The gloves are off in a standoff between the U.S. Global Positioning System industry and a satellite communications vendor seeking to light up a broadband satellite and terrestrial network to blanket the country.

GPS interests say plans for the satellite and terrestrial voice and data network with 40,000 base stations will operate too close to GPS on the spectrum and cause damaging interference to the entire system. They accuse the vendor of trying to slip past regulators an increasingly powerful and larger terrestrial component to its hybrid satellite and cell system.

“We are not opposed to broadband,” commented one GPS partisan who declined to be identified while next steps are being planned, but he believes the best solution is for the vendor to move to the 2 GHz band of the spectrum, where he says room is available. “It works fine there, and we have no opposition to it.”

The vendor, Reston, Va.-based LightSquared, accuses the GPS industry of intentionally engineering its GPS system around technology with such weak interference protection that signals on adjacent frequencies create conflicts. LightSquared says, in effect, that the GPS industry has appropriated LightSquared’s bandwidth by not using better devices.

The Federal Communications Commission is withholding permission for LightSquared’s network activation and has opened a second 30-day comment period to weigh new information.

NEW INFORMATION

The new information includes both a report released June 30 that was prepared for the FCC by a set of joint working groups composed of representatives from LightSquared and seven sectors of the GPS industry, as well as an alternate activation plan subsequently submitted directly to the FCC by LightSquared and not offered to the study group for analysis. GPS representatives on the working group, nonetheless, have characterized the alternative plan as a reshuffling of the original one that is unlikely to make much of a difference in resolving the interference issue.

“All phases of the LightSquared deployment plan will result in widespread harmful interference to GPS signals and service,” concluded one of the subgroups that studied the potential effects on general location and navigation. “Mitigation is not possible,” the group wrote in its report.

The group that prepared the report was co-chaired by Charles R. Trimble, chairman of the U.S. GPS Industry Council, and Jeff Carlisle, LightSquared executive vice president for regulatory affairs and public policy. LightSquared members participating in the work group noted many disagreements with the report conclusions, both in the pages of the report and in statements released later. LightSquared blamed the GPS industry for being “largely uninterested in finding a solution.” It said the GPS industry could have avoided the issue by equipping its devices over the last several years with filters that cost as little as 5 cents each.

“LightSquared is stepping forward to help resolve the problem,” the company said. “In contrast, the GPS device manufacturers, unlike relevant government agencies, have been largely uninterested in finding a win-win solution. Rather, their only answer to a problem of their own making is to demand that the government simply block LightSquared from using the company’s own spectrum to roll out the first wholesale-only wireless broadband network for the entire nation—an economic benefit worth as much as $120 billion to consumers.”

INDUSTRY FEELS THE CHILL

Construction industry sources are reacting with alarm to the threat of any potential interference with GPS, which is widely used for many constantly evolving purposes.

“Man hours and time; it saves millions and millions in the highway and airport system,” says Don Weaver, executive vice president at Weaver-Bailey Contractors Inc., El Paso, Ark., and former highway chair of Associated General Contractors of America. “If we had to go back to the old way it would be like riding a horse and buggy again. Every major airport project in the nation uses it, as far as I know.

“In the highway business we’ve gone to 3D modeling, so we send the plans to an engineering firm that digitizes it in 3D in GPS, and we download them onto your computers, and that’s how we do final grades. The machines run off GPS. All the surveying in the construction period is done with GPS,” Weaver says.

Adds Mark Knight, owner of Foothills Contracting, a grading contractor located in Webster, S.D., “Grading, fine grading, we’re totally dependent on it. It’s highly accurate. It’s quite a system, and that’s why we bought into it. We’ve made ourselves dependent on it. Everything is so critical nowadays with our schedules tightening up. When you do it the first time, you do it right with GPS. It eliminates a lot of human error. “

Brian Deery, senior director of the highway and transportation division of the Associated General Contractors, agrees that interference would likely be disruptive enough to invalidate the system. “I think the real concern is that if the LightSquared [plan] were approved, I don’t think the GPS would go out completely, but it would be sporadic. And the unreliability would be devastating to a company, screw up your scheduling. You could have a crew out there standing around for, well, a day or more. If it got that unreliable you’d have to go back to the old system.”

Equipment manufacturers feel the chill as well. “For a contractor to make this commitment to buy is huge,” says Nick Yaksich, vice president of the association of equipment manufacturers. “These kinds of things would set a bad precedent for construction. If things like this can happen, an undermining of the systems in which we’ve invested, contractors might be less likely to adopt new technology.”

LIGHTSQUARED’S PLANS

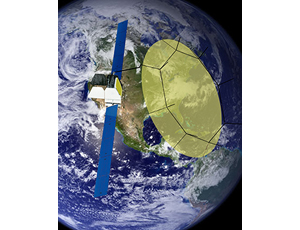

The LightSquared venture is backed by Harbinger Capital Partners, which announced last July 20 that it had formalized its plans to create a wholesale only, national 4G network in the U.S with a phased deployment plan to cover 92% of the population in five years. Harbinger and its affiliates said they were funding LightSquared through a $2.9 billion direct investment as well as backing debt financing up to $1.75 billion. LightSquared plans to use L-band mobile satellite service spectrum (MSS) originally licensed to SkyTerra, a satellite broadband operator Harbinger acquired in 2005.

Nokia Siemens Networks has the infrastructure contract for the project and also was selected to manage network operations a deal estimated to be worth $7 billion over eight years.

“Subteam” reports in the main study for the FCC, which covered aviation, cellular devices, general navigation, space-based receivers and GPS serving high precision receivers and networks and timing systems—were broadly negative and unequivocal. They also chided LightSquared’s proposal that filters can be designed to “cure” GPS interference as “speculative” and un-testable, since those filters do not now exist.

The group studying potential impact on GPS for high precision, timing, and network receivers said, “high precision receivers fielded today would experience harmful interference at up to 5km from a single LightSquared base station.” It added that, with respect to mitigations, “We know of nothing feasible that can be done” to make the currently fielded wide band receivers and augmentation systems used today operate properly when in the vicinity of a LightSquared base station under either the original or alternative roll out proposal.

“We do not foresee any possibility that LightSquared signals near the GPS band could ever be compatible with wideband receivers,” the sub-group report concluded, adding, “The most straightforward mitigation would be for LightSquared to use a different frequency band for their terrestrial network.”

LightSquared representatives on the group again disagreed that receiver side mitigation options were not possible, but noted “due to time constraints, the sub-teams were not able to give adequate consideration to potential receiver-side mitigation options.”

The cellular communications group also found that interference near the 40,000 towers and base stations LightSquared plans to employ was likely to impact “a significant number of mobile devices” until filters and other mitigation techniques are implemented.

Post a comment to this article

Report Abusive Comment