The housing contagion is starting to infect healthy nonresidential-building and public-works markets. The sub-prime mortgage virus has devastated the credit markets, causing sickness in the stock market and forcing the federal government to put virtually the entire financial system on life support. Given the economic backdrop, it is hard to find a pulse in this year’s batch of construction industry forecasts for 2009.

| + click to enlarge |

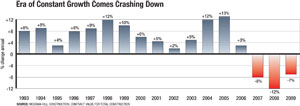

McGraw-Hill Construction (of which ENR is part) is forecasting a 7.4% decline in construction starts in 2009, following declines of 12.4% this year and 8.0% in 2007. The U.S. Dept. of Commerce forecasts a 7.5% decline in total new construction put-in-place in 2009, following this year’s 6.3% decline. The Portland Cement Association looks for construction put-in-place to fall 13.9% next year, after adjusting for inflation. FMI Corp. anticipates a 7.4% decline in total construction work next year. The National Association of Home Builders calls for housing starts to post their fourth consecutive year of double-digit declines, with another 16.2% drop in 2009.

The scary thing about these forecasts is that, to some degree, they all assume the best conditions. They assume that the $700-billion federal financial bailout will thaw out the credit freeze, that there will be further fiscal stimulus and that all of the other economic “shoes” won’t drop. To a person, every economist interviewed by ENR admits the risk of inaccuracy in their forecast due to optimism.

“The steep declines we have seen in construction starts [which are a leading indicator to construction put-in-place] will translate into declines in construction spending next year that will at least match the 7% decline called for by the U.S. Dept. of Commerce and others,” says Robert Murray, chief economist for McGraw-Hill Construction.

Those declines could continue into 2010; Murray predicts construction starts will tumble another 7% next year. Three years of retreat will pull the dollar volume of total construction starts back to $514.6 billion, its lowest level since 2002, according to MHC.

| FORECAST 2009 | |||||

|

$ millions (current dollars) | |||||

| TYPE OF CONSTRUCTION | ACTUAL 2007 | ESTIMATE 2008 | FORECAST 2009 | PERCENT CHANGE | |

| 07-08 | 08-09 | ||||

| TOTAL CONSTRUCTION | 634,395 | 555,475 | 514,575 | –12.4 | –7.4 |

| RESIDENTIAL | 264,134 | 172,800 | 168,075 | –34.6 | –2.7 |

| Single-Family Housing | 201,194 | 128,775 | 126,650 | –36.0 | –1.6 |

| Multifamily Housing | 62,940 | 44,025 | 41,425 | –30.1 | –5.9 |

| NONRESIDENTIAL | 233,864 | 243,875 | 220,200 | +4.3 | –9.7 |

| Office Buildings | 32,151 | 31,850 | 27,675 | –0.9 | –13.1 |

| Hotels and Motels | 13,988 | 15,200 | 12,900 | +8.7 | –15.1 |

| Stores and Shopping Centers | 29,513 | 23,050 | 20,700 | –21.9 | –10.2 |

| Other Commercial | 24,101 | 19,700 | 17,700 | –18.3 | –10.2 |

| Manufacturing | 17,491 | 29,625 | 20,275 | +69.4 | –31.6 |

| Educational Buildings | 52,712 | 56,900 | 55,025 | +8.0 | –3.3 |

| Health Care Facilities | 24,028 | 26,675 | 25,975 | +11.0 | –2.6 |

| Other Institutional Buildings | 39,880 | 40,875 | 39,950 | +2.5 | –2.3 |

| NONBUILDING CONSTRUCTION | 136,397 | 138,800 | 126,300 | +1.4 | –9.0 |

| Highways and Bridges | 53,437 | 51,900 | 50,000 | –2.9 | –3.7 |

| Environmental Public Works | 37,026 | 36,900 | 35,200 | –2.8 | –4.6 |

| Other Public Works | 30,482 | 26,,000 | 24,300 | –14.7 | –6.5 |

| Electric Utilities | 15,452 | 24,000 | 16,800 | +55.3 | –30.0 |

| SOURCE: MCGRAW-HILL CONSTRUCTION. | |||||

The most interesting part of the third year of declining volume is the new sectors hit. While the recession already has squeezed out most of the slack in the housing market, it is just starting to bite into the nonresidential sector. Murray predicts the dollar value of new residential construction starts will fall another 3% next year, but nonresidential building work will tumble 10% in 2009 after a 4% gain in 2008. Perhaps more significantly, Murray believes nonbuilding construction also will fall 9% next year, which would mean that every major construction market would fall into the negative column in 2009.

“If I were modifying the forecast now, I would be inclined to say there is a downside risk to the commercial building markets,” says Murray. “But if Congress passes a fiscal stimulus package, the declines projected for public works may not be so severe.”

Murray admits this year’s forecast was difficult to fashion because economic events are moving so fast. “There has been a huge amount of money directed to thawing out the credit markets, and there is a growing sentiment to go ahead with a massive stimulus package,” Murray says. “But as of mid-November, we still don’t have a sense of how effective these steps will be.”

The two biggest market swings forecasted by Murray are in industrial and power work. He predicts manufacturing work will go from a 69% boom in 2008 to a 32% bust in 2009. Likewise, work for electrical utilities will go from a positive 55% in 2008 to a negative 30% next year.

| + click to enlarge | + click to enlarge | + click to enlarge | ||||

|

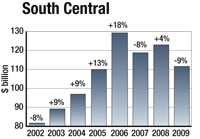

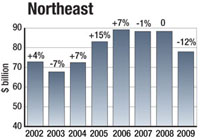

A once-strong market will see a further 7% decline in commercial and manufacturing work and a 2% drop in public buildings.

|

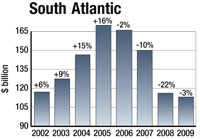

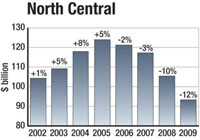

The region will be hit by a 26% decline in commercial and manufacturing work and an 8% drop in heavy and highway construction.

|

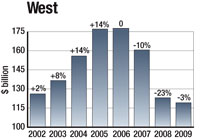

Housing in the western region will drop another 4% next year, combining with an 8% decline in the nonbuilding market.

| ||||

| ||||||

| SOURCE: McGraw-Hill Construction, Annual Starts | ||||||

But those swings are not so much a sign of weaker markets as they are a retrenchment from an extremely strong 2008. “This year’s manufacturing numbers were pumped up by four massive additions to oil refineries totaling...

Post a comment to this article

Report Abusive Comment