install baggage-screening equipment.

Military construction is in for a down year. Conferees cut those programs by 13%, to $9.3 billion. In the energy-water measure, appropriators cut the Corps of Engineers civil works budget 3%, to $4.6 billion, although that sum is $377 million more than President Bush requested. Within the overall civil works budget, the Corps construction account will receive $1.7 billion, down about $20 million from 2003.

The bill also has a tiny boost for the Bureau of Reclamation. That agency will get $987 million, up 1% from 2003. BuRecs water and related resource account will get $857 million, up $24 million from the 2003 level. Lawmakers also allotted $6.6 billion for the U.S. Dept. of Energys environmental cleanup program, a 1% reduction from the previous years level.

Many in industry are watching how the U.S. Dept. of Transportations budget fares. AGCs Loughlin calls it the "one bright spot in the remaining seven bills." The House and Senate have cleared these remaining appropriation bills, and while they must still be reconciled in a conference committee, it looks as if all three major DOT construction areas are in line for hikes.

For the federal highway program, the House bill recommends $34.8 billion and the Senate version $34.6 billion. Both would represent increases of more than $2 billion over 2003s $32.4-billion total. For the Federal Transit Administration, the House allocates $7.23 billion and the Senate proposes $7.3 billion. That compares with $7.18 billion for FTA in 2003. For airport grants, the House recommends $3.4 billion; the Senate is $25 million higher.

Many of the fiscal 2003 bills werent enacted until Februarymore than four months into the last fiscal year. "We appear to be heading down that same path," says Loughlin. "This is a precedent that we dont like to see."

| Homebuilding Is Expected To Slip From This Years Record Homebuilding almost single-handedly fueled overall construction growth this year, but rising interest rates will put the brakes on the industrys main growth engine in 2004, according to a forecast by the National Association of Home Builders, Washington, D.C. With the average 30-year fixed-mortgage rate falling to 5.8% in 2003 from 6.6% the previous year, the homebuying binge pushed single-family housing starts to a record high of 1.43 million, 5% higher than 2002s robust market. NAHB predicts that fixed mortgage rates will climb back to 6.2% next year and continue higher to average 6.7% in 2005. The higher rates will be enough to knock housing starts in 2004 back 4.9% to 1.36 million, to be followed by another 1.9% decline in 2005. NAHB also predicts that multifamily housing starts, which include condos, government subsidized housing and market-rate rental housing, will continue to decline over the next two years, after falling 4.2% in 2003 to 333,000 units. In 2004, NAHB forecasts that multifamily housing starts will drop 4.9%. |

| Commerce: Pluses and Minuses Balance Many nonresidential building markets will begin to turn around next year but not in time to affect construction put-in-place figures for 2004, says Patrick MacAuley, a U.S. Commerce Dept. economist. He predicts that both office building and commercial construction markets will slip an additional 5% in 2004 after posting major declines this year. The Commerce forecast stands apart from other projections in its optimism toward power and industrial construction markets, with both expected to turn the corner faster than office and commercial building sectors. Long-term construction needs and a push to upgrade the transmission system will boost construction put-in-place in the power market by 3.1% next year, Commerce predicts. "The manufacturing forecast is a bit more daring," MacAuley admits. But he believes this years 21% decline is rock bottom. "Business equipment spending is already up this year and [investment in] structures usually lags the recovery in equipment," he says, forecasting a 5.1% increase in the manufacturing market for next year. Commerce also is bullish on sewer and water sectors, believing that the recent housing boom has generated enough of a funding cushion through developer fees to propel those markets to respective increases of 4.8 and 5.1% next year. |

| FMI Sees Slowdown in Renovation Work The construction forecast from industry management consultant FMI Corp., Denver, calls for overall growth to slow from 2.5% this year to just 0.3% in 2004. FMI expects higher mortgage rates next year will cool the huge home improvement market, which grew 11.3% this year, to $137 billion. "Home improvements will flatten out next year, but that is a very positive story in that the market will hold onto this years huge gains," says Randy Giggard, FMI manager of market information. He predicts that new single-family housing will fall 3% next year, to $276 billion, after climbing 7% in 2003. This will be offset by a 1.2% rebound in the nonresidential building market as it comes off this years 1.4% decline. FMI sees the strongest growth potential in the public safety market, forecasting an 11.4% increase in construction activity next year. Also turning the corner with higher-than-average growth rates for 2004 will be the commercial, parking garage and service station markets, which will all increase more than 5% next year. |

Post a comment to this article

Report Abusive Comment