...more than $14 billion,” says Murray. If you take that out, you do not have that spike and the resulting fall off in 2009, he notes.

Likewise, electric utility work will fall back from its extremely high level in 2008, but alternative-power markets such as wind and solar will stay brisk, says Murray. “If you are looking for any positive elements in the forecast, there is still a lot of momentum for construction related to renewable energy or green buildings.”

In times of economic stress, federal spending is the key to a recovery, and most forecasts assume a significant stimulus package from Congress early next year. But as of now, the outlook for federal construction programs is mixed.

Congress passed and President Bush signed appropriations bills providing funding for fiscal 2009 for Dept. of Defense and Dept. of Veterans Affairs programs, including substantial increases for military construction. DOD’s base realignment and closure program, which includes substantial funds for construction projects, received $9.2 billion for 2009, up 18% from 2008. DOD family housing construction was hiked 39%, to $1.4 billion, and other military construction got a 23% boost, to $12.2 billion.

At VA, the major construction account was pared 14%, to $923 million, but the department’s minor-construction program climbed 75%, to $742 million.

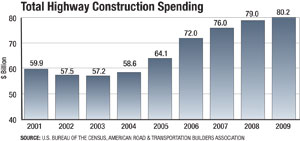

Congress was unable to agree on full-year spending levels for most other federal agencies and instead approved a continuing resolution that extends their funding only through March 6, 2009, generally at their fiscal 2008 levels. That part-year funding affects such important construction programs as federal-aid high-ways, Corps of Engineers water projects, Environmental Protection Agency aid for wastewater treatment and drinking water facilities and General Services Administration federal buildings.

Last Leg

While the funding crisis for highway work and commercial projects has been widely reported, the third leg of the stool that makes up national construction spending––government and institutional projects funded by long-term bonds––has received less attention. By all accounts, those markets are dead in the water in the near term, stalled by the collapse of the long-term bond market in recent months.

As a result, the ripple effect of delayed projects that rely on bond financing—state and municipal, university programs, K-12 schools and hospitals— could have a major impact on the construction outlook for 2009.

The collapse started in January 2008 and was completed in September and October, says Matt Fabian, managing director of Municipal Market Advisors, a Concord, Mass.-based municipal-bond-market research firm. Longer-term bonds, the kind typically used for construction projects, are the least attractive to buyers remaining in the bond market due to their perceived risk. “There is just no institutional demand of any size,” he says. As a result, interest rates have become prohibitive for all but the top-rated municipal borrowers.

| The U.S. Dept. of Commerce predicts that this year�s 6.3% decline in the value of new construction put-in-place is just the first step in the construction industry�s retrenchment. It forecasts another 7.5% decline next year as the housing market sinks further, pulling nonresidential building markets down with it. �The 12.5% rate of decline we are calling for in the housing market in 2009 is conservative,� says Patrick MacAuley, the Commerce Dept. economist who puts together the forecast. �Nonresidential has already started to swing into the negative. In terms of starts, it is getting pretty grim.� Commerce�s prediction makes many optimistic assumptions. �We assume the $700-billion bailout package will help control the financial crisis,� says MacAuley. In addition, the Commerce Dept. forecast assumes there will be a large economic stimulus package early next year and no major international crisis. This year�s relatively strong increase in manufacturing construction is a matter of �finishing up work that has already started� but there are relatively few new starts for manufacturing work in the pipeline, he says. The risk of the Commerce Dept. forecast is on the downside. �But the public side may have some upside depending on the size and makeup of the stimulus package,� MacAuley adds. |

Post a comment to this article

Report Abusive Comment