|

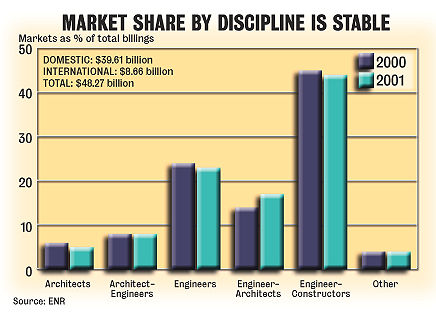

Last year may have been the beginning of the market downturn, but you would never know it from revenue figures posted by ENR's Top 500 Design Firms. The Top 500 generated a record $48.27 billion in revenue in 2001, an 11.0% increase over 2000. Domestic revenue rose a healthy 10.3% last year from the year before, to $39.61 billion. And international work rose an impressive 14.5% over 2000's total, to $8.66 billion.

Many firms see the recessionary side of the current market as a temporary glitch, rather than a cause for serious concern. "The recession seems to have passed its low point and early front-end work on major projects seems to be appearing again," says Frank DeMartino, president of Parsons Corp. "Through all the hoopla about a recession in the industry, our firm has seen very little of a downturn, except in spots," says Gerry Salontai, CEO of Kleinfelder. "The big impact is that team leaders complain that they are only two people short instead of six people short."

One reason the soft economy may have taken less of a toll on major firms is that it hasn't affected markets across the board. Commercial building, industrial process and, in particular, telecommunications have taken their lumps. But the infrastructure market remains strong and power, while softening, remains at a high level. Large design firms have taken great pains in the past few years to diversify in order to ensure against catastrophic declines in a particular market specialty.

Carter & Burgess is fairly typical of this trend. "We are just one of many firms that have tried to be fairly diversified so that if a particular market or region goes down, it doesn't harm the entire firm," says CEO Jerry Allen. He says the firm was big in telecommunications, "and I don't see that market coming back to anywhere near what it was." But the blow was cushioned by transportation and other public works, as well as private land development, Allen notes.

Some firms are continuing to look at new ways to diversify. One interesting new enterprise is Louis Berger Group's investment in a new firm providing information technology services: Gamblehill Systems, Richmond, Va. Berger and Gamblehill will provide and manage computer hardware and software equipment and services to engineering firms, similar to what companies like IBM, Hewlett-Packard and Cisco Systems provide to Fortune 500 companies. "We are in the infrastructure business, and we look at IT as just a new form of infrastructure," says Nick Masucci, Berger's president. "We aren't going into competition with IBM, but there are thousands of smaller engineering firms that don't have the in-house resources to manage their IT systems." Masucci says that Gamblehill will concentrate on engineering firms as clients, "because that is where we come from and what we understand."

Another design firm stepping out of its normal role is Anshen+Allen Architects, which specializes in hospital design. "Our hospital clients are all 24/7 operations with huge energy concerns and waste disposal problems," says Derek Parker, senior principal. "So we are looking into a medical waste-to-energy process." Anshen+Allen is working with three hospitals on a pilot program to provide an onsite chemical waste disposal process. "There's no combustion, so there are no greenhouse-gas concerns, and a by-product of the process is hydrogen, which supplies fuel cells," he says. Parker hopes to get the go-ahead for the program in about at month. "My colleagues ask what this has to do with architecture," he says. "Nothing, really. But it has everything to do with pure design."

While diversification has helped design firms weather the storm, they are not immune from its effect. One indication of a slowing market is a shrinking backlog. Despite last year's mad scramble to build up backlog as a hedge against tough times, 81 of those firms on the Top 500 reporting backlog reported declines, compared to only 33 on last year's Top 500. And nearly three times as many firms reported domestic staff cuts in 2001 as 2000, 70 compared to 27.

One firm that made a market-based decision to downsize, despite having a good year, was David Evans and Associates. "Telecommunications went from 40% of our business to about 5%," says David Evans, CEO. Despite slowdowns in its retail and telecom markets, firm revenue actually rose about 5% in 2001 due to increases in transportation and residential land development markets. But staff reductions were necessary. "We peaked at about 1,000 employees, but now we are about 900," he says. The firm closed its offices in Birmingham, Ala., and in Tucson. "The Birmingham office was our retail center, and that is a quiet market," Evans says. The firm experimented with work sharing, "but it's hard to do real work sharing cross-country," he says.

