|

Construction spending is down among the top corporate owners in the U.S. as most admit that it is becoming more difficult to justify capital investment in the wake of a recession. Increasingly, owners are looking to the construction industry not just to build their projects, but to find innovative new approaches that cut costs and speed the process. And some owners are not happy with the industrys response.

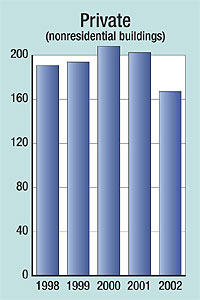

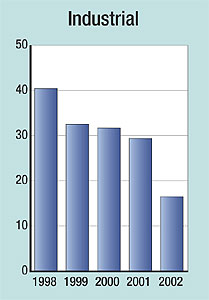

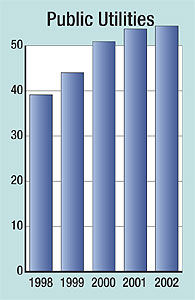

The private-sector construction recession in the past few years has been significant. The construction-in-progress figure for this years ENR Top 425 Owners dropped 14.7%, based on 2002 numbers, from last years list. In addition, the U.S. Commerce Dept.s construction put-in-place figures fell sharply in industrial and private-sector nonresidential building categories in 2002 (see charts below).

There doesnt seem to be a radical turnaround in most sectors in the near future, according to some recently released studies. The chemical industry isnt planning any major boost in construction. "We see maybe a 2 to 3% increase in capital spending this year and possibly 5% next year," says T. Kevin Swift, chief economist of the American Chemistry Council, Arlington, Va. He notes that the current survey of chemical manufacturers capital spending plans is still being compiled. "But I dont see the major turnaround everyone has been hoping for," he says.

|

After several years of a boom market, the multi-unit housing market is sagging. About 200,000 rental units will be completed in 2003, down 3% from 2002, says an Oct. 27 report by Torto Wheaton Research, a Boston-based unit of developer CB Richard Ellis. The report anticipates another 10% drop-off in construction in 2004. "Construction has been relatively high, while vacancy rates remained stable," says Gleb Nechayev, author of the report. "Net absorption rates have fallen. We expect a reduction in construction until the absorption rates catch up, probably in 2005."

But a recent study gives cause for optimism in one sector. Worldwide construction and revamping of semiconductor fabrication plants appear to be turning around in the third quarter of 2003 and the market looks to be rebounding, although not to the heady levels of 2000, says the Quarterly Spot Report on Semiconductor Fab Projects, issued last month by Strategic Marketing Associates, a Santa Clara, Calif., firm that tracks semiconductor fab construction. There will be a total of $14 billion in new fab plants started in 2003 worldwide, up 53% over 2002, says SMA. "Next year, that figure should rise to $20 billion," says George Burns, SMA president.

Much of this activity results from chip manufacturers moves to 300-mm wafer assembly lines. "But IBM is moving from a 90-nanometer technology to 65 nanometers. This may spark a new round of construction for a new generation of chips in 2005," Burns says.

|

| This graph and others below indicate new construction put-in-place ($billion in current dollars) Source: US Commerce Dept. |

Economic uncertainty has pushed corporate construction executives to justify every dollar spent. "Were coming out of a recession, so owners have been squeezed," says Hans Van Winkle, director of the Construction Industry Institute, Austin, Texas. Owners are being forced to evaluate each capital investment more carefully, not just for return on investment but for the timing of that return. "The bottom line has taken on even greater importance," he says.

CII next year may fund a study on the financial impact of preplanning work on the resulting project. "There is a tendency to try to cut costs on up-front work in an effort to get the project done faster and cheaper," says Van Winkle. "But preplanning is key to getting off to a good start. Sometimes slower and more expensive at the outset can mean faster and cheaper in the longer run. We want to see if we can quantify that."

Many of the largest corporate owners already subscribe to this philosophy. "Johnson & Johnsons delivery process depends heavily on front-end loading," says William P. Tibbitt, J&Js executive director of worldwide engineering. "We hire the designer and the contractor very early in the process and make sure they are engaged with the end user. That way, when we get to final authorization, all the major problems are worked out."

