The construction recession has presented firms providing professional construction services with mixed messages. As owners have downsized their facilities staffs to cope with the recession, they increasingly need outside professional providers to help plan, develop and execute their construction programs.

On the other hand, owners that traditionally have relied on outside help—such as the federal government and the educational markets—have scaled back their capital programs, leaving many construction and program managers scrambling. This contrasting set of circumstances has meant some agency construction managers (CMs) and program managers (PMs) are doing well, while others are struggling.

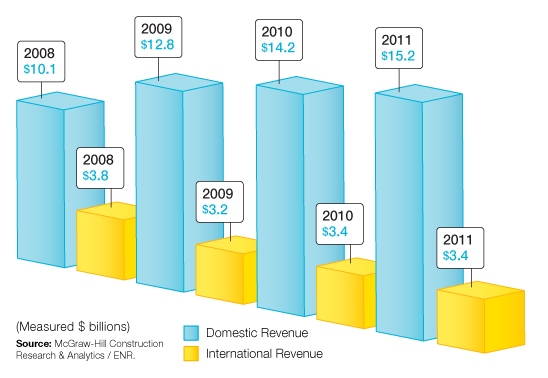

The results of the ENR Top 100 Construction Management-for-Fee/Program Management list seem to indicate 2011 was a good year for CM/PM firms. Revenue for the CM/PM group rose 6.3%, to $18.66 billion, in 2011. What is more encouraging is that the rise in domestic revenue (7.4%, to $15.22 billion) was greater than in the international market (up 1.7%, to $3.44 billion).

While 54 of the 90 firms on this year's Top 100 CM/PM list that also sent in surveys last year reported increased CM/PM revenue in 2011, 34 firms reported revenue declines. This is evidence that, while there is a continuing interest in professional construction services among owners, the construction recession continues in many prime markets for CM and PM.

For many CM firms, the market is stable, and owners are not moving away from using CM services. "I don't think the economy has significantly impacted owners' movement to or away from third-party professional services," says Kenneth A. Roberts, executive vice president of Project Time & Cost. He says decisions by owners to use CM firms are based on past experiences with the benefits of CM, not on cost.

The recession also has put a crimp in owners' facilities staffs, helping CM firms. "With minimal staff and resources, we have found that [corporate real estate] divisions are moving to and relying more on third-party project management/professional services," says Mark Schrader, western-region managing director for project management at Cushman & Wakefield. He says the increasing complexity of many major projects is forcing owners to bring in professional CM firms.

CM also is benefitting from the growing market for energy-efficient facilities. "Owners are more likely to engage a professional management firm for their complex facilities, especially the critical facilities that require the integration of energy efficiency," says Kevin Bernier, CEO of MOCA Systems. He says the complexity around net-zero energy-efficiency guidelines and budget constraints means owners must put more emphasis on planning and structuring the work at the earliest phase, which CM firms can provide.

But slowdowns in some core markets are softening the opportunities for CM firms. "The economy has put a little dent in CM activity. No one wants to spend on major capital programs right now," says Ron Price, senior project manager at Parsons Brinckerhoff and this year's chairman of the Construction Management Association of America (CMAA), McLean, Va. In the public sector—one of agency CM's core markets—cities, counties and states are holding back on new construction because of budgetary concerns, he says.

CM firms with a narrow market focus are struggling. "There are an awful lot of proposals out on the street now, but money is tight," says Bruce D'Agostino, CMAA's CEO. This is especially true on the public side. "If you are focused on the federal market, you may be in trouble," he says.

"With the [Base Relocation and Closing] program ending and federal money drying up, more and more federal agencies are being asked to do more with less," says John Jones, COO of MOCA Systems. He says this means federal agencies are relying less on independent contractors and more on full-time employees. "Staff augmentation is being put on hold, and the current federal employees are working over capacity," he says.

Infrastructure Gains

The public market is not all gloom and doom. Infrastructure projects increasingly are using CM and PM. However, many firms in the industry worry that a lack of a federal funding bill has stalled the transportation market. Not everyone agrees. "The transportation market is a huge market," says David Richter, president of Hill International. "You are not seeing a lot of huge, showcase projects, but there are plenty of bread-and-butter road and bridge projects out there."

Post a comment to this article

Report Abusive Comment