The world’s Great Recession is the equipment sector’s Depression, according to a September report jointly issued by the Association of Equipment Manufacturers and the Associated Equipment Distributors. The sales slump dominated AEM’s annual conference, held Nov. 15-17 in Hollywood, Fla.

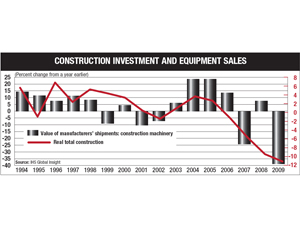

The contraction of original-equipment manufacturers (OEMs) is “unprecedented in the post-war era,” says the report, prepared by IHS Global Insight for Milwaukee-based AEM and Oak Brook, Ill.-based AED. “The output of [OEMs]…will decline from $35.1 billion in 2006 to $17.5 billion in 2009,” it forecasts. The employment impact will be severe “as jobs fall from 56,800 to 23,100, a loss of 33,700 jobs or 59% of the 2006 labor force.” Taking into account supply chain and distribution, total job loss in the equipment sector is an estimated 550,000.

After releasing the report, AEM and AED launched a national “awareness campaign,” noted Dennis Slater, AEM president. A series of national rallies, archived on the Web at www.startusupusa.com, recently climaxed in Washington, D.C., where AEM lobbyists met with members of Congress, who Slater says were not aware the condition was so dire. He approved of Congress extending the transportation bill only to Dec. 18, hoping it will pass a new bill soon. “They’ve got to deal with it,” he said.

That level of intensity is new for AEM, but Chuck Martz, CEO and president of Link-Belt Construction Equipment Co., Lexington, Ky., and AEM’s incoming chairman, expects the effort to continue. “We needed to be more active than...in the past,” he said.

PRESIDENT, Bechtel Equipment Operations

The president of Bechtel Equipment Operations Inc., Sugar Land, Texas, gave attendees a customer’s perspective. “It’s hard to follow Bechtel,” admitted President Robert B. Hall. “I sold to them for years in my distribution days, and it’s a very complicated company to try to figure out—who should I call on, and what should I do after I’ve called on them?”

On the conference sidelines, Hall told ENR he sees equipment quality across the board as “very much equal….The quality of the support of the distributors is the real differentiator.”

Observers should watch equipment rentals for early signs of industry turnaround, noted Christine Wehrman, CEO of American Rental Association, Moline, Ill. “Rental will be first to come out of the economic downturn because of the immediate need for equipment,” she said.

Post a comment to this article

Report Abusive Comment