One ironic twist is that design firms, whose financials have always been carefully checked by owners, now are taking a more careful look at their clients' own numbers. "We got burned by one of the telecom companies," says Evans. "We had to write off nearly $1 million in bad debt." This shows you have to be extremely careful on payments, he says.

STV Groupmade one of the more interesting management moves last August by taking the firm private after years of being a public company. "The decision was based on performance," says CEO Dominick Servedio. "Most of our shareholders were employees to begin with, but now that we are wholly employee owned, there is a greater recognition among employees of the link between performance and share value."

Consolidation is continuing despite a shaky market. One of the biggest moves made in the past few months was MACTEC Inc.'s acquisition of Law Cos. This move came on top of MACTEC's purchase of Environmental Science & Engineering in 1999 and of Harding Lawson Associates in 2000. "Our strategy is to build a North American platform to provide engineering services from coast to coast," says Scott E. State, CEO, noting a trend among major clients to consolidate the supply chain. "You have to be able to deliver all services needed wherever needed," he adds. The Law deal raises MACTEC's total work force to about 4,000. "It also brings a heavy presence in the Southeast, which we didn't have, along with geotechnical skills and hard engineering experience," says State.

But these moves have posed an identity problem for MACTEC. "We want to establish a unified brand name out there," says State. "But this becomes a sensitive issue when you acquire high- profile names in the industry." So the growing company has hired a branding consultant to solid-ify its identity. "It could be under the MACTEC name or some other name, but we want to present a unified name to the market," he says.

Despite such dilemmas, acquisitions are continuing steadily among U.S. design firms. Kleinfelder is planning to acquire GeoSystems Engineering Inc., a Lenexa, Kan.-based engineering firm. "It gives us a bigger presence in Kansas, Nebraska, Oklahoma and Missouri," says CEOSalontai. And this may not be the last we hear of Kleinfelder on the acquisition trail. It is looking to expand into the Middle Atlantic region and Southeast, and to build its water resources and construction management practices, Salontai says.

Consolidation has been a double-edged sword for many designers. "For one thing, it has reduced competition," says Servedio. "Instead of competing with eight firms, we are competing with only four big firms." But he worries whether firms now have to be big to compete. "We used to be considered a large firm. Now STV is probably considered a mid-sized firm," Servedio says. "Do we now have to get bigger to compete?"

Some Top 500 firms believe that tightening financial markets could stall the acquisition frenzy. "Consolidation in the market will continue, but there will be a slowdown," says State. He expects financing to loosen up in the next 6 to 12 months before the next round of major mergers. Salontai agrees. "The tightening of the financial markets will make it tougher for firms to expand as rapidly as before," he says. "The banks want to make sure the move makes sense."

But many believe the tide will not be turned. "There are still a lot of quality companies out there," says Derish M. Wolff, CEO of the Louis Berger Group. "But banks aren't going to be as quick to lend to the high flyers," he says. Still, Wolff sees continuing buys from about 30 of the largest firms, "plus 10 or so smaller casual acquirers each year."