Flo Mostaccero, vice president of technical services and business process development for Coors Brewing, says a lack of sufficient front-end attention by owners can make contractors ineffective.

|

For General Motors Corp., heavy preplanning is critical over the life of the project. "All common systems are thoroughly evaluated in terms of life-cycle costs," says August Olivier, its director of corporate projects for GM. "We are not a developer who can build and then walk away. We are an owner that realizes that we have to live with what we build."

GM now is considering taking the next step on early planning and cooperation. "We are considering a modified form of design-build for a possible major assembly plant in the future," Olivier says. "Weve never used design-build before but we are exploring its use."

One major initiative by the Construction Users Roundtable, Cincinnati, is its TriPartite Initiative to help communicate owner concerns about construction issues to the labor community. The initiative, launched in January, includes leaders among owners, unions and contractor organizations to discuss cooperation on issues of mutual concern.

CURT owner members are enthusiastic about the response from labor. "We have nine general union presidents representing the building trades along with nine owners on the committee," notes Larry Wargo, consultant for contractor services for FirstEnergy Corp. "The union leaderships response has been impressive." He hopes that such cooperation can lead to efforts to increase productivity and reduce absenteeism.

Several owners have noted that the enthusiasm among the leadership of the major trade unions to provide a sense of mutual cooperation, rather than confrontation, has yet to bear fruit on regional and local levels. "To be successful, this sense of cooperation has to extend beyond the Beltway to locals," says Tibbitt. But he remains optimistic. "There has been an honest and energetic effort on the part of the union leadership to find ways to benefit all sides in the construction process. Its no longer a feeling of us against them."

|

One of the biggest owner frustrations is the lack of progress in technological innovation in the construction industry. "Some of our recent experiences show that neither the contracting community nor the design community are taking advantage of technology," says Tibbitt. "In the rest of industry, you learn to adapt and adopt."

Tibbitt says construction firms seem to cling to old business models and processes. "There is an incentive not to innovate, not to be the first to do something," adds Alex Molinaroli, vice president of global sales for Johnson Controls. "We need to move to a program relationship, not a project relationship, to bring in new ideas."

GMs Olivier says contractors need to better understand "lean" processes. "As manufacturers, our whole life revolves around them," he says. Olivier notes that there is little evidence of investigation into modularity or just-in-time procurement or other lean methodologies that are common in other industries.

"We see technology improving productivity and the way we do business," agrees Allen Bunner, vice president of global markets for fire and security at Tyco International. Many owners like Internet-based project Websites. "Weve seen significant reductions in turnaround time on submittals," says Olivier. Bunner likes the reduction in errors and omissions. "And you always know which is the latest drawing," he notes.

Still, owners are hoping for more progress. Johnson & Johnson uses a provider-based system for project tracking. "We are happy with it," says Tibbitt. "But until these types of programs are more widely used, we wont really see how these tools can be best used and what they will eventually be able to do."

|

One form of technology that owners increasingly are embracing is use of reverse auctions. "We have spent a lot of time and effort on reverse auctions in the last year and have had significant success," says Wargo. "We havent seen the horror stories you keep hearing from the contractors. We had one mechanical contractor that told us that, in using this bid process, he ended up getting the job at a higher price than if he had been forced to prepare a sealed bid."

CURT has just completed a set of guidelines on the use of reverse auctions. "As an organization, we neither support nor oppose their use," says Gregory L. Sizemore, executive vice president. "But we believe that there should be some guidelines for their effective use."

The guidelines will be unveiled at CURTs national conference beginning Nov. 10 in Naples, Fla. They urge owners to prequalify bidders, clearly define the bid scope and the nonbid criteria to be used and investigate any unreasonably low bids. They also caution that reverse auctions may not be appropriate for some procurements and set up rules for the conduct of the auction.

Post a comment to this article

Report Abusive Comment