As the American Recovery and Reinvestment Act nears its one-year anniversary, waste-cleanup firms anticipate another year of backlog boosts. But their peers in the water and wastewater infrastructure sector hope a U.S.-Canada agreement signed on Feb. 5 will ease “Buy American” tensions that have been dogging progress of their stimulus-funded work.

With a stable of contractors in place, entities with cleanup missions—such as the U.S. Environmental Protection Agency’s Superfund program and the U.S. Energy Dept.’s effort to shrink nuclear waste sites—touted stimulus progress last year. DOE sites across the U.S. have more than $6 billion in ARRA funds through 2011, with most funding obligated through existing contracts. At DOE’s Hanford, Wash., nuclear site, cleanup contractors have spent $273.9 million through last December, “a little under target,” says a site spokesman. But he says spending and project completion will meet targets by the end of fiscal 2011.

Garry Flowers, CEO of the Fluor Corp. unit running DOE’s Savannah River site in Aiken, S.C., claims nearly $100 million in ARRA-funded contracts to mostly smaller firms, about 2,200 jobs created or saved in 2009, and a 50% site footprint reduction by 2011.

The Army Corps of Engineers says that, as of Jan. 29, it obligated 63%, or $2.9 billion, of its $4.6 billion in stimulus funding for cleanup, river infrastructure, and other construction, operations and maintenance projects.

But for some environmental-sector firms, work is moving slower than hoped. “Most of our clients have received small amounts” from ARRA, says Gary Bleecker, national water director for Omaha-based HDR. “In general, it has had very little impact on the market, and we’re seeing that from coast to coast.”

Luis Ventoza, regional vice president for PCL Construction Enterprises Inc., Denver, says the stimulus “has not created a lot of work” in water/wastewater. He says California was allotted $2.6 billion for transportation projects and just $443 million for water and wastewater work.

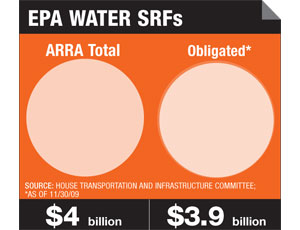

EPA has awarded $3.98 billion of its total $4 billion in ARRA funds for clean-water and drinking-water state revolving funds (SRFs) as of last Nov. 30. Of that, $1.7 billion was under contract and under construction. With ARRA’s stipulation that all funds be allocated or under contract by Feb. 17, industry sources expect the number of stimulus projects to dwindle to a trickle. “Unless there’s a second stimulus, there won’t be a lot of pursuits going on,” says Paul Shea, president of Denver-based CDM Constructors, a unit of Camp, Dresser & McKee.

But some state and local agency managers of ARRA funds have moved quickly. Minnesota, Wisconsin and Georgia have nearly all stimulus-funded water projects out to bid. Alaska has awarded 100% of its ARRA funds, says Bill Griffith, facilities program manager for the state Dept. of Environmental Conservation. However, he cites mountains of required new ARRA paperwork as a key challenge for aid recipients. “It’s been a lot of work for our program staff and our communities,” Griffith says.

ARRA’s “Buy American” provisions also have been “an enormous challenge” for water-sector suppliers, contractors, engineers and municipal officials, according to Water and Wastewater Equipment Manufacturers Association President Dawn Champney. She says some cities have simply walked away from ARRA-funded projects rather than comply with rules that require, for instance, all equipment used on the project be manufactured in the U.S.

EPA has granted some “Buy American” waivers. PCL’s Ventoza says its agency client obtained a waiver on a $22-million upgrade to a 50-million-gallon-per-day water treatment plant in North Tempe, Ariz., that had received $10 million in stimulus aid. But he cites the lengthy waiver process as a key factor in continuing project delays.

The U.S.-Canada pact may help. Under the tentative deal, which each country must still approve, Canadian suppliers could gain access to ARRA-funded public-works jobs in the U.S. Canadian and U.S. officials say they hope to have the agreement ratified by Feb. 16.

Post a comment to this article

Report Abusive Comment