|

THE 2002 TOP 500 AT A GLANCE*

|

||||||

|

VOLUME

|

||||||

|

DOMESTIC

|

INTL

|

TOTAL

|

||||

| $BIL | % CHG | $BIL | % CHG | $BIL | % CHG | |

| Revenue | 39.6 | 10.3 | 8.7 | 14.5 | 48.3 | 11.0 |

|

PROFITABILITY

|

||||||

|

NUMBER OF FIRMS REPORTING

AVERAGE % OF

|

||||||

| PROFIT | LOSS | PROFIT | LOSS | |||

| DOMESTIC | 449 | 23 | 7.7 | NA | ||

| INTL | 145 | 29 | 5.9 | NA | ||

|

PROFESSIONAL STAFF

|

||||||

|

NUMBER OF FIRMS REPORTING

AVERAGE % OF

|

||||||

| DOMESTIC OFFICES | INT'L OFFICES | DOMESTIC OFFICES | INT'L OFFICES | |||

| INCREASE | 296 | 48 | 12.0 | 43.8 | ||

| DECREASE | 70 | 14 | 10.7 | 21.3 | ||

| SAME | 117 | 83 | NA | NA | ||

|

BACKLOG

|

||||||

| NUMBER OF FIRMS REPORTING | AVERAGE % | |||||

| HIGHER | 237 | 17.8 | ||||

| LOWER | 81 | 16.1 | ||||

| SAME | 139 | NA | ||||

|

*Ranked according to design revenue obtained in 2001; NA=Not available or not applicable.

|

||||||

|

MARKET ANALYSIS

|

||

|

TYPE OF WORK

|

REVENUE $ MIL. | PERCENT OF TOTAL |

|

BUILDING

|

10,043.4 | 20.81 |

|

MANUFACTURING

|

1,479.6 | 3.07 |

|

INDUSTRIAL

|

3,125.1 | 6.47 |

|

PETROLEUM

|

6,017.7 | 12.47 |

|

WATER

|

2,505.9 | 5.19 |

|

SEWER/WASTE

|

3,439.6 | 7.13 |

|

TRANSPORTATION

|

9,340.4 | 19.35 |

|

HAZARDOUS WASTE

|

4,729.3 | 9.80 |

|

POWER

|

4,693.8 | 9.72 |

|

TELECOMMUNICATIONS

|

1,500.6 | 3.11 |

| *Ranked according to design revenue obtained in 2001; NA=Not available or not applicable. | ||

| INTERNATIONAL REGIONS | |||

| NUMBER OF FIRMS | REVENUE $ MIL. | PERCENT OF TOTAL | |

|

CANADA

|

91 | 1,097.0 | 12.7 |

|

LATIN AMERICA

|

131 | 884.5 | 10.2 |

|

CARIBBEAN ISLANDS

|

82 | 315.6 | 3.6 |

|

EUROPE

|

137 | 2,801.4 | 32.3 |

|

MIDDLE EAST

|

76 | 718.6 | 8.3 |

|

ASIA/AUSTRALIA

|

136 | 2,279.0 | 26.3 |

|

AFRICA

|

55 | 550.8 | 6.4 |

|

ANTARCTIC/ARCTIC

|

3 | 13.7 | 0.2 |

| *Ranked according to design revenue obtained in 2001; NA=Not available or not applicable. | |||

For some firms, acquisitions can pay big dividends. The biggest jump on the Top 500 this year was by Bibb and Associates, with revenue rising over 250%. The firm did this not by acquisition but by being acquired.

Bibb was bought in 2000 by contractor Peter Kiewit Sons', Omaha. With Kiewit's backing, "our ability to participate on the power side in design-build has been the key driver for our growth," says Ken Burkhart, Bibb president. The firm teamed with Kiewit and other contractors on eight combined-cycle powerplants last year, totaling 3,200Mw in capacity, Burkhart says. It now is looking at entering the industrial market from the utility side.

If there was a market that carried the water for the industry last year, it was transportation. "Last year's transportation market was as strong as we've ever seen, and it may be the strongest we will ever see," says Robert Prieto, chairman of Parsons Brinckerhoff. But there may be some dark clouds on the horizon.

"A number of state DOTs are seeing budget shortfalls, and that is a real cause for concern," says Salontai. Prieto agrees, noting that "state deficits haven't come home to roost yet." He says some studies place the combined state budget shortfall at around $34 billion before corrective action, "and that doesn't take into account an estimated $5 billion in additional expenses for homeland defense measures." This could seriously affect state transportation programs, according to Prieto.

Not everyone is as concerned about budget shortfalls. "I sense that a lot of the [negative budget] numbers were overreactions to 9/11," says James Moynihan, CEO of Heery International. He believes economic models don't take into consideration the surprisingly mild level of recession and the seeming recovery in the economy. And, Moynihan adds, "many state agencies are doing what we [in private industry] would do. They are watching their costs and personnel."

Airport work continues to be hit hard in the wake of 9/11. "These projects haven't been shelved, they have merely been delayed" while the government assesses security and financing issues, says Robert Busler, vice president and director of architecture in the Washington, D.C. office of HNTB. He expects a 9 to 15-month impact on airport projects on the boards."We saw about 40 major airport projects coming out this year and about two-thirds of them have been deferred," Busler says.

Len Rodman, CEO of Black & Veatch, sums up the power market by citing the Chinese curse: "May you live in interesting times." Last year, "we had to be selective in who we worked with. Now we have a big backlog, but the new work is off significantly," he says. The power market has been so hot in the past few years that a falloff was inevitable. "For one thing, you can buy turbines again," says John Hopkins, group executive of Fluor Corp. The power market exploded over the past few years "because of years of underinvestment, as reserves dropped from 15% to 7% to 8%," he says. Normally, the U.S. economy needs about 15 gigawatts of new capacity a year, but over the past two years, about 45 Gw a year were built. "That's why you are seeing companies canceling projects now," says Hopkins.

Stanley Consultants had a big year in power last year, but CEOGregs Thomopulos agrees the market is off. "The California power crisis accelerated a lot of construction activity among utilities, but when the real crisis didn't materialize inCalifornia, that slowed activity," he says. "Then, after 9/11, a lot of private power developers started deferring or canceling projects. And when Enron went belly-up, it really hurt the market."

The Enron debacle has caused lenders to take a closer look at independent power producer financing. "Lenders now are demanding developers to have up to 50% capacity commitments before providing financing," says Rodman. Prieto of Parsons Brinckerhoff believes the market will recover, but it will take some time. "I think that we still need a quarter or two of financial statements from the big energy companies to play through before there is any major turnaround in the market."

Education still is the cornerstone of the general building sector. "You can defer a building, but you can't defer kids growing up," says Prieto. The American public seems to agree. "A lot of school funding referenda passed last fall and this spring," notes Moynihan of Heery. "I think this says a lot for consumer confidence through the voice of the voter."

Another active market is healthcare. "The healthcare market has been generally steady at about $16-17 billion a year,"says Anshen+Allen's Parker. "We expect investment to increase over the next 10 years to about $27 billion a year." He sees several factors driving an increase in investment. One is the need to replace technologically obsolete facilities. The baby boom generation is also rapidly aging. "This group is more well informed and sophisticated than previous generations and they won't be willing to put up with substandard healthcare delivery," Parker says.

Another critical driver in healthcare is increasing scrutiny by government agencies, insurers and the public of the hazards in hospitals themselves. "There are 40,000 to 90,000 preventable deaths each year in hospitals because of system failures," Parker says. This has led hospitals to embrace environmental factor design–designing simple precautions into facilities to prevent in-hospital injuries and illness, Parker says. These factors are leading to a major increase in opportunities in the healthcare market.

Many firms are interested in security as a new market. One firm already benefiting from this concern is Versar. "We'vebeen in the market for the past 15 years," including missile-site decontamination and biohazard testing, says George Anastos, executive vice president. "This was just a natural extension of our hazardous waste practice." The firm won $6.5 million in security work in the last three months of 2001. "Security was always an issue lurking in the background," says Anastos. "But 9/11 put it squarely on the table."

But finding payment for security upgrades may not be easy. "There's a lot of talk about clear zones and setbacks" at airports, Busler notes. "But if the [Federal Aviation Administration] comes down with such mandates, the airlines will ask where the money is going to come from." He points out that when Europe and Israel reacted to airport bombings in the 1980s, they addressed the security issue without making major structural changes.

The economy and markets have design firms scrambling. But few have lost sight of their primary mission–to produce quality designs. "Just look at the troubles at Arthur Andersen," says Bob Giorgio, CEO of CDI Engineering. "What that says isthat your best asset is your name and reputation. If you lose that, you have poisoned your own well."

THE TOP 500 DESIGN FIRMS LIST

WHERE TO FIND THE TOP 500 DESIGN FIRMS

INTERNATIONAL WORK

Post a comment to this article

Report Abusive Comment